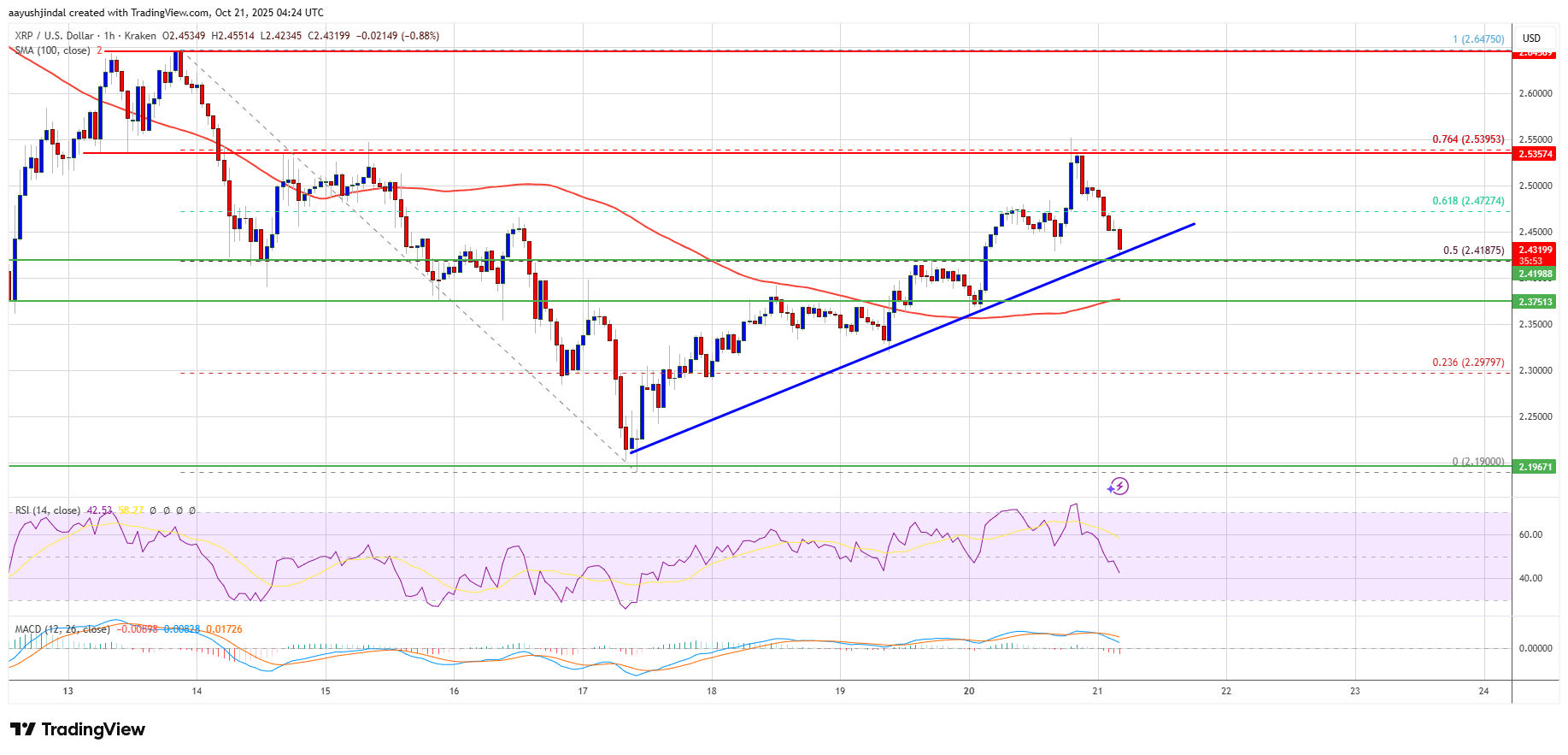

XRP’s Desperate Dive to $1? Buckle Up, It’s a Rollercoaster 🎢💸

XRP just executed a technical breakdown so dramatic it made the 50-day moving average cry into its gluten-free granola. 💔 Traded at $2.1842 now, which is basically the crypto equivalent of “I’ll have a large pizza and a side of existential dread.” Short-term support? Gone. Confidence? Vanished. This is what happens when bulls get a panic attack and bears start a conga line. 🕺