Chaos at the Fed: Trump vs Powell, Freefall or Just Costly Renovations?

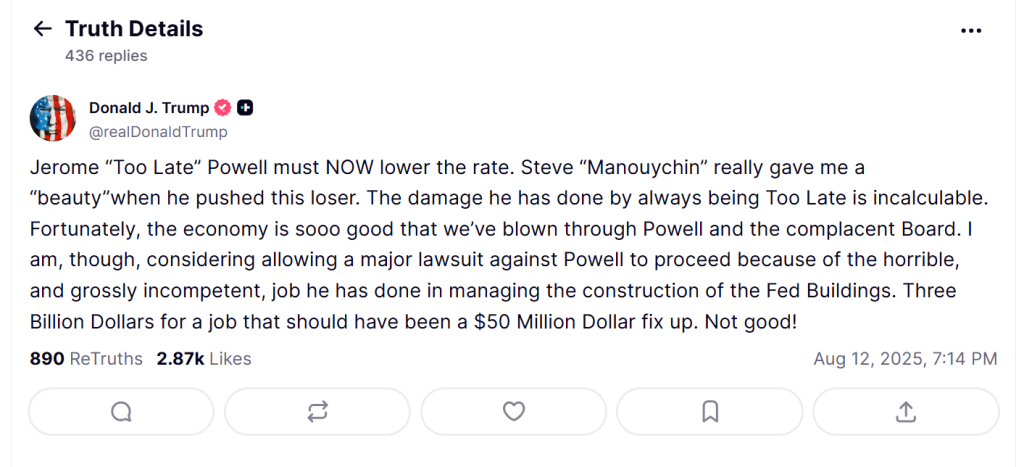

In a social media post that surely woke the ghosts at the Federal Reserve, Trump accused Powell of orchestrating a renovation that cost three billion dollars. That’s enough to buy a small island or a surprisingly luxurious yacht-whichever you prefer, really. According to him, the supposed fix-up that was so *horribly managed* should’ve only set back the government fifty million, tops. Because who needs fiscal discipline when you have $3 billion to burn? 🏗️🔥