So, the markets decided to throw a party this week, and no one was invited. Checkonchain’s new “stress meter” for Bitcoin buyers has plunged into a low so extreme it makes 2018 look like a relaxing beach day.

This fancy metric compares how much the latest buyers have peeled off the price versus where Bitcoin actually is. A pinch of math suggests that, on average, the last 155 days’ purchasers are sitting half‑hidden under the seat-no, not literally, just below break-even. That’s the kind of vibe that tells traders, “Hey, you’ve got water all over you, go buy a boat.”

Short‑Term Buyers Are All in the Shallow Pool Now

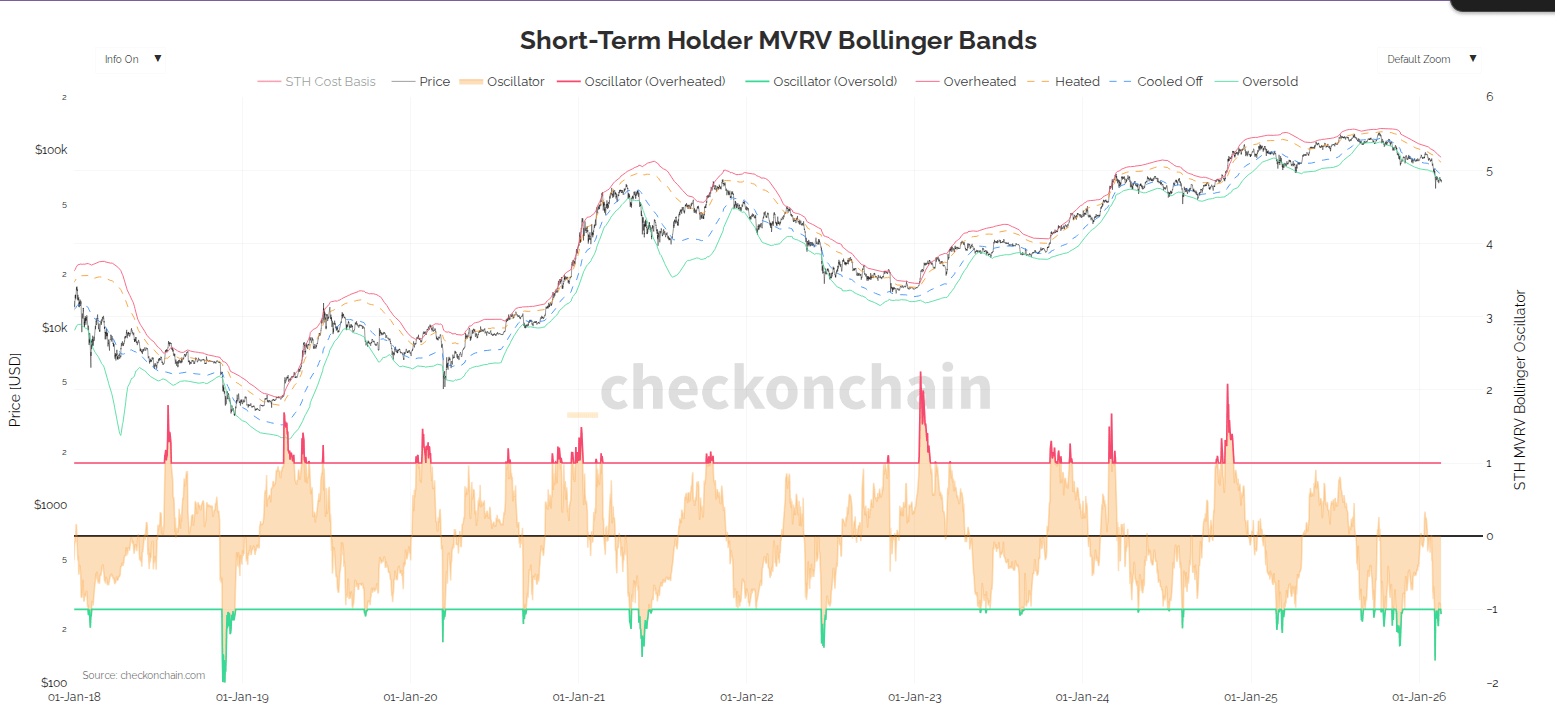

The Short‑Term Holder Bollinger Band has taken a dip that’s literally “under the water line.” Historically, that’s a whisper that selling has crashed the price and then buyers have started nodding along like it’s a new dance craze.

Insert a dramatic pause.

Large wallets that have been holding short-term haven’t yet blew up in losses. MatrixPort whispers that the bigshots might be holding for the long hauls-maybe, maybe, they’re just pretending not to care. The same signal preceded Bitcoin’s 1,900 % leap from 2018 to 2021, so you can’t help but get nostalgic.

Today’s #Matrixport Daily Chart – February 17, 2026

Bitcoin Sentiment Hits Extreme Lows ⁰- Durable Bottom Are Emerging?#Matrixport #Bitcoin #BTC #CryptoMarkets #MarketSentiment #FearAndGreed #RiskManagement #Volatility #CryptoResearch

– Matrixport Official (@Matrixport_EN) February 17, 2026

Price Behaviour: More Confused Than a Dog at a Food Truck

Bitcoin wobbled under $70k as risk‑off flows marched in. The go-to explanation? geopolitical tensions in the Middle East and some other far‑off drama that the market can’t figure out. And, get this, a Wells Fargo strategist believes that the scent of tax refunds might coax fresh money into risk-so, maybe buckle up for a March rally?

Bitcoin STH Bollingers most oversold in 8 years

– Quinten | 048.eth (@QuintenFrancois) February 17, 2026

What History Can (and Cannot) Tell Us

History is kind of like a stubborn ex; it will tell you stories that soothe and yet never amount to predictions. The oversold signal flashed before 2018’s big lift and before that November 2022 low that eventually turned ugly.

Back then the money supply was a different character, interest rates were someone else’s problem, and institutional players were still learning the dance floor. Today we have ETFs, a volley of derivatives, and global politics playing with a tighter policy string.

Bottom line? Past wins don’t automatically repeat, but patterns are the GPS that tells you when you’re about to put your money into a rollercoaster.

Short‑term pain may still creep up on us, and volatility might stick around while the world tries to sort itself out. But if you’re a long‑term holder, the stretched readings mean the next buy window might be close-like the next downhill slope in that ever‑oscillating rollercoaster we call crypto.

Read More

- BTC PREDICTION. BTC cryptocurrency

- USD MYR PREDICTION

- EUR JPY PREDICTION

- Gold Rate Forecast

- Shiba Inu: The Dramatic Rise of a Troupe of Canines – Will They Dazzle or Dwindle? 🐾

- USD VND PREDICTION

- Tether’s Big Bet on Bitcoin Lightning Network: Will It Work? 🤔

- EUR RUB PREDICTION

- GBP CNY PREDICTION

- Why Bitcoin and Crypto Prices Are Soaring: A Tale of Greed and Bullish Patterns

2026-02-19 18:14