The market, that grand circus of dreams and despair, reveals once more its savage beast lurking beneath the guise of digital gold. Data screams of yet another blow-how many have learned to dance on the edge of a blade? The crypto derivatives arena, that peculiar coliseum, has once again seen a maelstrom-longs crushed under the weight of a retrace that seems almost orchestrated by the gods of chaos.

Crypto Sector Has Just Seen $700 Million In Liquidations

On a day when Bitcoin and its comrades chose to retaliate with dramatic flair, the futures market saw a spectacle worthy of tragedy. Liquidation-ah, that sweet term-meaning contracts that, having run out of luck, are forcibly ejected from the game. The very act reminiscent of a gladiator’s final breath, but for digital currencies. Imagine a battlefield where a staggering $11 billion in Bitcoin alone was wiped out-like a giant eraser scribbling away hopes of the unwise.

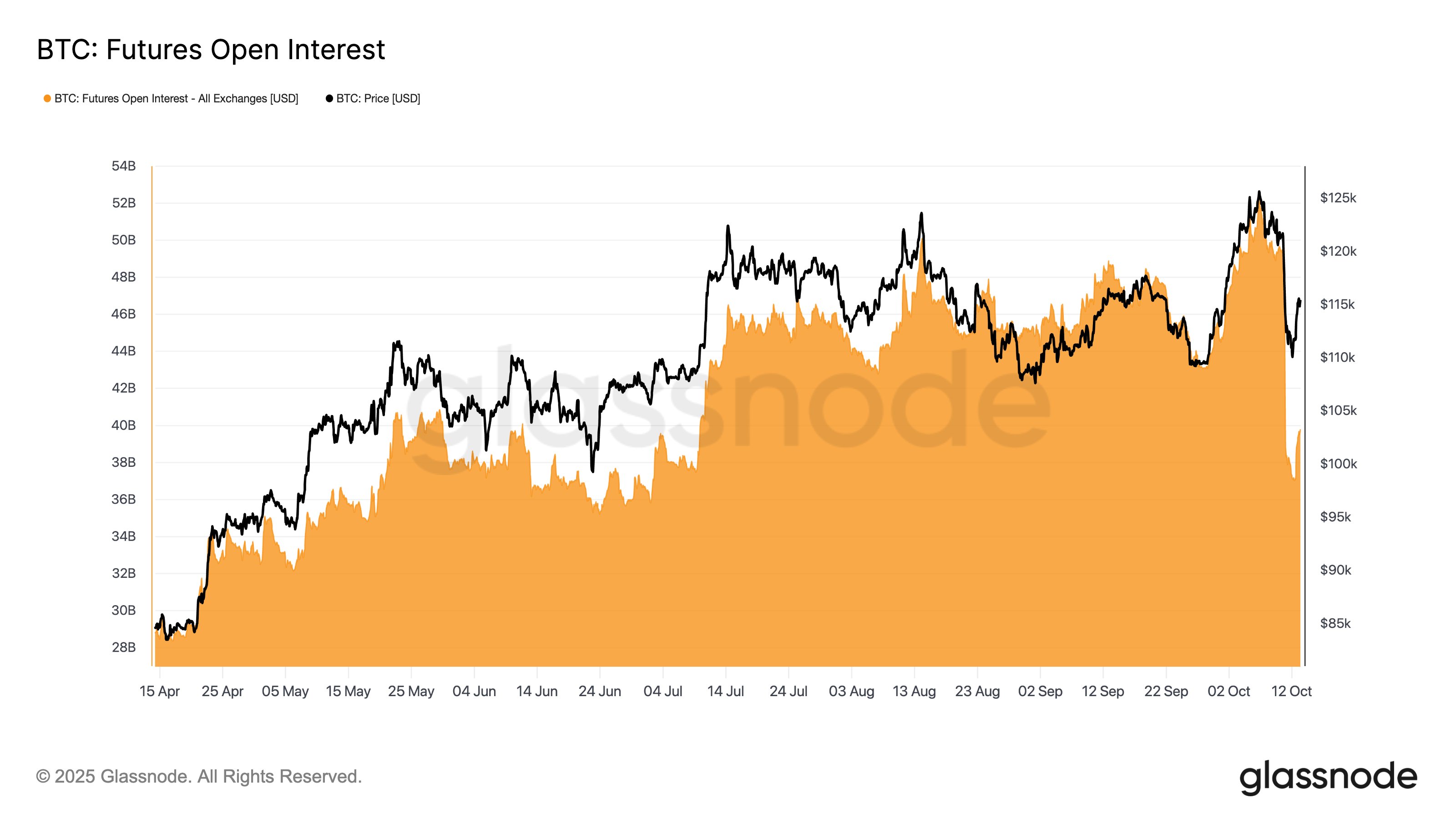

This plunge, the largest in the history of this strange arena, reset the rules-derivatives, that engine of greed, coughed and spat out its excess. Open Interest, that ominous measure of all active bets on Bitcoin across exchanges, shrank in a spectacle of colossal proportions, reminding us that even the richest gamblers can be humbled by the invisible hand.

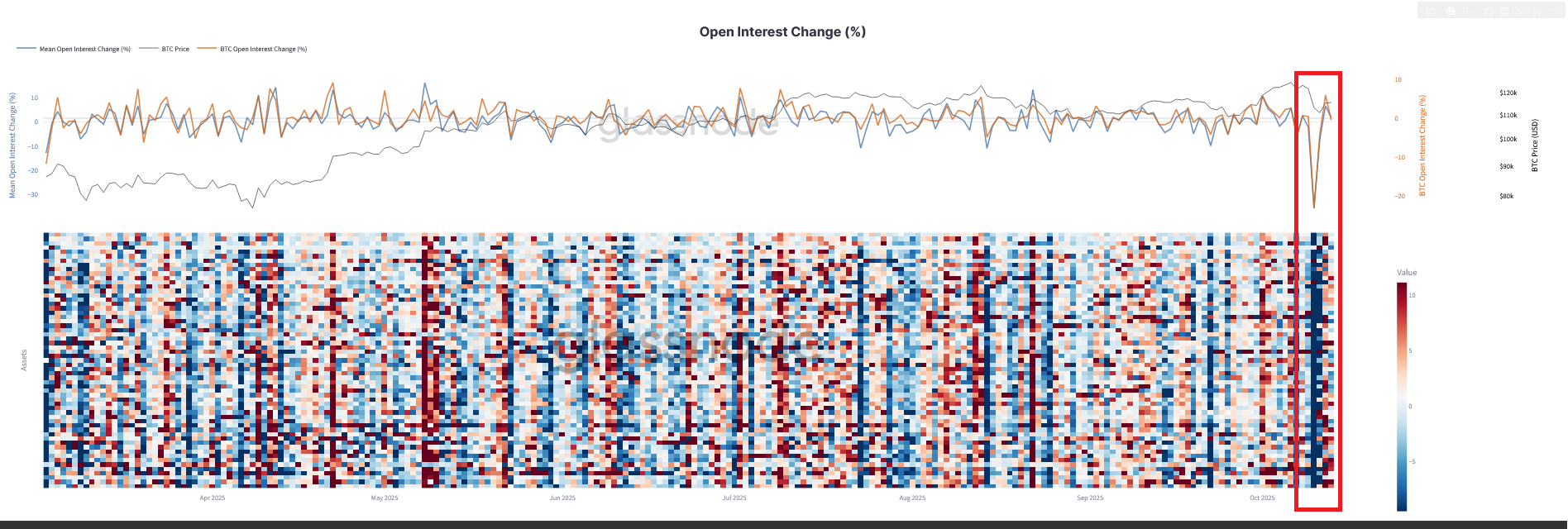

And just for kicks, a heatmap-an abstract map of chaos-showing how the mania rippled across more than 100 coins. The swing was so violent, it put the Storm of 1812 to shame. Markets, dear reader, are either patient or simply amused by our folly.

Yet, as if mocking the very notion of predictability, traders once again fell prey to volatility’s cruel joke. Liquidations, that merciless gauge of market love or disdain, climbed to nearly $708 million in just a day. Perhaps a reflection of despair or just a lunatic rush to the exit doors.

Long positions, those daring bets on the upward march, bore the brunt-an estimated $457 million, or about 64%, of the total bleed. Bitcoin’s downward dance, accompanied by Ethereum’s own display of mercy and Solana’s quick retreat, cemented this latest chapter of chaos in the ledger of madness.

Though smaller than last week’s spectacle, this event underscores a simple truth-leverage and volatility are inseparable, like fire and fury. The market’s volatility, that capricious mistress, continues to tempt the foolish and enrich the cunning.

Focus on Ethereum-over $234 million swept away-and Bitcoin, second with $168 million, as the stars of this tragicomic show. The scene is set, dear reader, for yet another round of the absurd game we call crypto investing.

Such mass liquidations defy the mundane notions of stability-they’re a staple in the theater of crypto. Extreme leverage, amplified swings-like a rollercoaster designed by mad scientists. And yet, even in this chaos, the recent upheaval was nothing short of legendary.

BTC Price

As I write, Bitcoin floats at $113,300-a number that seems as arbitrary as a random fact. Down 6.5% over the week, it’s the kind of decline that makes you wonder if fate has a dark sense of humor.

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- ETH PREDICTION. ETH cryptocurrency

2025-10-15 13:44