Crypto’s Wild Ride: BNB, Solana, and Tron’s August 2025 Drama Revealed 🎢💸

BNB: The Overachiever With a Trust Fund

BNB: The Overachiever With a Trust Fund

Bonk (BONK) is now trading lower than my self-esteem after reading internet comments, at just below $0.000026. Down 8% in a day, 27% in a week. Volumes? $570 million. That’s a lot of people panic-selling and/or YOLOing in the same breath. Everyone’s staring at this cartoonishly important support; apparently, what happens here could shape BONK’s next personality arc.

This ballet of descent, you ask? Well, let us delve into the possible choreographers of this dramatic performance, ranging from the grand gestures of global economic uncertainty to the subtle steps of substantial ETH withdrawals.

Behold, the digital gold rush hath birthed a new breed of madcap alchemists—Bitdeer, with a gleam in their corporate eye, hath added 38 BTC to their vault, now clutching a grand total of 1,675.9 BTC like a dragon guarding its hoard. 🐉 Is this the height of wisdom or the nadir of madness? One might … Read more

Meanwhile, the volume of trades is more uneven than a toddler’s lunch, and the big sharks in the pool are replotting their next move. Ethereum now lounges around $3,500—a nearly 9% plummet in a week—making everyone wonder: Should we panic, buy the dip, or wait for the ‘big reveal’? 🎢🤔

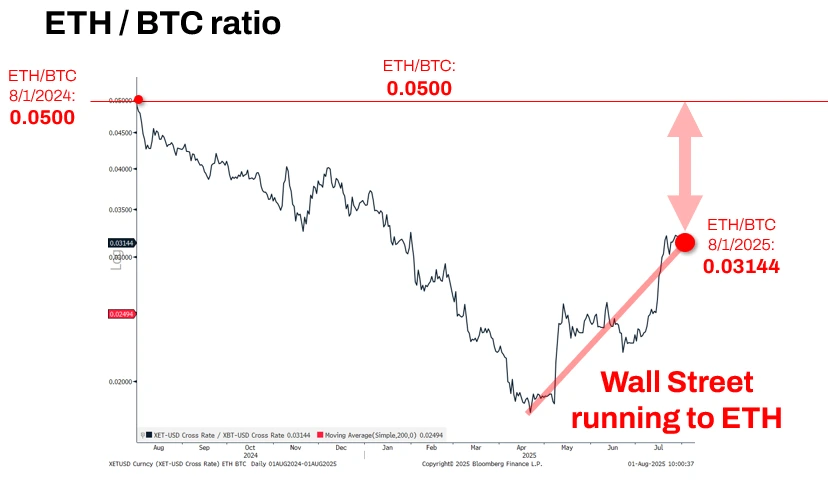

Mr. Lee, a Managing Partner at FSInsight – a name that sounds suspiciously like a clandestine organization – has expounded, at length on X (a platform best left to pronouncements of questionable wisdom), why these institutions are positively flocking to Ethereum. It currently trades around $3,600, a pittance, naturally, given its ‘implied value.’ A matter of ratios, you understand. So dreadfully boring.

Dogecoin [DOGE], that eternal jester of the crypto court, faced rejection at $0.285, a level it once claimed as its throne in February. Now, it kneels before the same tyrant.

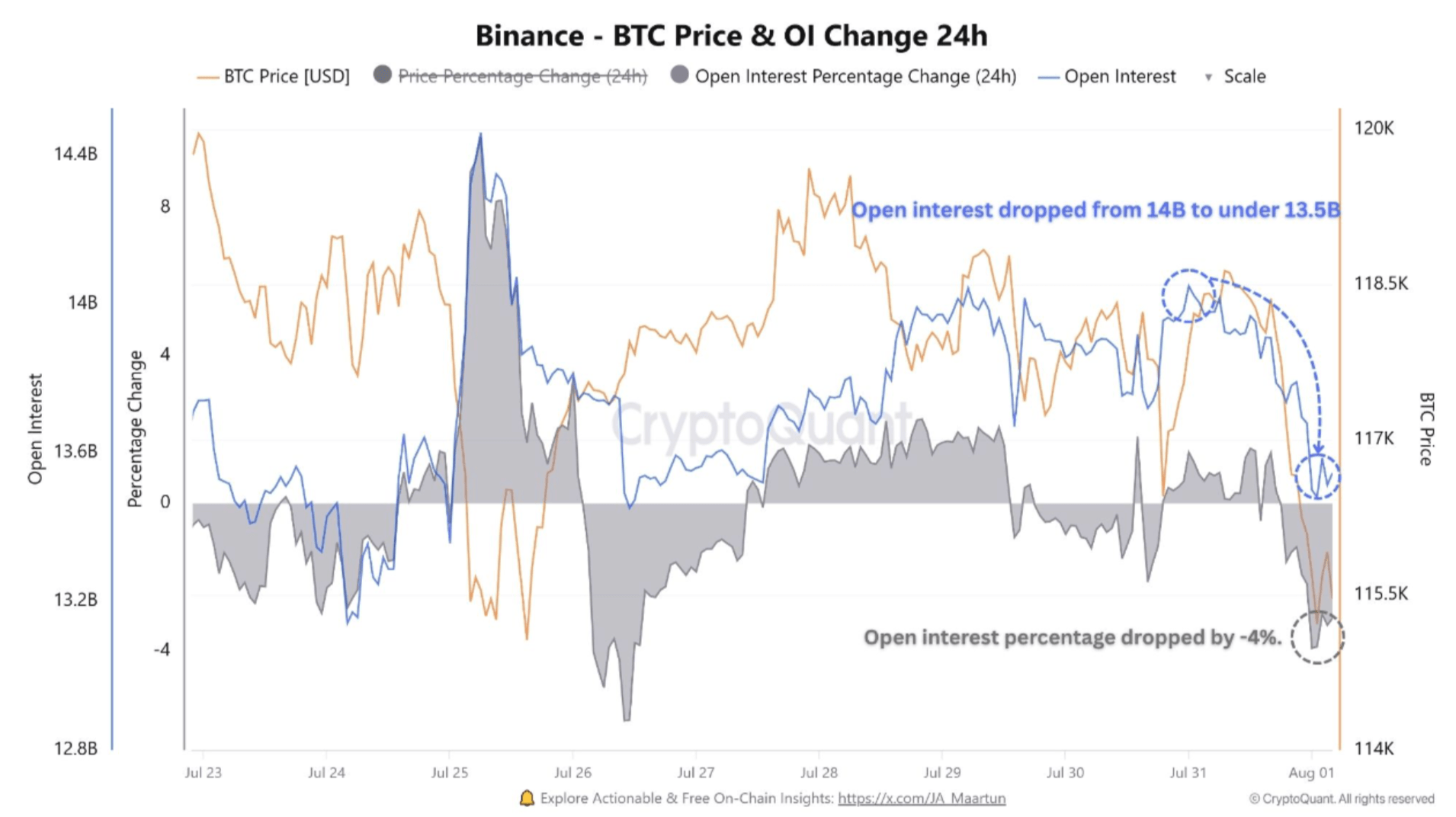

Our beloved digital gold, Bitcoin, wobbled on the precipice of despair, dipping into the $114,000’s—an unpretty sight that prompted a quick, somewhat desperate bounce back above $115,000. Who knew that beneath the shiny veneer lay such volatility? The recent chart outlines this chaotic dance, as if Bitcoin were auditioning for a tragicomic ballet.

CryptoQuant’s Amr Taha informs us—probably with a numb look on his face—that this harrowing drop prompted open interest on Binance to plunge from a burly $14 billion to $13.5 billion. That’s right: half a billion dollars disappeared faster than your optimism in a crypto bear market.

But hold on, don’t panic yet. The experts? They’re saying this rotation? It’s just Bitcoin’s coming-of-age story. More institutions are moving in, and honestly, they’re the real players anyway.