Crypto’s Grand Finale Turns into an Absurd Bloodbath 😢💥

Markets

What to Know:

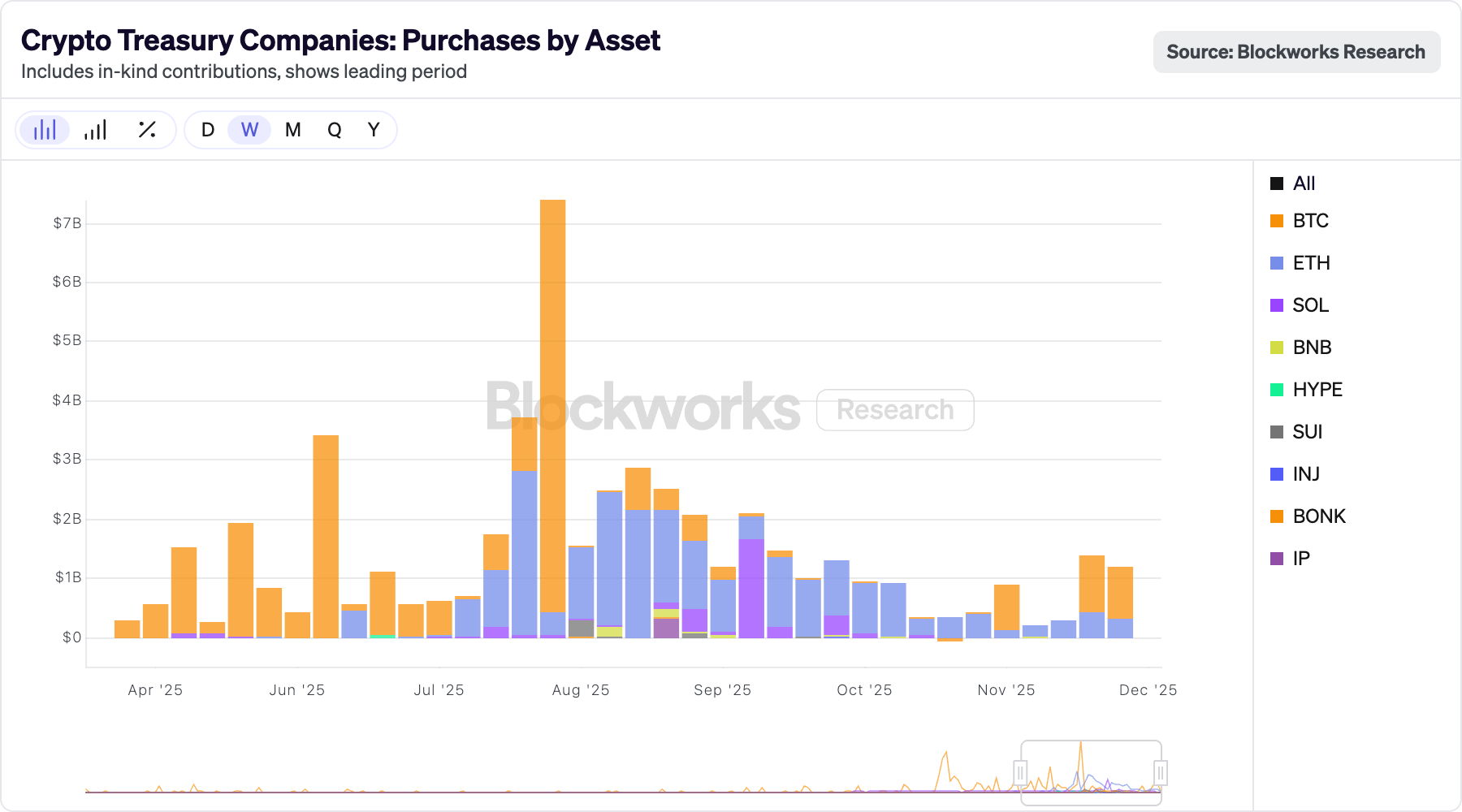

- Digital asset treasuries, altcoin ETFs, and seasonal hopes all went down faster than a drunken sailor, now some DATs are heading straight for the forced sale rodeo 🐂🤠. Market caps sinking below NAV? That’s the crypto version of a sinking ship, folks.

- October’s $19 billion liquidation had more drama than a soap opera, hollowing out market depth. The rebound? More short covering than genuine demand – sounds like a bad sequel, doesn’t it?

- ETF hype is fading quicker than last year’s New Year’s resolutions, DATs are squeezing tighter, and rate cuts aren’t the magic wand – crypto enters 2024 without that lucrative theme song. Capitulation? Possibly. Opportunity? Maybe – if you’re brave enough to dance on the graveyard.

Crypto was supposed to go out with a bang, like fireworks on the Fourth of July, right? 🎆 Instead, what do we get? A $19 billion bloodbath, a market emptied out faster than a tavern after 마지막 call, and crypto’s cheerleaders hiding under their desks.

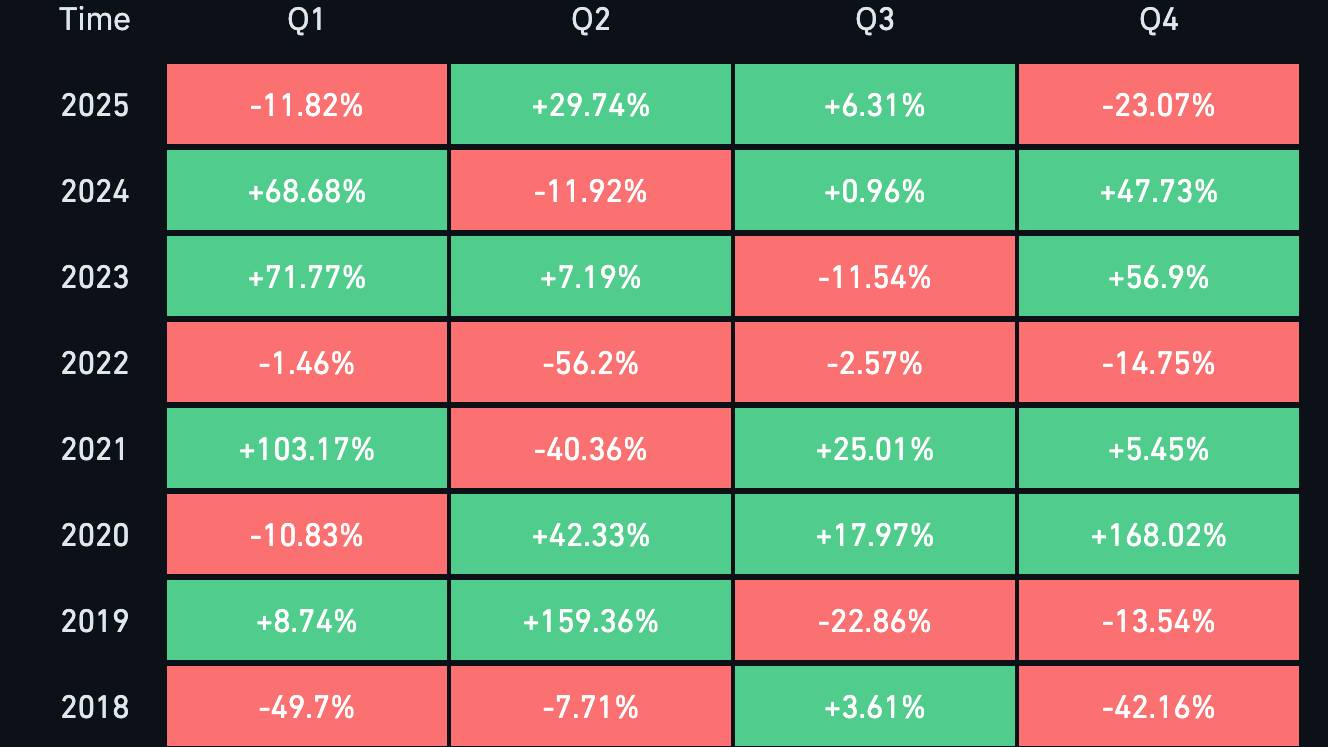

Heading into Q4, Bitcoin was the star of the show: ETF inflows, DATs acting like leverage-fueled rockets, analysts dusting off their charts like fortune-tellers predicting the year’s end success story. Everyone was dreaming of new records, money flowing like water, politics smiling kindly – a perfect fairy tale. 🧚♀️

But reality kicked in: the $19 billion liquidity hole in October made the market look like a haunted house – spooky, empty, and filled with echoes of hope long lost. The rebound? A flimsy cover-up, more about short squeezing than genuine demand. Bitcoin? Down 23% since October, trying to hold onto its dignity while stocks and metals are laughing all the way to the bank 💰.

DATs: From Flywheel to Fraitwheel

These digital asset treasuries, born from the fevered dreams of dudes copying Michael Saylor’s schemes, promised to be the saviors of crypto prices. What do we get? A rapid descent into chaos. Investors yawned at spring’s hype, and as prices slid in October, DATs started selling off faster than a barber’s sign on a windy day. Many are now worth less than their bitcoin holdings – and that’s saying something!

Altcoin ETFs – The Great Disappointment?

Everyone was excited about spot altcoin ETFs in the U.S., like kids waiting for Santa. Solana’s ETF brought in $900 million – impressive! XRP? Over a billion! Yet, the underlying tokens? They’re falling faster than a lead balloon: SOL down 35%, XRP down 20%. Talk about buying hype and selling pain.

Small players like Hedera? Barely anyone’s interested, as risk appetite evaporates quicker than morning dew. 😅

Seasonality – What Holy Nostradamus Never Saw Coming

Analysts loved to preach that Bitcoin’s year-end rally was a sure thing – like the sun rising tomorrow. Historically, Q4 has been the shining jewel – a 77% average return! Shine bright, right? Well, not this year. BTC down 23% since October, on pace to make the worst last quarter in seven years. The old adage? Still irrelevant – 2024 is rewriting the rules. 📉

The Liquidity Void – Market’s Mourning Song

October 10, a day that will live in infamy, saw $19 billion vanish faster than your paycheck after rent. Bitcoin dropped from $122,500 to $107,000 – a feat of financial magic. The supposed safety net of ETFs? Just illusions, my friend. It proved crypto is still that wild tribal dance, only now dressed in Wall Street suits.

Market depth? Gone. Confidence? Shattered. Investors? Fuggedaboutit. Bitcoin tried a small rally from November’s lows, peaking at $94,500 in December, but the open interest? Still sliding down like a greased pig – from $30 billion to $28 billion. All hype. Just smoke and mirrors.

2026 – The Year of False Promises?

Since October, stocks and metals have outperformed crypto – Nasdaq up 5.6%, gold 6.2%, while Bitcoin? Down a devastating 21%. Looks like the glittering hopes of 2025 went up in smoke, and the future? As clear as mud. 🚧

The Trump buzz, relaxed regulations, and the mythical U.S. crypto strategy? Fading faster than your New Year’s resolutions. The only “bullish” pointer: rate cuts that did zilch – BTC lost 24% after September’s lull.

Many investors are now clutching their pearls, wondering if a collapse is imminent. DATs, those crypto Frankenstein monsters, are looking less like saviors and more like ticking time bombs. Some giants like MicroStrategy are eyeing the exits, while others wait anxiously for the storm to pass. When the dust settles, perhaps it’s a good time to buy – but only if you enjoy living on the edge. 🧗♂️

So here we are, dear reader, at the dawn of another uncertain year. Will crypto rise again, or is this just the prelude to its final curtain? Grab your popcorn – it’s going to be a wild ride. 🎢

Read More

- EUR PHP PREDICTION

- Brent Oil Forecast

- EUR USD PREDICTION

- USD INR PREDICTION

- USD MYR PREDICTION

- EUR THB PREDICTION

- USD PLN PREDICTION

- USD JPY PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

2026-01-01 15:26