EU Slaps Sanctions on Russia’s A7A5 Stablecoin – Crypto Chaos Ensues!

no more transactions involving A7A5 anywhere in the EU.

no more transactions involving A7A5 anywhere in the EU.

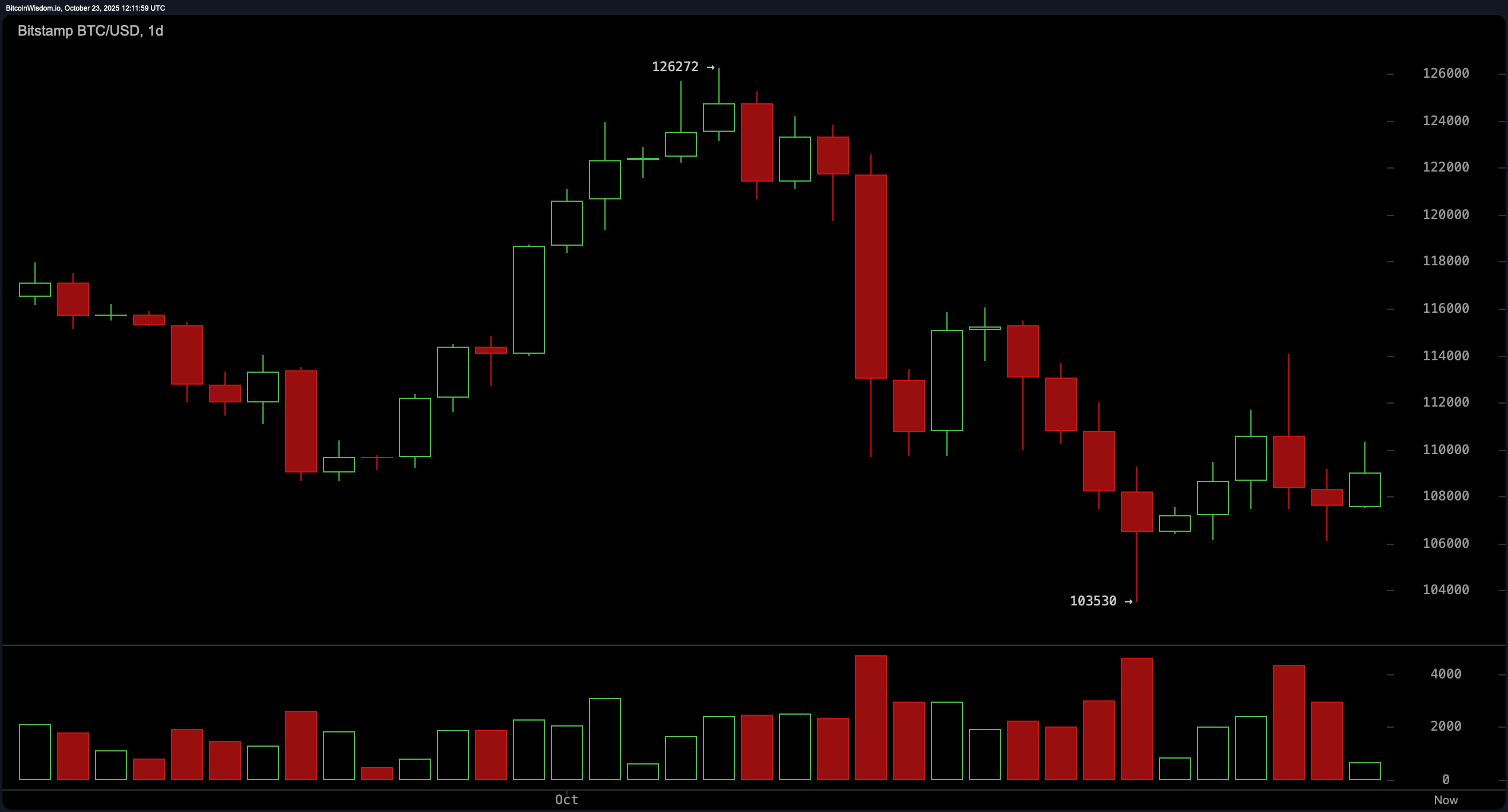

If Bitcoin had a personality, it’d be that friend who shows up to every party with a suitcase of Monopoly money and a story about escaping a black hole. Today’s daily chart is a tale of desperate ambition: after peaking at $126,272 (a number so high it makes Mount Everest blush), it plummeted to $103,530, leaving traders clutching their keyboards like they’re about to stop a supernova. Volume spiked so hard, it probably caused ripples in the space-time continuum. 😂

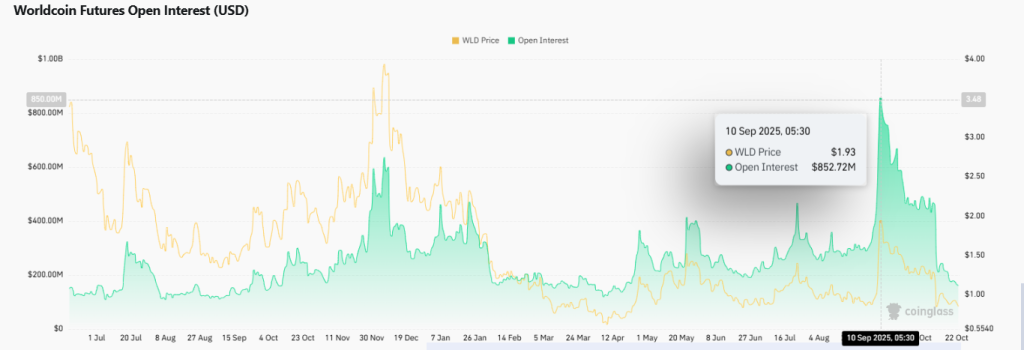

Meanwhile, the technical patterns-those squiggly lines that analysts love to overanalyze-show that WLD has broken down from an ascending channel. This channel, once the backbone of its upward momentum, now lies in ruins, like a forgotten Lego tower after a toddler’s rampage. 🧱💥 The analyst (probably sipping coffee and looking concerned) notes that if the bleeding continues, the next support level is around $0.40. That’s a steep correction, or as I like to call it, “a trip to the financial bargain bin.” 🛒

Schiff reckons gold’s just perfect for blockchain-says it’ll do everything Bitcoin can’t do, like actually being worth somethin’ when the chips are down. And he’s plannin’ to give folks a debit card linked to their gold or silver holdings, like you’re buyin’ groceries with a bag of coins. Sounds real fancy, until you realize it’s just “trust me, bro” gold-a “trust me” token, not the real deal. 🥴

This tantalizing tidbit emerges from Vet’s own frolics on the devnet, where he dallied with NFT mintings and payments, proclaiming with wicked glee: “Ah, what a splendid frolic for those NFT bazaars or exchanges-pure peer-to-peer pandemonium!”

A new report shows that banks, payment networks, and cloud providers – from SWIFT and to Google Cloud and Visa -are now leveraging blockchain at scale – reshaping how global finance moves, settles, and stores value. 🧠

In a press release that has set the ton abuzz, FalconX has announced its intention to acquire 21Shares. FalconX, you must know, is the very essence of sophistication in the crypto world, offering its esteemed clients-numbering over 2,000 institutions-a smorgasbord of services: deep global liquidity, derivatives, financing, custody, and settlement. Oh, and did I mention they’ve facilitated over $2 trillion in trading volume? Quite the catch, indeed! 💼✨

Market gossip says XRP is bobbing at $2.42-up 0.62% in a 24-hour blink but down 0.83% over the week. Since that October 10 chaos, XRP’s support level turned into resistance, like a bad habit refusing to go away. 🙄

The first reason, he declares with the gravity of a soothsayer, is Bitcoin’s hard cap of 21 million coins. “A fixed supply!” he exclaims, as if discovering fire. Unlike the endless streams of fiat currencies or the ever-multiplying stocks, Bitcoin’s scarcity is etched in code. “Ah, but this is what makes it special,” he intones, as if Bitcoin were a rare orchid in a field of dandelions. A long-term investment, he says, not a mere trifle for the short-sighted.