Bitcoin’s $147K Target: Why a Pullback Could Come First

Several key signals, both from price charts and blockchain data, suggest a more significant price drop might be developing, even as analysts consider a new long-term price goal.

Several key signals, both from price charts and blockchain data, suggest a more significant price drop might be developing, even as analysts consider a new long-term price goal.

Enter stage left, the ever-eloquent entrepreneur Anthony Pompliano, who in a recent podcast, proclaimed that there lies a new mantra-a concept to grip like a lifeline. It appears these institutions have finally grasped that the relentless machines of currency printing shall remain unfettered and unhinged. Who would have thought? Surely not the goldbugs and Bitcoin zealots who have been banging on about this until the cows came home! Or, perhaps they just wanted to sell us a few shiny tokens? 🤔

It appears, dear reader, that even the most venerable of financial institutions – those bastions of tradition and sensible shoe-wearing – are, shall we say, experimenting with this digital “blockchain” business. One might have imagined them content with ledgers bound in calfskin and the reassuring weight of gold, but alas, even they succumb to the winds of change… or perhaps just the promise of slightly larger profits. State Street, in its infinite wisdom, has observed this curious phenomenon in its 2025 Digital Assets Outlook.

In a world where digital currencies were once viewed as the playground of eccentric billionaires and tech nerds, Block Inc. (NYSE: SQ) is giving bitcoin a permanent home in everyday commerce. They’ve launched Square Bitcoin on Oct. 8, boldly declaring it “the first fully integrated bitcoin payments and wallet solution – built for local businesses of all sizes.” Yes, you read that correctly: Bitcoin is now for *everyone*. 💸

Critics, ever the sourpusses, have declared that this move might just be the death knell for DeFi. Oh, how terribly dramatic. 😒

BVI – In the mysterious realm of decentralized finance, Falcon Finance, a protocol as intriguing as a cat on a hot tin roof with aspirations to transform universal collateralization, has received a $10 million strategic treasure-chest contribution from M2 Capital Limited. The venture is as diplomatic as it is financial, with UAE’s esteemed M2 Group leading the charge, joined in part by Cypher Capital, known in the blockchain circles as the support act that never backs down.

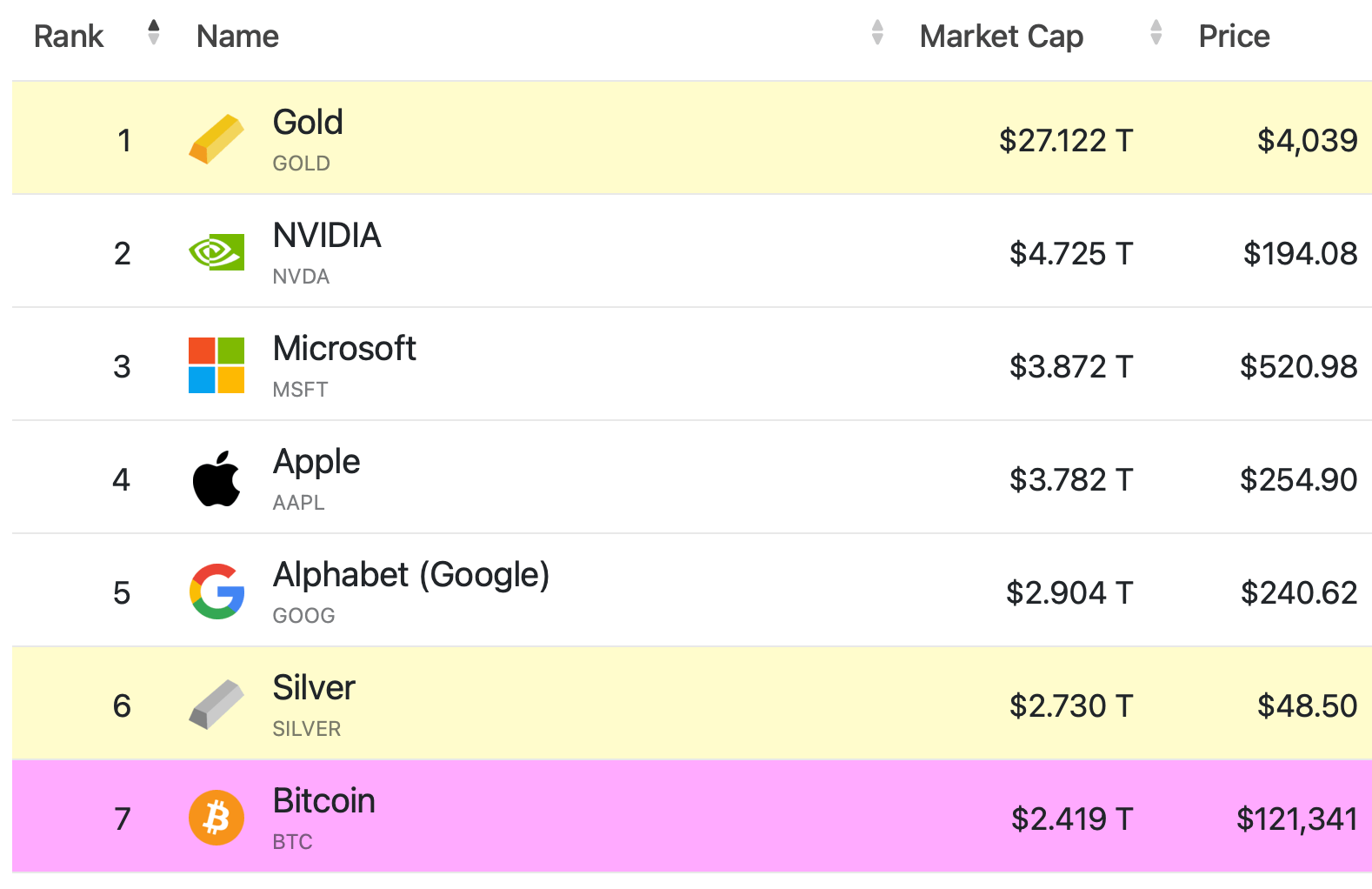

Well, buckle up! Nvidia’s shares closed at $194.06, marking a sharp 2.62% increase from the day before. This move sent its valuation skyrocketing, leaving competitors like Microsoft ($3.8 trillion) and Apple ($3.7 trillion) eating its dust. Are we all sure we’re not just talking about a sci-fi movie plot here? 😅

Ah, North Dakota. Always thinking of ways to make history seem a tad more… relevant. The coin is named after Theodore Roosevelt’s “Rough Riders”-a nod to the state’s self-appointed pioneering spirit. Because, why not? It’s not like they could have gone with something entirely unremarkable, like “North Dakota Dollar Coin” or “DakotaCoin”.

Our dear Bybit hath turned its attention to fortifying its foundations in other burgeoning crypto meccas, making noteworthy advances in Europe, Vietnam, India, and beyond. One must applaud their foresight, for such a grand strategy may indeed yield bounteous rewards for the enterprising souls involved. 💰

So, the drama unfolded on Tuesday when a bill designed to create a Bitcoin strategic reserve for Massachusetts was met with… well, let’s call it a lukewarm reception at best. This was the bill’s first legislative hearing in a whole eight months, and I think we can all agree that it could’ve used a bit more excitement.