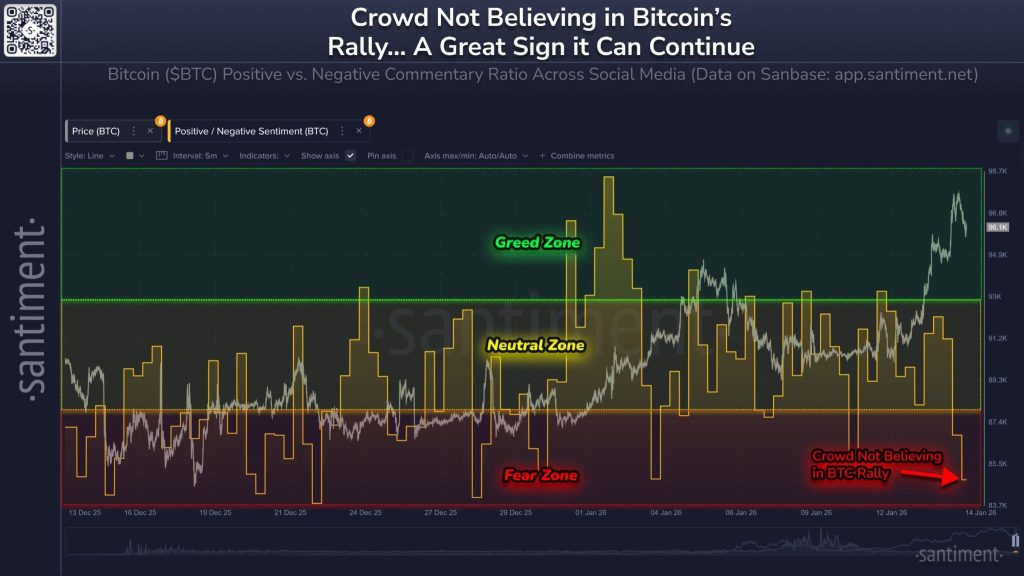

Bitcoin Rises While Haters Cluck-Could This Cluckin’ Good Rally Reach $100K? 🐔💸

This awkward disconnect-price going up, everyone going MIA-is the crypto version of leaving your gym clothes on the living room couch and hoping no one notices. If you’ve ever owned a dog that fake-laughs at your takes until the paraquat kicks in, you know how this feels. The Santiment index is currently screaming “FRAID ME!” like a parrot who’s seen one too many bad TikTok trends while BTC just smugly tries on its $100K hat. You know it will look cute.