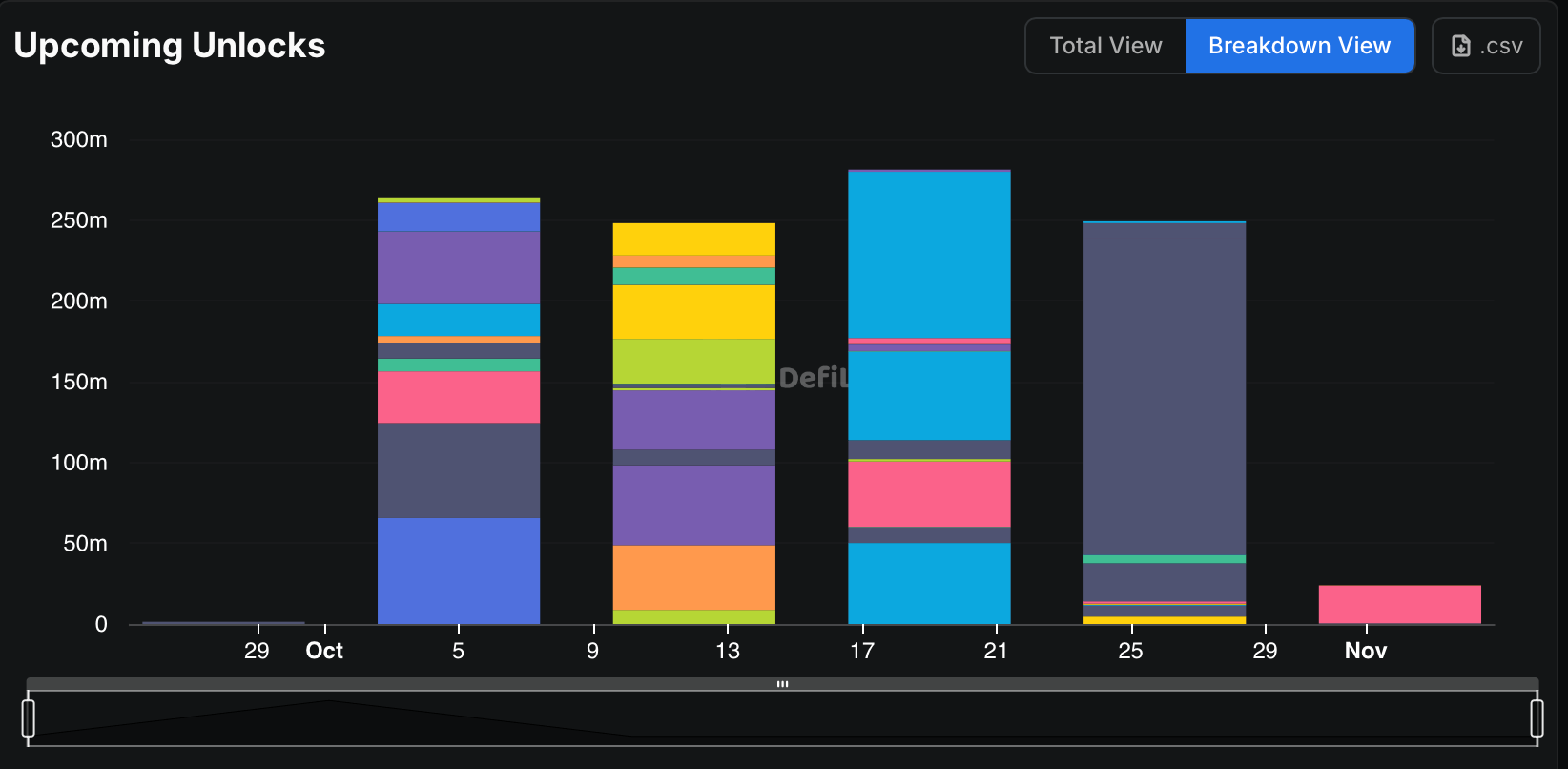

🦙 DefiLlama Spits Out Aster’s Data Like a Bad Oyster 🦪

One might imagine the scene: DefiLlama, with a raised eyebrow and a sniff of disdain, declaring, “My dear Aster, your numbers are as authentic as a society matron’s laughter. We simply cannot have it.” And so, with a flick of its metaphorical wrist, the data was banished, left to wander the digital wilderness like a disgraced baronet. 🏇