CoinDesk Indices

What to know:

You’re reading Crypto Long & Short, our weekly newsletter featuring insights, news and analysis for the professional investor. Sign up here to get it in your inbox every Wednesday.

The digital realm of assets, which had hitherto been a source of great speculation, was struck by an unprecedented tempest of liquidation, henceforth known as crypto’s Black Friday. Within 24 hours, over $19 billion in leveraged positions were wiped out, marking the single biggest deleveraging event in the industry’s history. 💰💸

The sell-off commenced in the late hours of the American session, following His Majesty’s (President Trump) declaration of a 100% tariff on Chinese imports, thereby inciting global risk aversion across equities, commodities, and crypto. The steepest declines occurred within a 25-minute window, as high leverage collided with meager liquidity. According to CoinDesk Reference Rates (CADLI), bitcoin fell to $106,560, ether to $3,551, and solana to $174, with smaller-cap tokens dropping more than 75% intraday. A most lamentable sight, indeed. 📉

Market dynamics & scale of deleveraging

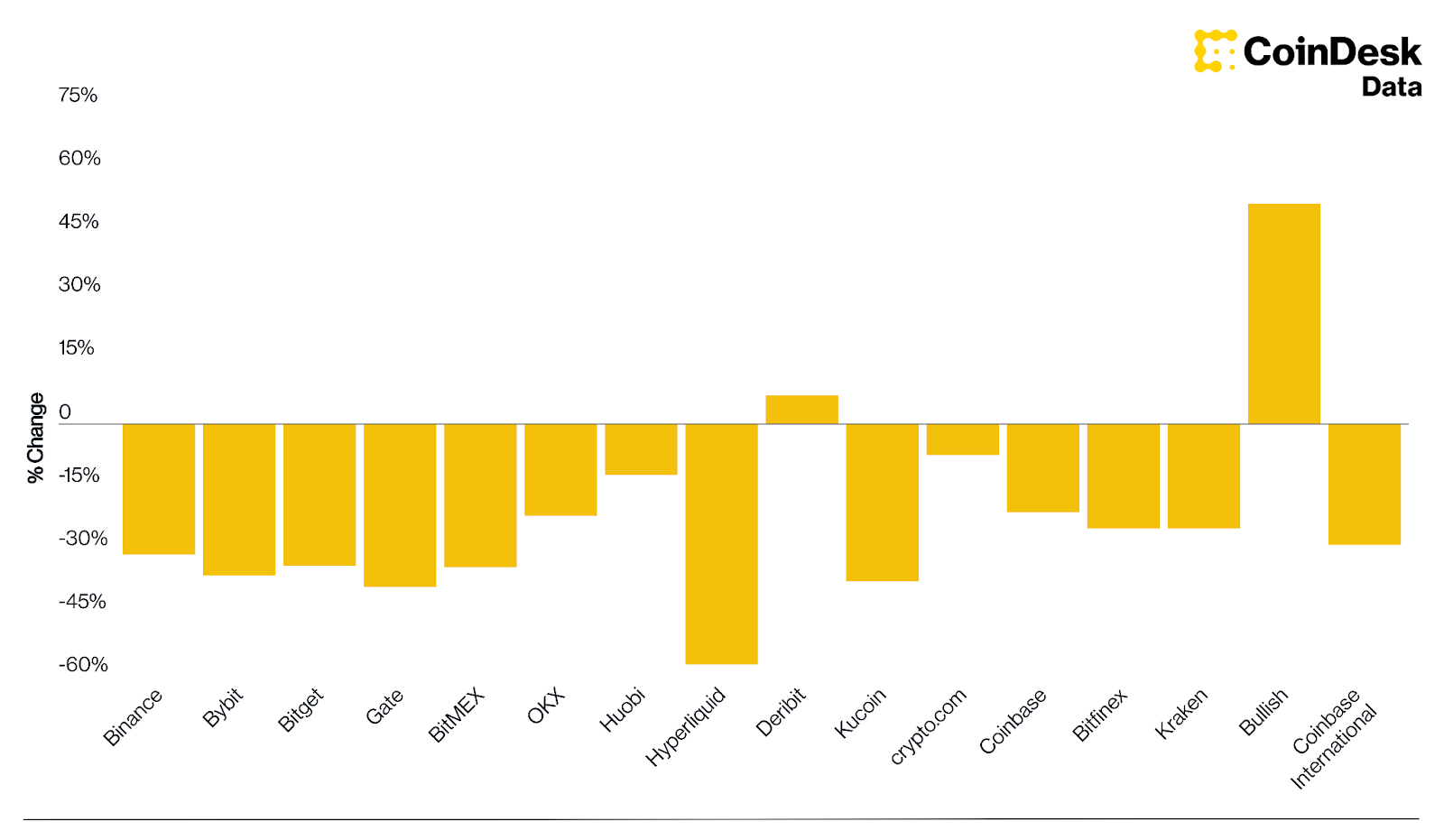

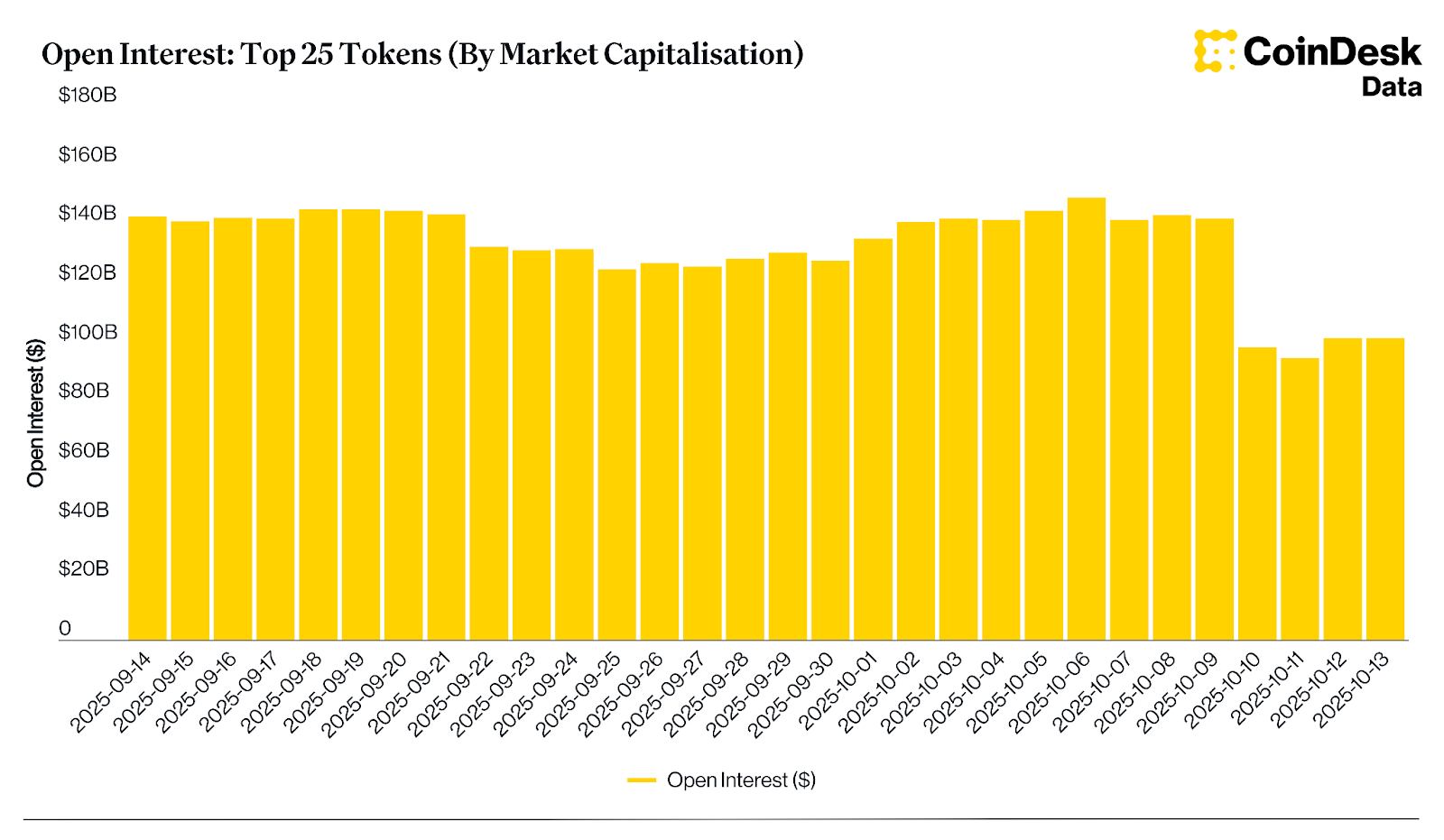

According to CoinDesk Data, total perpetual futures open interest fell 43%, dropping from $217 billion on October 10 to $123 billion by October 11. The largest single-day contraction occurred on Hyperliquid, where open interest declined 57%, from $14 billion to $6 billion, as positions were forcefully unwound. A most distressing turn of events for those who had placed their trust in such platforms.

Data suggests that around $16 billion of the $19 billion total came from long liquidations, with nearly every trader carrying 2x leverage or higher with no stop-losses on altcoins being wiped out within minutes. A most unfortunate predicament for the unwary. 🧙♂️

Public blockchains such as Hyperliquid provided a rare, transparent look into the sequence of forced liquidations, where the liquidation queue and execution can be verified on-chain. By contrast, centralised exchanges aggregate and batch liquidation data, meaning the true scale of forced unwinds may have even exceeded the widely reported $20 billion, since grouped reporting often understates notional values. A most opaque affair, indeed. 🕵️♀️

Structural stress & order book collapse

The episode underscored how inextricably linked liquidity, collateral, and oracle systems have become. What began as a macro-driven unwind swiftly evolved into a market-wide stress event. As prices breached key liquidation levels, market depth collapsed by more than 80% across major exchanges within minutes. A most alarming development, to be sure. ⚠️

In some instances, thin order books saw large-cap assets like ATOM temporarily print near-zero bids; a reflection not of fair market value, but of market makers withdrawing liquidity as risk systems throttled activity. With collateral shared across assets and venues relying on local price feeds, feedback loops amplified volatility across the ecosystem. Even well-capitalised platforms proved vulnerable once liquidity evaporated across the board. A most perilous situation for all concerned. 🧨

Fair-value pricing in volatility

When exchange-level pricing becomes erratic, CoinDesk Reference Rates such as CCIX and CADLI act as stabilising mechanisms. These multi-venue benchmarks aggregate prices from hundreds of sources, applying quality filters and outlier rejection to produce a global, consensus-based fair value. During Black Friday’s volatility, reference rates revealed that market-wide valuations remained far less extreme than certain venue-specific prints suggested. This transparency allows market participants to distinguish between genuine repricing and localised dislocation, providing a neutral reference for post-trade performance assessment. A most invaluable service, indeed. 📊

Reference rates don’t stop volatility, but they define it – ensuring traders, funds and exchanges have reliable data when the market breaks.

Closing thoughts

The severe dislocation in the market showed how leverage, liquidity, and fragmented infrastructure can converge into a feedback loop that overwhelms even the largest trading venues. It also revealed the limits of transparency in a system where some on-chain exchanges, such as Hyperliquid, expose liquidation flows in real time, while centralised venues still operate as partial black boxes.

Crypto’s maturity will be defined by how it internalises these shocks. Better risk controls, unified collateral standards, and real-time transparency will matter just as much as utilising pricing benchmarks. CoinDesk Reference Rates help confirm fair valuations when screens go red, but true resilience depends on exchange architecture, deeper order books, more robust oracle design and ultimately, exchange uptime.

The industry now faces a choice between treating this as a singular event, or as the blueprint for building a market that can absorb the next one. A most pressing decision, to be sure. 🧭

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Crypto Carnage: Fed’s “Hawkish Cut” Leaves Bitcoin in Tatters 🎢💸

2025-10-15 21:11