Tom Lee, that eternal optimist with a heart as steadfast as a Russian winter, proclaims from his pulpit of numbers and charts that the crypto abyss may soon reveal its floor. Oh, the drama! The suspense! One might imagine him, quill in hand, scribbling prophecies on parchment while the market’s tempest rages outside his ivy-clad tower.

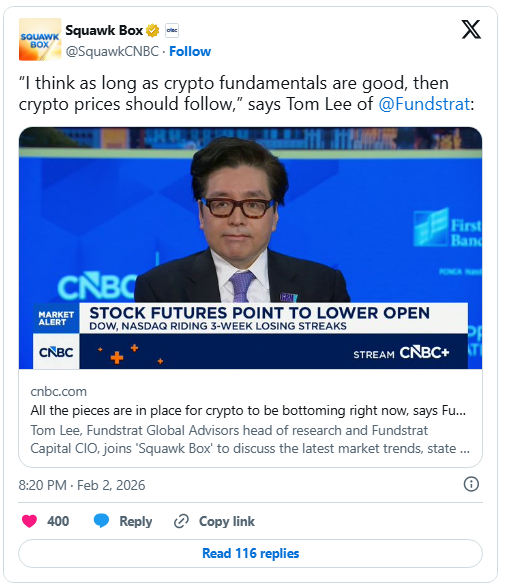

In a recent soiree on CNBC-a stage where financial actors perform daily-he, the so-called “head of research” at Fundstrat, declared that the market’s bones are growing sturdy. As if crypto were a delicate sapling, not a forest of code and greed. One wonders if his monocle fogged over while delivering this soliloquy.

Yet here lies the rub: his own firm, BitMine, clutches a $6.95 billion albatross of unrealized losses. A curious detail, like a maestro conducting an orchestra while drowning in a bathtub. Observers, ever the skeptics, might ponder: does one trust a prophet whose crystal ball is cracked?

Market Moves And Capital Flows

Reports whisper of gold and silver, those ancient relics, hoarding the peasants’ coin like dragons guarding treasure. Crypto, abandoned in the lurch, gasped as liquidity fled to the hills. Traders, once bold as Cossacks, now skulked with borrowed positions lighter than a widow’s purse.

“As long as crypto fundamentals are good…” Tom Lee intones, his voice echoing through the digital steppes. One expects a chorus of blockchain angels to chime in. Alas, only the clatter of liquidations replies.

Big Sales And Liquidations

$2.56 billion vanished in Bitcoin’s whirlpool this week-a sum so vast it could buy a principality. BitMine’s losses, meanwhile, swell like a gut after a feast. A tale of two tragedies: the market’s collapse and the analyst’s credibility, both sinking faster than a lead boot in the Volga.

Ethereum’s active accounts multiply like spring mushrooms, and Wall Street’s titans toil on its blockchain vineyards. Yet even these tender shoots of progress may wilt if the frost of geopolitical winds descends.

Washington’s bureaucrats play chess with crypto’s fate, their moves as transparent as a samovar’s steam. Meanwhile, the Middle East simmers-a cauldron of chaos that drives investors to gold like peasants fleeing a pogrom. Crypto, that nervous sparrow, flutters between uncertainty’s branches.

Will the bottom hold? Perhaps. Or perhaps the abyss yawns wider. Tom Lee’s targets-$77k for Bitcoin, $2.4k for Ethereum-are as precise as predicting a snowflake’s landing spot. In this circus of volatility, even fundamentals wear clown shoes.

So, dear reader, we await. The market’s heartbeat thuds like a peasant’s drum: arrhythmic, urgent, and laced with the sweet, sour tang of schadenfreude.

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

2026-02-04 08:26