Well, bless my stars and garters, the folks are all atwitter about Chainlink and its grand ambition to hit the $100 mark by 2025. Seems like every Tom, Dick, and Harry with a smartphone is chattin’ about it, and I reckon it’s high time we sifted through the hullabaloo. 🧐

Chainlink, that clever little scamp, started as a mere oracle pioneer but has since grown into a full-fledged player in the institutional fintech circus. Its business model is as solid as a brick outhouse, and its commitment to innovation is about as meaningful as a preacher’s Sunday sermon. Though its current price might seem as modest as a church mouse, there’s more to this story than meets the eye. Global capital-market integrations, a dwindling supply on exchanges-why, it’s enough to make a fellow think Chainlink’s price might just be on the cusp of something big. 🤔

From DeFi Oracles to Global Capital Markets 🎪

Originally, Chainlink was just a simple tool for DeFi, but like a caterpillar turning into a butterfly (or a frog into a prince, if you prefer fairy tales), it’s transformed into a modular backbone of services. It’s now the go-to for institutional-grade data, interoperability, and seamless connectivity with those old, creaky legacy systems. Take its DataLink platform, for instance-it’s like a magic wand that lets firms wave regulated market data across 40+ blockchains. Abracadabra! 🎩✨

According to Sergey Nazarov, the brains behind this operation, Chainlink’s evolution is all about being the bridge between traditional institutions and decentralized systems. It’s like herding cats, but with secure and verified data exchange. Their aim? To create standardized frameworks that marry blockchains with existing financial infrastructures. If that ain’t ambitious, I don’t know what is. 🤵💍

Expanding Integrations and Institutional Partnerships 🎉

Now, let’s talk about integrations-Chainlink’s been busier than a one-armed paperhanger lately. Between October 27th and November 2nd, there were 62 integrations of the Chainlink standard across 24 blockchains. That’s more cross-chain adoption than a barn dance! It’s no wonder Chainlink’s sitting pretty as the industry’s leading oracle solution. 🌉

And then came the big kahuna-FTSE Russell, with its $18 trillion in benchmarked assets, decided to team up with Chainlink. They’re publishing major global indices on-chain via DataLink, including the Russell 1000, 2000, and 3000, the FTSE 100, WMR FX benchmarks, and FTSE DAR digital asset prices. That’s like connecting the financial world’s biggest rollercoaster to Chainlink’s secure data delivery system. 🎢💰

We’re excited to announce that @FTSERussell, a leading global index provider with $18T+ in AUM benchmarked, is collaborating with Chainlink to publish its world-leading global indices onchain for the first time via DataLink.

With this integration, the…

– Chainlink (@chainlink) November 3, 2025

This sets the stage for a unified data framework that not only strengthens Chainlink’s price forecast but also cements its importance across capital markets. It’s like the financial world just got a shiny new toy, and everyone wants to play. 🧩

On-Chain Accumulation and Technical Setup 📈

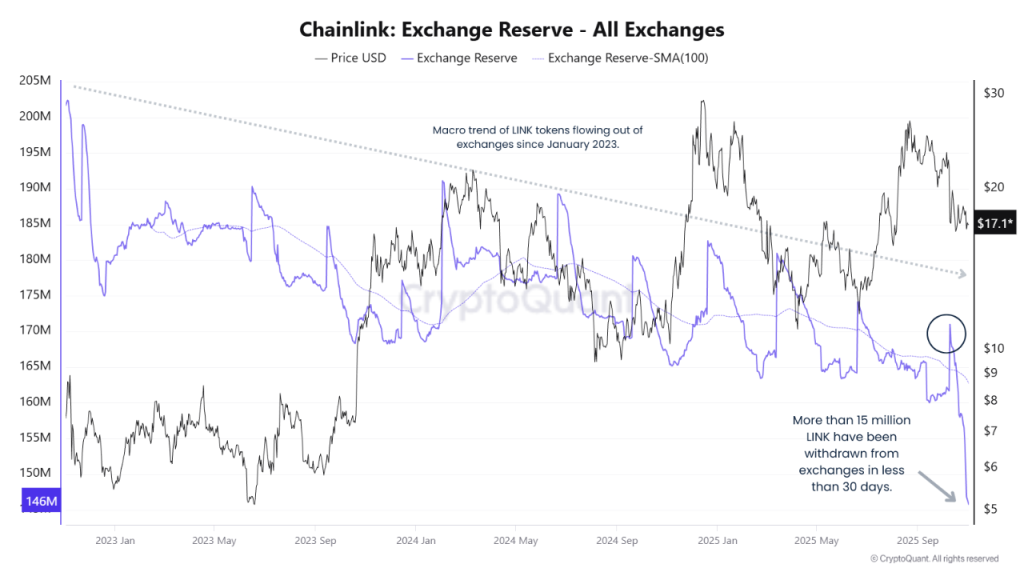

On-chain data shows that investors are piling into LINK like it’s going out of style. Over 15 million LINK tokens have been withdrawn from exchanges in less than 30 days, reducing total reserves from 180 million to 146 million. That’s what I call long-term holding behavior-or as I like to say, “squirreling away for the winter.” 🌰🐿️

This pattern suggests a supply squeeze might be on the horizon, with bullish accumulation at an all-time high. Sure, Chainlink’s price might still face some volatility, but the declining supply shows that holders are in it for the long haul. 💪

A dip to $15 could be the golden buy zone for Chainlink $LINK before the breakout to $100.

– Ali (@ali_charts) November 2, 2025

Technically speaking, the Chainlink price chart looks like a symmetrical triangle-a formation that’s about as predictable as a Twain novel. Projections indicate a possible dip to $15, but that’s just the calm before the storm. It’s the perfect accumulation zone for a rally toward the $100 level. So, if you’re feeling lucky, punk, now might be the time to place your bets. 🃏💸

In the grand scheme of things, this setup supports a long-term bullish outlook that far exceeds Chainlink’s short-term targets. So, buckle up, buttercup-it’s gonna be a wild ride! 🚀

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- STX PREDICTION. STX cryptocurrency

- CNY JPY PREDICTION

- USD MYR PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- EUR ARS PREDICTION

- INJ PREDICTION. INJ cryptocurrency

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

2025-11-03 16:52