Dogecoin Founder’s Sardonic Take on $150B Crypto Crash

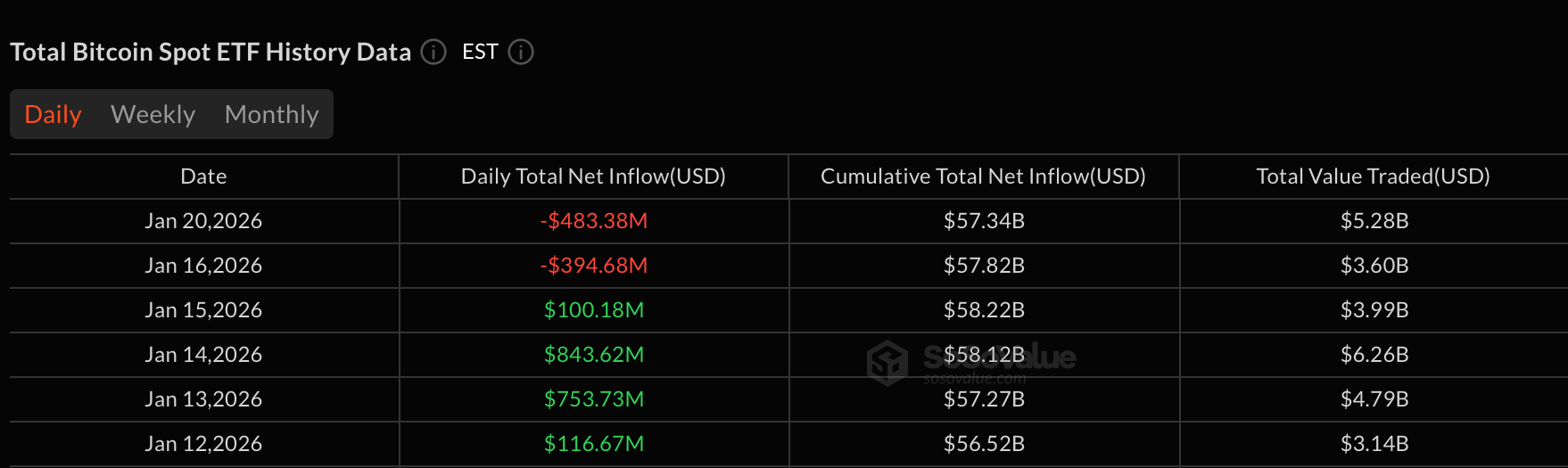

Today, Markus took to X to address the recent crypto market crash, a calamity so profound it has erased $150,000,000,000 from the digital ledger of human folly. Bitcoin, that paragon of stability, plummeted while gold, the eternal skeptic’s refuge, soared to new heights.