Markets

What to know:

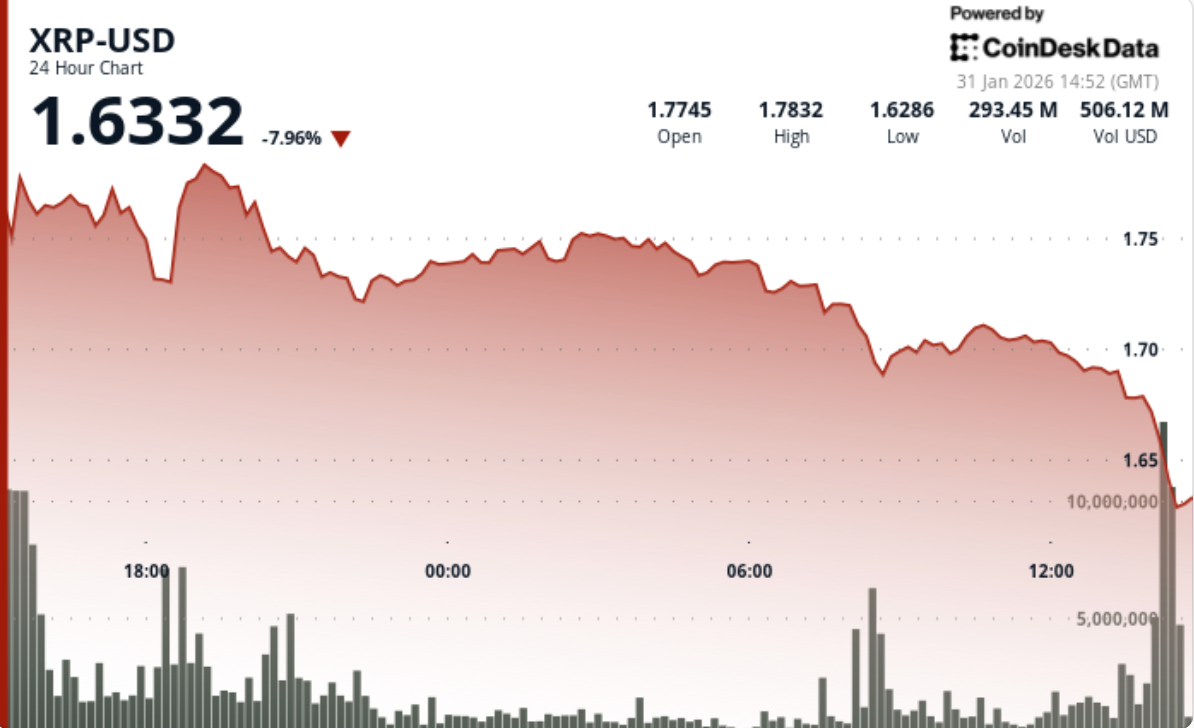

- XRP, that plucky little token, decided to take a swan dive of about 6.7 percent, landing at a rather uncomfortable $1.75, all thanks to a bitcoin-led crypto sell-off that sent long positions packing faster than you can say “liquidation.”

- More than $70 million in XRP futures evaporated into thin air-mostly long positions-when the price decisively broke below the $1.79 support, which was supposed to be sturdier than a cardboard box in a rainstorm.

- Traders are now peering hopefully at $1.74-$1.75 as the new “do not cross” line; if they want to avoid further chaos, they’ll need to reclaim $1.79-$1.82 like it’s a lost puppy and not just a number on a screen.

XRP took a sharp nosedive as broader crypto weakness pulled the rug out from under long positions, sending the price crashing below crucial support until buyers cautiously tiptoed in around $1.74, probably hoping they weren’t too late to the party.

News Background

- XRP fell in tandem with a broader crypto selloff, with Bitcoin leading the charge downwards like a roller coaster that forgot to slow down.

- This delightful plunge was driven by positioning rather than any juicy token-specific gossip, as over-leveraged longs were forced out once the critical support levels decided to take a holiday.

- Derivatives data revealed more than $70 million in XRP futures liquidations, mostly from long positions, highlighting how crowded the trade was before everybody scrambled for the exits.

Price Action Summary

- XRP dropped about 6.7%, tumbling from $1.88 to $1.75, and let me tell you, that was not a graceful fall.

- The support near $1.79 decided it was too hot and failed during the selloff, leaving traders flailing.

- Volume surged sharply during this delightful breakdown, signaling forced selling and a lot of panic.

- By the end of the session, the price managed to stabilize in a narrow $1.74-$1.76 range, which is like finding a slightly less uncomfortable chair at a bad wedding.

Technical Analysis

- XRP decisively broke below $1.79, triggering a liquidation-driven cascade that pushed prices down to a session low near $1.74, as if to say, “Look Ma, I’m falling!”

- This breakdown happened on exceptional volume, confirming that institutional participants were involved, rather than just a few day-traders throwing darts.

- A modest rebound followed, but recovery attempts stalled below $1.76, with volume fading on the bounce-a classic sign of stabilization rather than a triumphant comeback.

- Former support between $1.79 and $1.82 has now flipped into resistance, effectively capping any upside unless bulls make a convincing case for a return.

What Traders Say is Next?

- Traders are squinting at $1.74-$1.75 as the immediate line in the sand, or perhaps more accurately, the line in the quicksand.

- If $1.74 holds, XRP might continue to consolidate as liquidation pressure eases-but bulls need to reclaim $1.79, and ultimately $1.82, to bring the structure back toward neutral, which sounds easier said than done.

- If $1.74 breaks, downside risk opens towards $1.72 and $1.70, with momentum likely building as whatever support remains crumbles away.

- For now, XRP remains as sensitive to liquidation as a diva to negative reviews and tightly correlated to Bitcoin, with technical levels-not headlines-steering the ship.

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

2026-01-31 19:46