Well, well, well, looks like our dear crypto hackers are getting bored of the usual shenanigans. A brand-new report from CertiK reveals that the bad guys are shifting their focus to something juicier: RWA (real-world assets) projects! Yep, you heard that right. The hackers have swapped their old playgrounds for the shiny new toy in town. Time to bring out the popcorn 🍿!

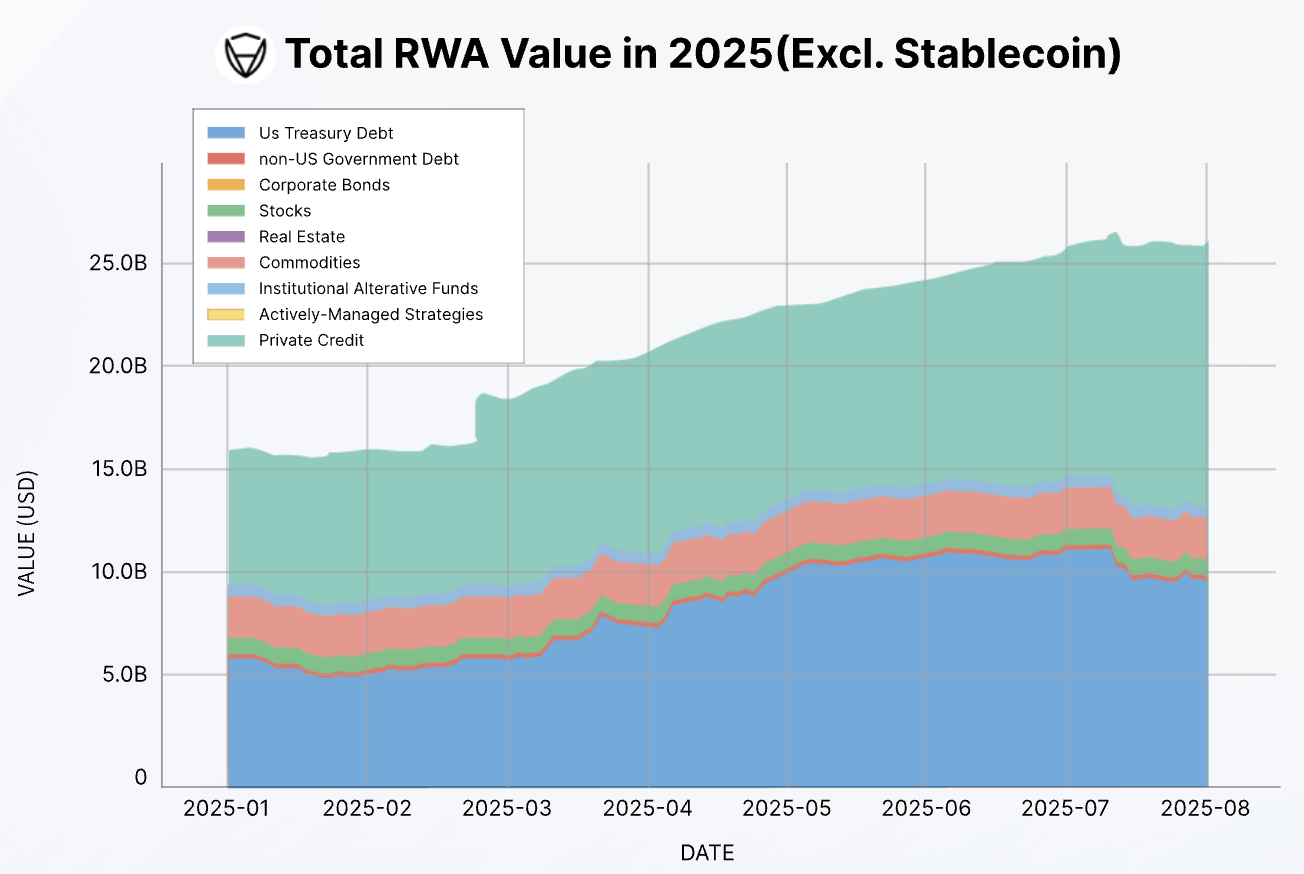

But wait, there’s more! The report also points out that most of these tokenized assets are chilling on Ethereum and a few other dominant protocols. So, what does that mean? A single hack could send the entire $13.9 billion+ RWA sector into a tailspin. Yikes! 😱

RWA Hacks on the Rise

In the latest and greatest report from CertiK, they break down how the threat landscape for RWA projects has evolved since 2023. The bad news? The attack surface is now as broad as an all-you-can-eat buffet – from on-chain to off-chain assets. It’s a hacker’s dream!

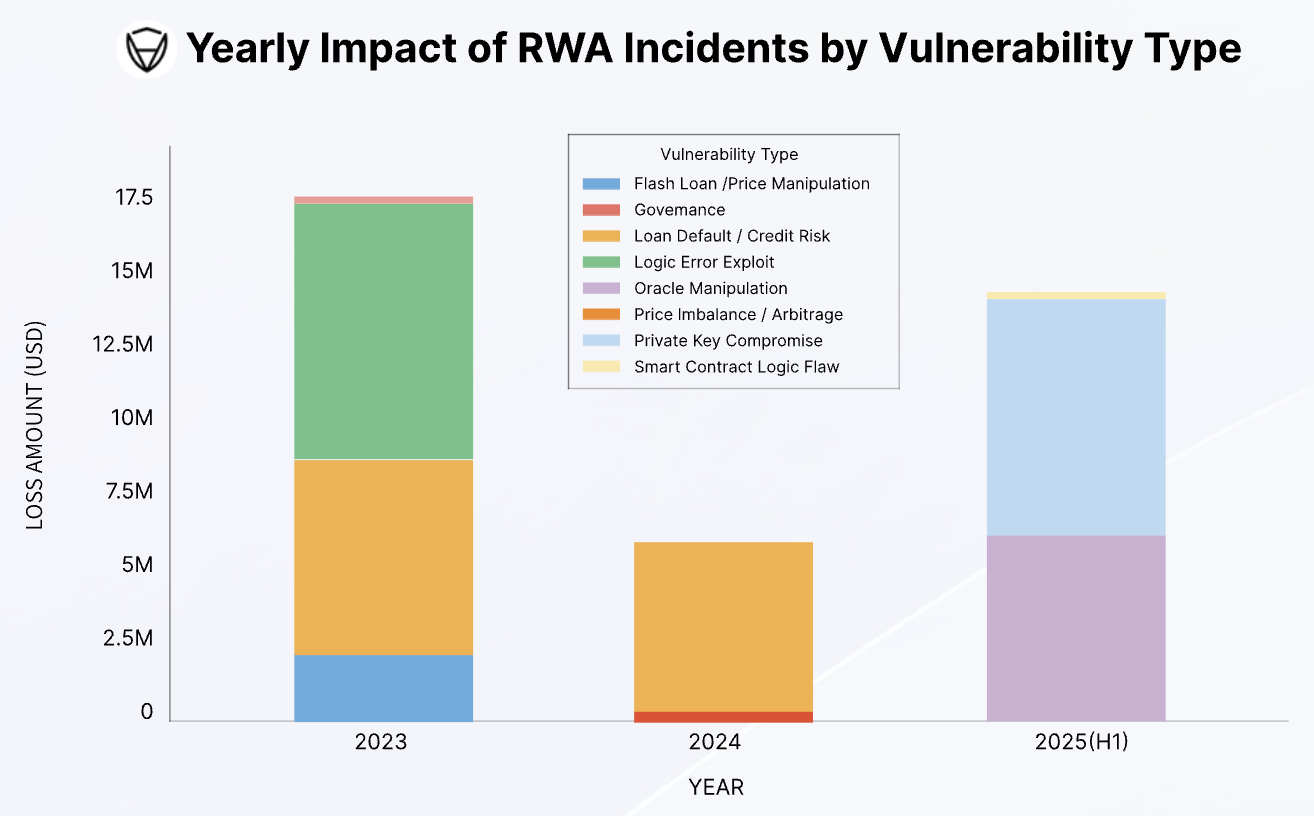

Hold onto your hats, folks. Between January and July, the RWA sector lost $14.6 million to hacks and frauds. That’s nearly the same amount as the entire year of 2023! Guess what? There’s no sign of this fun party stopping anytime soon. More attention = more problems. Fun times, right? 😏

Unique Hybrid Vulnerabilities

Now, CertiK isn’t blaming market forces for this shift. Nope, it’s not all about the economy. In previous years, RWA criminals loved to mess with off-chain threats-things like credit and loan defaults. But in 2025, the hackers have switched gears and are targeting the technology itself. Hello, core systems! 🔧

But here’s the real kicker – the RWA market is now as vulnerable as a toddler on a sugar high:

“The data highlights a clear transformation in the RWA threat landscape. The first half of 2025 shows a complete shift: losses jumped to nearly $14.6 million, and were caused entirely by on-chain and operational failures. The threat has evolved from exploiting external financial arrangements to attacking the core technology…itself,” CertiK claimed.

Basically, it’s like an evil mastermind hacking into the inner workings of a well-oiled machine. And RWA’s special relationship with TradFi (traditional finance, for those still trying to keep up) makes them the perfect target for hackers who want to hit both ends of the spectrum. Oracles, anyone? 🕵️♂️

So, imagine this: a firm offers RWAs backed by “solid” assets like gold or US Treasury bonds. Seems like a fortress, right? WRONG. A well-timed hack could bring the whole thing crashing down faster than a house of cards. Talk about a buzzkill. 😩

And don’t even get me started on real estate-backed RWAs. While they seem sturdy, their illiquid nature makes them prime targets for manipulation. Most RWAs in the US are backed by these kinds of assets – but don’t let that fool you. No one is safe. 🙄

Security Measures and TradFi’s Role

Now, CertiK has a few tricks up their sleeve to prevent the hackers from running wild. But here’s the plot twist: some of their solutions are totally unexpected! They still emphasize classic crypto protection principles, but they’re throwing in some good ol’ legal mumbo jumbo for extra flavor.

One gem from CertiK? The importance of legally sound contracts. Apparently, a poorly drafted agreement could make everything collapse faster than a bad date. Who knew legal language was that powerful? 💼

And here’s where TradFi comes in – the big players like BlackRock already have solid principles for things like legal language, asset storage, and admin guardrails. But 🚨

In the end, this report serves up a platter of recommendations. Firms in the RWA space need to stay vigilant and keep improving their security to keep those hackers at bay. It’s a never-ending race, folks! 🏃♂️💨

Read More

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- Gold Rate Forecast

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- USD TRY PREDICTION

- USD MYR PREDICTION

- EUR ILS PREDICTION

- EUR JPY PREDICTION

- Silver Rate Forecast

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

2025-08-21 20:03