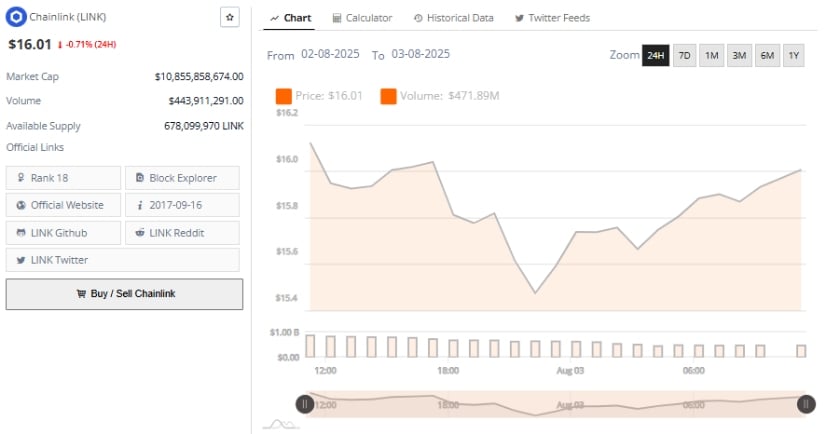

Ah, the eternal struggle of Chainlink—forever flirting with resistance levels like an awkward suitor at a ball. At the time of writing, LINK finds itself back in the dreary embrace of the $16 range, clinging to life as if it were a soggy biscuit 🍪. With a 24-hour loss of 0.71%, its price lingers at $16.01, and momentum indicators whisper cautiously into the void, much like Chekhov’s characters contemplating their meaningless existences.

A Clean Rejection: The Drama Unfolds 🎭

Behold! Trader Rai has shared a chart that reads more like a Shakespearean tragedy than a trading setup. LINKUSDT.P executed what can only be described as a perfectly choreographed short trade, descending from the lofty heights of $17.50 to bow humbly before the take-profit altar at $16.60. Alas, poor LINK could not hold above its previous resistance structure, retreating instead with all the grace of a cat falling off a windowsill 🐱.

The stop-loss was placed just above the invalidation line at $17.66—a noble attempt at discipline—but let us not forget the red-shaded zone on the chart, where dreams go to die. And yet, oh, how those bearish candles formed in succession, mocking any hope of recovery. Truly, this is modern literature in candlestick form.

Once the price broke below interim support near $17.40, gravity took over, dragging it mercilessly toward $16.60. Momentum carried the day, leaving LINK trapped in a bearish continuation bias unless it summons the courage (and volume) to reclaim $17.50. Spoiler alert: it probably won’t. 😅

A Weak Recovery Attempt: Comedy or Tragedy? 🎭📈

Between August 2 and 3, Chainlink attempted a recovery so feeble it might have been mistaken for a toddler trying to lift a sack of potatoes 🥔. After dipping from $16.20 to $15.80, it briefly rallied above $15.95, but alas, without sufficient volume to confirm a trend reversal. Support hovered tantalizingly near $15.75, but follow-through? Nonexistent.

By session’s end, LINK had dropped again toward $15.60, only to rebound slightly to $16.01. Daily trading volume reached $471.89 million, which sounds impressive until you realize most of it was people buying the dip out of sheer desperation. Buyers must now hold above $16.20 and reclaim prior resistance—or face eternal ridicule in the crypto markets. 🤦♂️

MACD Turns Cautiously Bearish: A Tale of Woe 📉📊

The daily chart from TradingView paints a picture bleaker than a Russian winter. LINK, having peaked near $20.28 in July, now tests recovery momentum around $16. Price bounced by 2.36% in the latest session, showing fleeting strength, but resistance near $19.53 remains unyielding. Lower highs continue to haunt the downtrend like ghosts in a haunted mansion 👻.

The MACD indicator whispers cruel truths: the MACD line sits at 0.27, while the signal line looms menacingly at 0.73, resulting in a histogram reading of -0.47. RSI has fallen to 44.32, confirming reduced upward momentum. Unless LINK stages a miraculous comeback—holding above $17.20 or flipping the MACD positive—it may remain stuck in this purgatory of ranging and trending lower. Poor thing. 😢

Read More

- EUR USD PREDICTION

- Gold Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- Silver Rate Forecast

- Brent Oil Forecast

- CNY JPY PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- EUR RUB PREDICTION

- USD MYR PREDICTION

- GBP CHF PREDICTION

2025-08-04 01:14