XRP’s Wild Ride: From Skepticism to $5 Dreams 🚀😂

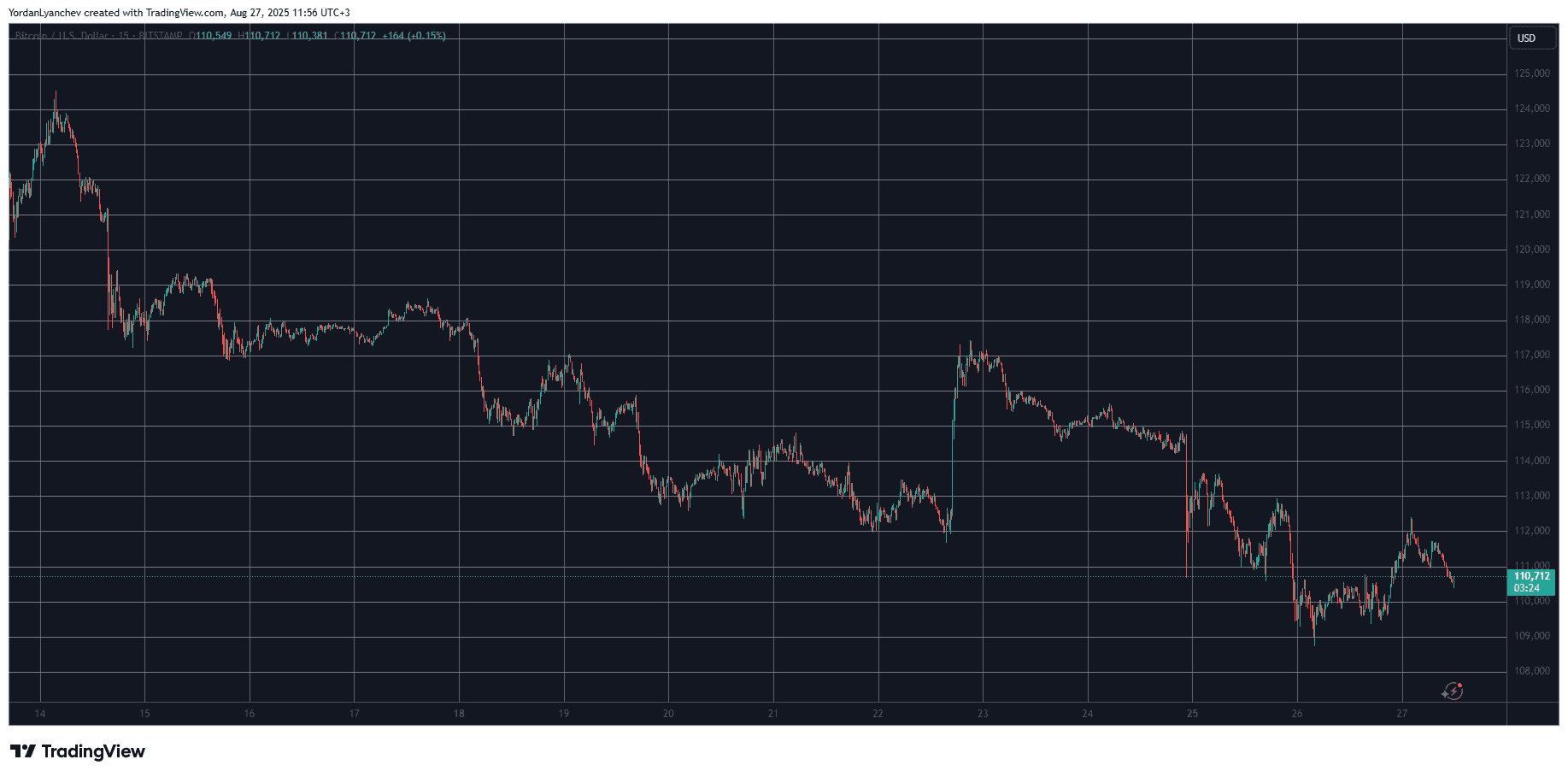

According to this erstwhile skeptic, XRP has been quietly sketching an elegant “W” pattern on its weekly chart-a move so suave it could rival a tango champion. The sequence begins with a peak at $3.4 in January, dips to $2.11 in April, bounces back to $2.6 in May, plunges again toward $2 in June, and then makes a triumphant return above January’s high. A veritable symphony of price action, if one can call such chaotic movements harmonious.