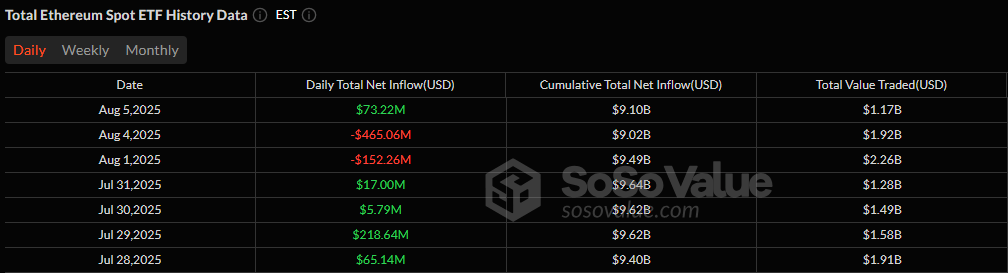

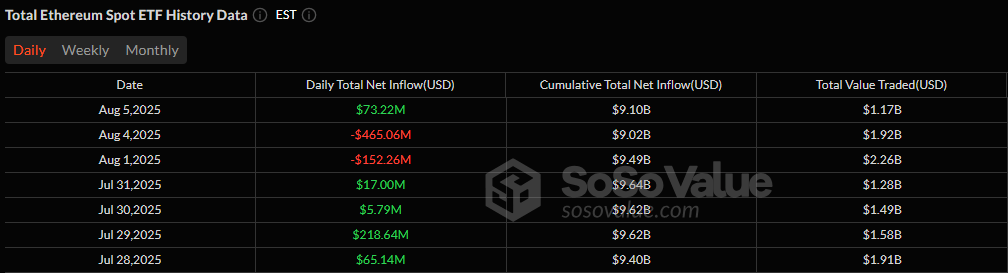

Here’s the tea: the split between Bitcoin and Ether ETFs got even more dramatic on August 5. Bitcoin funds dumped a staggering $196.18 million-probably because HODLers are busy trying to remember what they bought last night-while Ether ETFs waltzed in with a siren call and grabbed $73.22 million. Honestly, it’s like watching a soap opera, with investors switching spots faster than they change outfits at a fashion show.

Major culprits in Bitcoin’s heartbreak included Fidelity’s FBTC, which shed $99.11 million, and Blackrock’s IBIT, which took a hit of $77.42 million-because who needs that much fame? Grayscale’s GBTC also bowed out with $19.65 million-maybe it’s just not their scene anymore. Despite all this drama, trading was still buzzing at $2.66 billion-probably trying to drown out the chaos-and total Bitcoin ETF assets slipped to $146.18 billion, which, let’s face it, is still a lot of zeros in a row.