On October 10, Bitcoin took a little tumble, dipping below $110K and dragging $19.31 billion worth of liquidations along with it. Over 1.6 million traders? Outta luck. 😬

Liquidation Frenzy: A Historic Fall from Grace

What started as a week full of promise for Bitcoin (BTC)-two shiny new high scores-ended with a dramatic nosedive. The price briefly plummeted under $110,000, with Bitstamp recording the low at $109,683 on October 10, while Coingecko reported an even scarier dip to $105,896. Some sources even whispered about a terrifying drop to $101,516 before it bounced back, probably gasping for air. 😱

The sharp plunge set off a chain reaction of liquidations. By the end of October 11 at 1:13 a.m. EST, over 1.6 million traders were shown the door. And the damage? A whopping $19.31 billion in total liquidations, making it one of the biggest wipeouts in crypto history. 💥

Not surprisingly, the “long positions” bore the brunt of the carnage, losing $16.81 billion. Bitcoin and Ethereum took the biggest hits, with $5.36 billion and $4.42 billion wiped out, respectively. Other big losers included Solana ($2 billion), HYPE ($890 million), and XRP ($707.5 million).

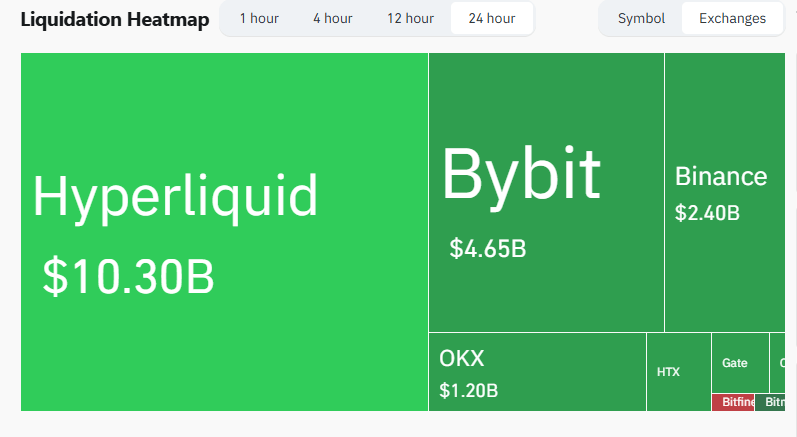

According to Coinglass’s liquidation heatmap, Hyperliquid saw the most damage with $10.3 billion worth of liquidations. Bybit wasn’t far behind at $4.65 billion, Binance stumbled with $2.4 billion, and OKX rounded off the chaos with $1.2 billion.

Tariffs or Manipulation? You Be the Judge

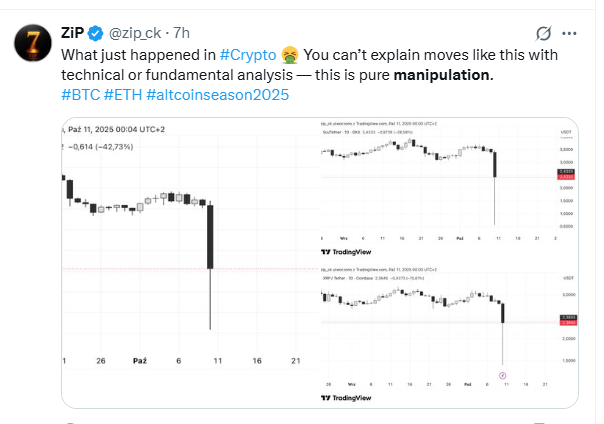

While some folks blamed President Trump’s ominous tariff threats on China for the market madness, the scale of the liquidations made conspiracy theories run wild. BitMEX founder Arthur Hayes decided to stir the pot by suggesting that the auto-liquidation of collateral tied to cross-margined positions at a major centralized exchange could be the true culprit behind the altcoin massacre. In Hayes’ words: “Word on the street is that big CEX’s auto liquidation of collateral tied to cross margined positions is why lots of alts got smoked on the move down. Congrats to all you stink bidders. We won’t be seeing those levels any time soon on many high-quality alts.” 🤷♂️

Meanwhile, other analysts on X joined the chorus, accusing big players of orchestrating this latest crypto bloodbath, now being dubbed the worst market collapse since the COVID crash, LUNA’s spectacular flameout, or the FTX fiasco. Guess it’s just another day in the wild west of crypto, folks! 🤠

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- ETH PREDICTION. ETH cryptocurrency

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

2025-10-11 14:23