Well, well, well. Looks like the crypto crowd has finally discovered what the rest of us already knew: the Federal Reserve is the ultimate party pooper. Last week, a cool $454 million decided it was time to leave the crypto casino, presumably to buy something sensible like a money market account or a really nice houseplant. 🌱

According to CoinShares-yes, that’s a real name, not a pirate’s treasure map-the early-week gains of $1.5 billion were about as stable as a Jenga tower after a few glasses of wine. By the end of the week, it was all just a pile of wooden blocks and shattered dreams. 🧱💔

Bitcoin: From Hero to Zero (Almost)

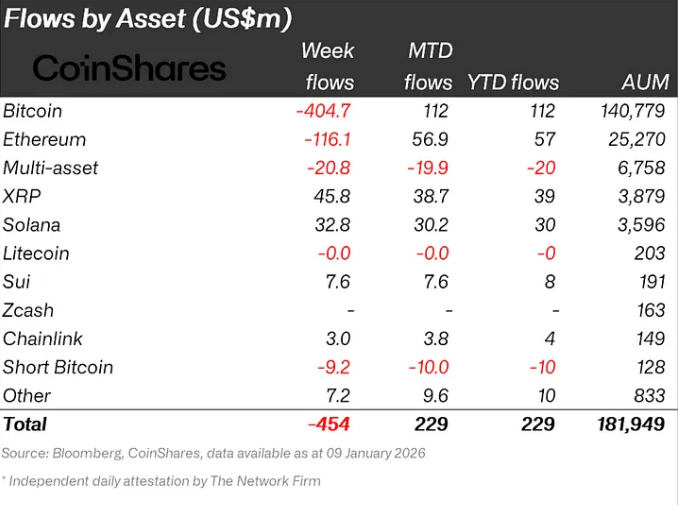

Bitcoin, the prom king of crypto, got dumped harder than a bad blind date. $405 million fled Bitcoin ETPs faster than I flee a conversation about CrossFit. Ethereum, the slightly cooler but still awkward sibling, lost $116 million. Even the multi-asset crypto products were like, “Nope,” with $21 million in redemptions. 🚀➡️🚽

Why the sudden cold feet? Apparently, inflation and jobs data decided to crash the party, reminding everyone that the Fed might not be handing out rate cuts like party favors. Risk assets? More like “risk, please don’t asset.” 📉

The Misfits Who Got Invited to the Cool Table

Not everyone got left in the dust. XRP and Solana were like the kids who brought snacks to the party, attracting $46 million and $33 million, respectively. Even some obscure layer-one projects got a few crumbs, because apparently, desperation makes people creative. 🍿

Total assets under management? Still a whopping $182 billion. So, yeah, crypto’s not dead-it’s just taking a nap. Or maybe it’s sulking in the corner. Hard to tell. 😴

America: The Crypto Grinch

In a shocking twist, the U.S. decided to be the Grinch of the crypto world, with $569 million exiting faster than a Black Friday sale. Meanwhile, Germany, Canada, and Switzerland were like, “Oh, you’re leaving? Cool, we’ll take your money.” 🇩🇪🇨🇦🇨🇭

Capital? Moved. Investor appetite? Held up better in Europe, because apparently, they’re less dramatic. Or maybe they just have better snacks. 🧀

Analysts-those people who get paid to state the obvious-are calling this a “reassessment of monetary easing.” Translation: everyone panicked when they realized the Fed might not be their sugar daddy after all. Inflation’s still stubborn, the job market’s still flexing, and risk assets got a reality check. 💼🔍

Volatility? Oh, it’s here to stay. But hey, at least some altcoins are throwing little rallies, like the kid who still dances when the music stops. 🎉

So, what’s the takeaway? Crypto’s as sensitive as a teenager with a new pimple. $454 million is a lot, but $182 billion in AUM means this isn’t exactly a garage sale. Everyone’s just waiting for the Fed to text back, and in the meantime, it’s a lot of refreshing and sighing. 📱😔

Stay tuned, folks. This soap opera’s just getting started. 🍿

Read More

- ETH PREDICTION. ETH cryptocurrency

- GBP CHF PREDICTION

- USD VND PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- CNY JPY PREDICTION

- EUR RUB PREDICTION

- SHIB PREDICTION. SHIB cryptocurrency

- XMR PREDICTION. XMR cryptocurrency

- USD MYR PREDICTION

2026-01-13 06:07