Oh, China is at it again! Rumor has it the Middle Kingdom is flirting with the idea of letting yuan-backed stablecoins waltz onto the global stage for the very first time. Yes, you heard that right-digital yuan tokens might soon be strutting their stuff. 😉

This little scheme will reportedly get its moment in the spotlight at the Shanghai Cooperation Organisation (SCO) Summit in Tianjin later this month. The plan? To convince everyone that the yuan should be the belle of the trade settlement ball. 🎉💃

Yuan-Backed Stablecoins: Beijing’s Crypto Comeback? 🐉

According to Reuters, China’s State Council is dusting off a roadmap this month to supercharge yuan internationalization. Think pilot programs for stablecoins in Hong Kong and Shanghai. Oh, the drama! 🍿

If greenlit, this masterstroke would come with all the bells and whistles-regulatory guidelines, risk controls, and usage targets. Why? To take a sledgehammer to the iron grip of US dollar-pegged stablecoins, of course. Because nothing screams “rivalry” like a currency showdown. 💥💵

[ ZOOMER ]

CHINA CONSIDERING EXPANDING USE OF YUAN INTO STABLECOIN, TO DISCUSS AT SHANGHAI SUMMIT THIS MONTH: RTRS

– zoomer (@zoomerfied) August 20, 2025

Meanwhile, across the Pacific, Washington isn’t exactly twiddling its thumbs. President Trump’s administration is sprinting ahead with stablecoin regulation via the GENIUS Act. Dollar-backed stablecoins are already the MVPs of crypto trading and cross-border payments. 🏆📈

For those living under a rock, stablecoins are digital tokens designed to keep their value steady, usually by clinging to a fiat currency like a koala to a eucalyptus tree. 🌳🐨

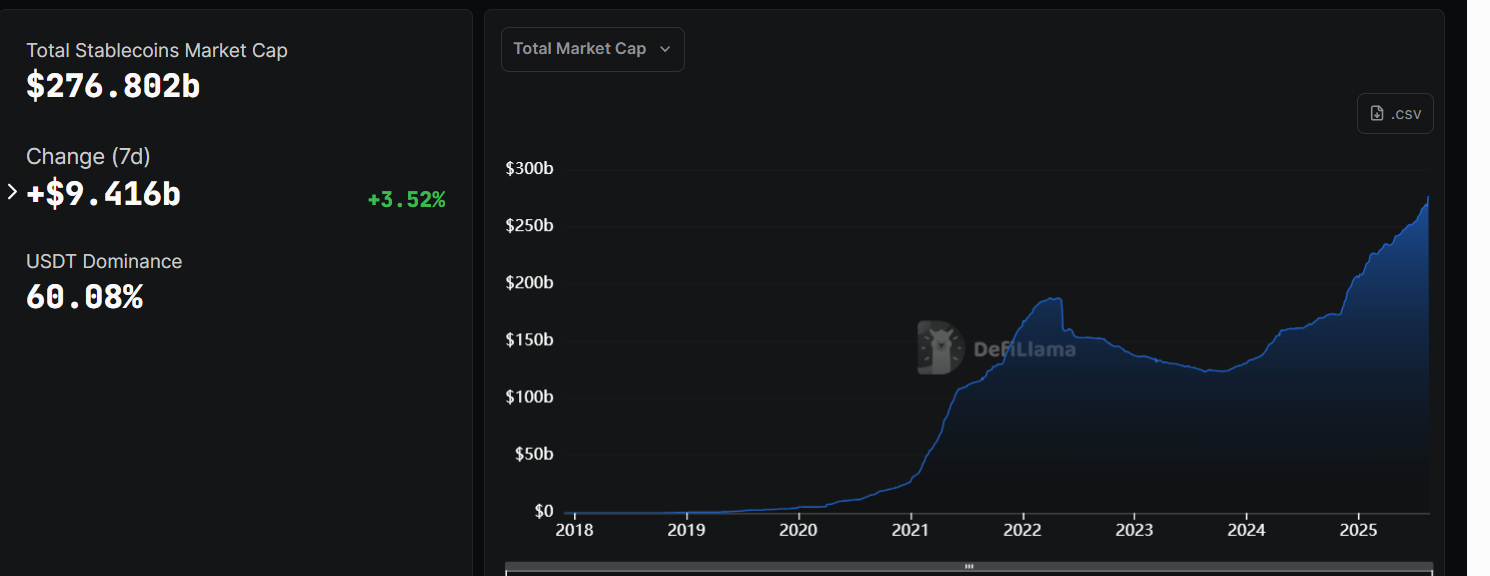

Currently, the global stablecoin market is worth around $276 billion, with over 99% tied to the almighty US dollar, according to the Bank for International Settlements. Talk about dollar dominance! 💵👑

Hong Kong and Shanghai: The Stablecoin Showstoppers? 🌟

Hong Kong, fresh off the heels of its shiny new stablecoin ordinance rolled out on Aug. 1, is ready to play ringmaster. Meanwhile, Shanghai is flexing its muscles as an international hub for digital yuan operations. Both cities are poised to become the playgrounds for offshore yuan-denominated stablecoins. 🎪💰

Analyzing this move through a geopolitical lens, it’s clear Beijing is playing a long game. This isn’t just about stablecoins; it’s about countering US financial hegemony. After all, Chinese exporters are already cozying up to dollar stablecoins, which highlights the yuan’s current limitations in global payments. 🌍💸

If approved, this decision would mark a jaw-dropping reversal from China’s 2021 ban on crypto trading and mining. Irony much? 😏 While capital controls remain a thorn in the side, yuan-backed stablecoins could give China a shiny new weapon in the global finance arena-especially in Asia, where Japan and South Korea are also dipping their toes into fiat-backed token pilots. 🇯🇵🇰🇷

Stay tuned, folks. More tea will surely spill as Chinese policymakers wrap up their consultations. 🫖✨

Read More

- BTC PREDICTION. BTC cryptocurrency

- Gold Rate Forecast

- USD MYR PREDICTION

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- EUR USD PREDICTION

- USD TRY PREDICTION

- Brent Oil Forecast

- USD VND PREDICTION

- EUR ILS PREDICTION

- EUR JPY PREDICTION

2025-08-20 15:18