SEC’s Crypto Staking Update: What You Didn’t Know (But Should!) 😏

and the ever-so-astute

and the ever-so-astute

In this modern age of mercantile speculation, one observes that Ripple’s [XRP] has been graced by the rare technical event of a golden cross-a phenomenon which, in bygone days, has presaged rallies of 630% and 54%. This metric, which carefully weighs the relationship between market value and realized value, serves as a most reliable indicator of whether the token is undervalued or, heaven forbid, overvalued.

And lo, Blackrock, titanic chimney of world coin, exhales black smoke of denial-yet the chorus of hopeful ragpickers swells louder. 🙄

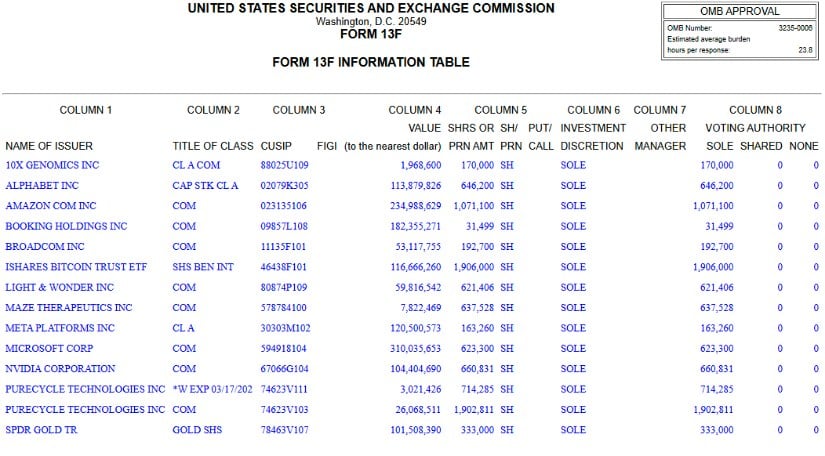

Details of this audacious investment emerged from a regulatory filing, submitted to the Securities and Exchange Commission on a day that will surely be remembered in the annals of financial history-August 8. The Harvard Management Company, the stewards of this vast fortune, revealed that as of June 30, they were holding 1.9 million shares of BlackRock’s IBIT fund. It’s almost as if they’re saying, “Why not throw a little Bitcoin into the mix?”

The Friday filing reveals that Harvard’s $117 million investment in IBIT secures its place as the university’s fifth-largest investment. This clever maneuver places the IBIT investment comfortably ahead of the Ivy League’s modest $114 million stake in Alphabet, the parent company of Google. In a twist that might make even the most stoic of academics chuckle, Harvard’s largest investment for Q1, 2025, was in Microsoft, totaling a robust $310 million. 🖥️

The market, ever a stage of folly and wisdom, is abuzz with whispers. Some proclaim this the dawn of a historic ascent to $12,000, while others, with furrowed brows, warn of a bear trap so brutal it would make Tartuffe blush. 🌋

Tokenization? More like “toke-ni-zation”! The buzzword is so hot it needed sunscreen. In today’s episode of “As the Blockchain Turns,” Exodus-yes, the wallet your cousin Dave brags about-has locked arms with Superstate. What for? To slap Exodus shares on-chain faster than you can say “Why is this night different from all other nights?” 🤦♂️

According to CEO Kevin Chin (a name that sounds like it belongs to a Bond villain or perhaps an avant-garde fashion designer), this “dual approach” aims to maximize returns while lowering the average cost of acquiring XRP tokens. Bravo, sir! It’s almost as if you’ve discovered the holy grail of financial alchemy-though I suspect your shareholders may require more than just clever phrasing to be fully convinced. 😉

Yes, you heard that right. A whopping $1.5 billion. For context, that’s enough money to buy several small islands, fund a space mission to Mars, or pay off your student loans while still having enough left over for a lifetime supply of nachos 🧈. But no, this cash is destined to prop up what can only be described as “crypto chaos meets political theater.” According to whispers from Bloomberg, big-money tech and crypto investors are being courted faster than you can say “blockchain.”

After nearly five long years of legal bouncing, the two titans finally kissed and made up-well, sort of. They settled for a cool $125 million, and Ripple got some restrictions on its “fancy institutional sales.” Think of it as Ripple getting a timeout-but with a billion dollars in its pocket. 💰