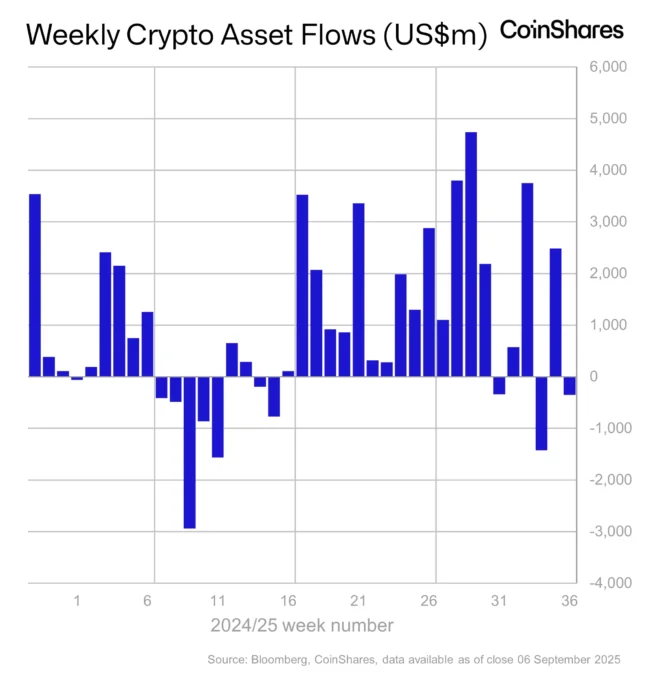

Ah, Brazil-a veritable carnival of crypto coins! Last week, the samba rhythm of digital dollars swelled by a modest $5.4 million (or a dazzling R$28.8 million, if you prefer your numbers with a dash of tropical flair), hitching a ride on the global crypto rollercoaster that joyfully clattered to a $3.3 billion crescendo. Our trusty informant, CoinShares, assures us this frenzy owes itself to the sweet siren song of a U.S. Federal Reserve rate cut, scheduled for September 17. Because, naturally, nothing pumps investor optimism quite like the tantalizing prospect of the Fed playing monetary maestro.

Global flows and Brazil’s position

The U.S. is the grand puppeteer here, directing a hefty $3.3 billion inflow, while Germany shows up with a polite $160.2 million, Canada humbly offers $14.1 million, and Hong Kong and Australia toss in their loose change at $5.4 million and $2.4 million respectively. Meanwhile, Switzerland and Sweden, ever the party poopers, are busy refunding their crypto tickets with outflows of $92.1 million and $5.6 million-because who doesn’t love a dash of Scandinavian skepticism?

And Brazil? Ever aspiring, it shimmies into sixth place globally, boasting a cool $1.68 billion under management. Trailing behind the colossal U.S. with its $165.79 billion, Switzerland’s $7.92 billion, Germany at $7.55 billion, Canada’s $7.31 billion, and Sweden’s $4.01 billion, it’s like the modest yet spirited drumbeat in the cacophonous symphony of global finance.

Single-asset crypto funds dominate as multi-asset products see outflows

Bitcoin swaggers ahead, leading with $2.4 billion in fresh infusions, followed by Ethereum lounging with $645.9 million and Solana smashing previous records with a staggering $198.4 million. Meanwhile, XRP and Sui chip in with $32.5 million and $14 million. Institutional players, led by BlackRock’s iShares Bitcoin and Ethereum ETFs, parade past with $1.11 billion-Fidelity’s Wise Origin Bitcoin Fund isn’t far behind, clutching $850 million like a prized carnival prize. ARK 21 Shares, Bitwise, and Grayscale toss their hats into the ring, adding to the scrumptious smorgasbord of crypto enthusiasm.

In a less exhilarating subplot, multi-asset funds have done a slow moonwalk out of the spotlight, posting $1.1 million in outflows. And if you thought 21Shares AG and CoinShares XBT Provider AB were joining the fiesta, think again-they’ve excused themselves with $94 million and $6 million in withdrawals, proving sometimes less really is more, especially when it comes to the fickle taste of single-asset connoisseurs.

The takeaway

Summing up this samba of statistics, Brazil’s steady inflows echo the global crowd chanting that crypto isn’t just a passing fancy but a wild beast clawing its way into the financial mainstream. Bitcoin and Ethereum funds are catching a breath, Solana breaks its own records as though the sky were the limit, and the markets – ever on the brink – await the Fed’s decree. Which begs the question: will institutional appetite blaze anew, or will it sulk in the shadows? Grab your popcorn 🍿, crypto enthusiasts, the show is just beginning.

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- ETH PREDICTION. ETH cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

2025-09-15 23:37