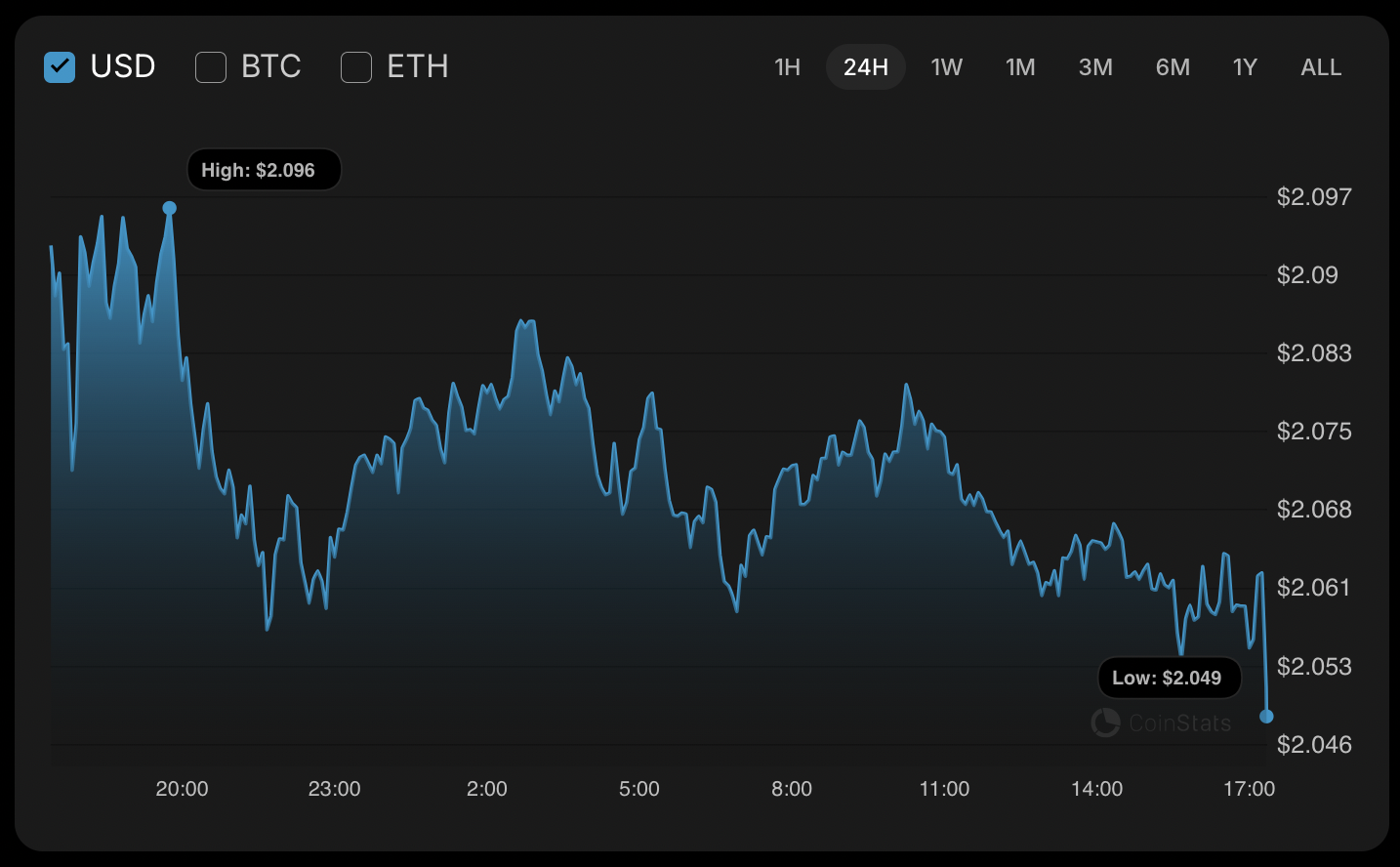

Ethereum’s Magical MACD Crossover: Will It Summon $8K Dragons? 🐉💸

The setup is so suspiciously promising, one might think Ethereum’s been secretly brewing a potion in its blockchain cauldron. Javon Marks, our crypto sage, claims this crossover could kick off a rally that stretches until 2026, because why not? Time is just a suggestion in the world of decentralized magic. 🕰️