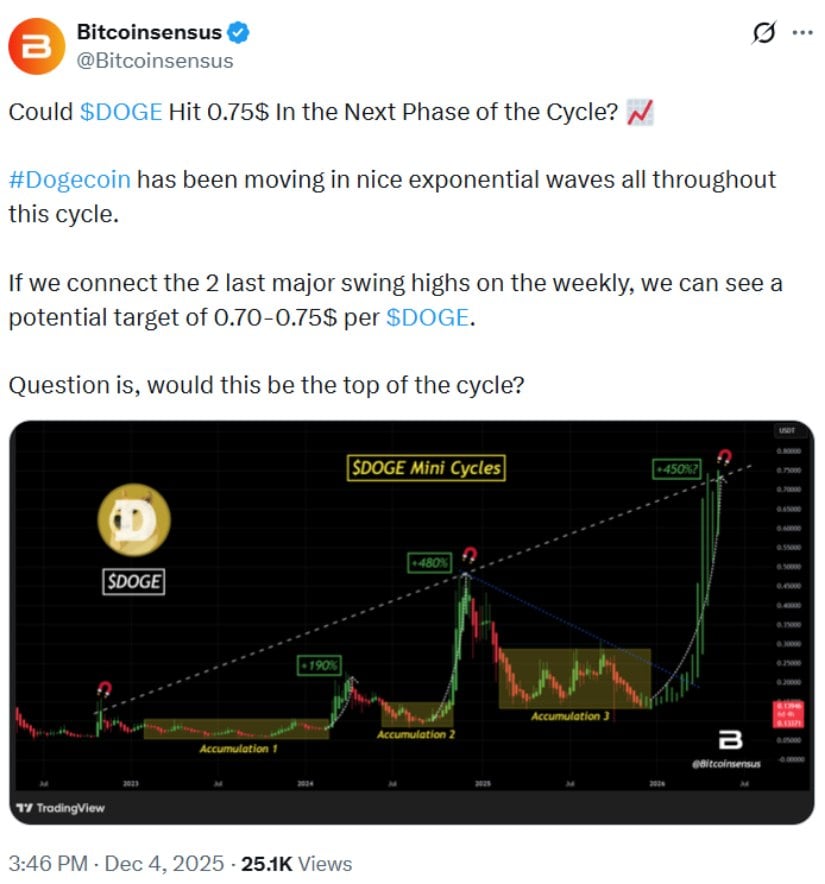

A certain chartist, with the solemnity of a man measuring tea leaves, has declared that Dogecoin’s price may soon echo its past misadventures. The analysis, steeped in “exponential wave structures” and “recurring swing-high patterns,” suggests DOGE might revisit the $0.70-$0.75 range. One might call it optimism; others might call it a delusion dressed in Fibonacci numbers.

The chartist, with the precision of a poet, claims the trendline confluence “indicates a possible 450% upside.” A 450% gain, you say? How quaint. But let us not forget: this is a model, not a prophecy. The analyst, ever the realist, adds that such levels may mark a “bull cycle peak,” as if to preemptively apologize to those who’ll inevitably lose money.

These logarithmic charts, dating back to 2014, are as reliable as a weather vane in a hurricane. While visually appealing (one might mistake them for modern art), they’ve shown a talent for error margins. Prior crypto cycles? Well, they’re less “predictive” and more “historical hot air balloons.”

Current Market Performance and Technical Conditions

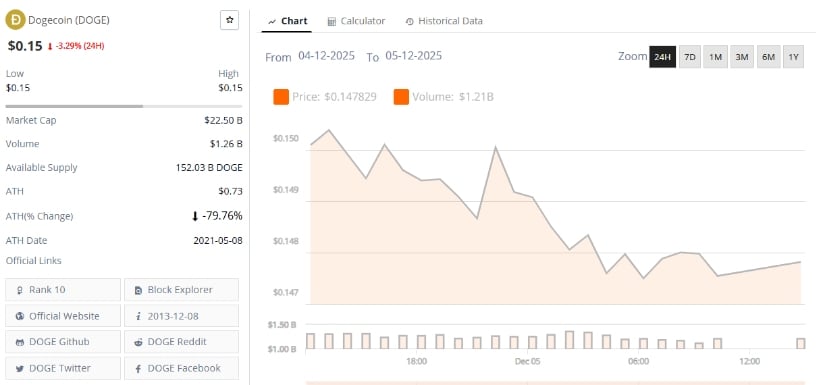

As of December 5, 2025, DOGE trades near $0.15, a far cry from October’s $0.26 highs. The coin has also hit a yearly low of $0.148, a price so pitiful it makes a broke student’s coffee budget look luxurious. The market, it seems, is taking a nap-or perhaps a long, existential sigh.

Technical indicators, those cryptic oracles of the trading world, whisper of doom:

-

Moving averages: DOGE sits below its 20-day, 50-day, and 200-day averages. A triple whammy. One might call it a “triple threat” if the result weren’t so bleak.

-

MACD: The indicator, a barometer of trend strength, shows downward momentum. Analysts, with the enthusiasm of a deflated balloon, note a “strong sell” signal. Volume support? Multi-timeframe analysis? Those are just fancy excuses for the coin’s lack of pizzazz.

Still, some models predict a short-term rebound to $0.19 by December’s end. A modest goal, but one that feels like a Hail Mary pass thrown by a team with no playbook.

Community Sentiment and Analyst Commentary

The same chartist who previously called $0.1500 and $0.1522-targets DOGE promptly hit-now declares, “Doge is ready to go.” How inspiring. Yet, this is less a consensus and more a man shouting into a void while wearing a dog costume.

Feedback on X (formerly Twitter) is a delightful mix of hope and eye-rolls. Some users marvel at the “alignment” of patterns and prices; others demand liquidity and capital flows, as if crypto were a well-run business and not a casino with better lighting.

Professional platforms, ever the optimists, predict a 2025 range of $0.33-$0.65. A “move toward $0.70,” they say, would require “supportive macro conditions.” Translation: May the gods of Bitcoin smile upon us all.

DOGE’s 70% correlation with Bitcoin is as reliable as a best friend who always borrows your car and never returns it. Without broader crypto-market strength, DOGE’s breakout is about as likely as a snowstorm in the Sahara.

Institutional Flow and Real-World Adoption

Grayscale’s DOGE ETF, now on NYSE Arca, has attracted “early-stage institutional interest.” One imagines analysts sipping lattes and muttering, “This could be big… if we ignore the red flags.”

Buenos Aires, in a surprising turn, now lets residents pay taxes with DOGE. A payments consultant, with the gravitas of someone explaining why their Wi-Fi is slow, notes this signals a “shift toward broader utility.” Or, as the rest of us might say: “Cool story, bro.”

Such developments, while charming, are about as impactful on price as a pebble tossed into the ocean. Still, they’re nice for the Dogecoin narrative-like giving a stray dog a collar and calling it a rescue.

Historical Context and Long-Term Considerations

A hypothetical $1,000 investment five years ago would now exceed $60,000. A miracle? Perhaps. But DOGE still languishes below its 2021 high of $0.74. The coin’s volatility is the stuff of legends-like a Shakespearean tragedy written by a drunk bard.

Crypto strategists, with the wisdom of sages who’ve seen it all, advise caution. Repeating a 2021 rally? That would require retail enthusiasm, a strong macro environment, and a sprinkle of fairy dust. Not impossible. Just improbable.

Key risks include:

-

Unlimited supply: DOGE’s no-hard-cap model is the crypto equivalent of a bottomless pizza box. Delicious at first, but eventually… just crumbs.

-

Sensitivity to sentiment: DOGE reacts to social media like a drama queen to a canceled Netflix show. One tweet from Elon Musk, and the price could spike-or crash-like a poorly timed TikTok trend.

-

ETF uncertainty: Early institutional products are a “maybe.” They’re the crypto version of a participation trophy. Pretty, but not particularly useful.

-

Pattern-based forecasts: Technical models, like horoscopes, are great for entertainment and terrible for investing. Especially when the universe throws a curveball.

Analysts, with the optimism of a gambler at a roulette table, acknowledge DOGE’s community strength and viral moments. But let’s be clear: Communities don’t pay bills. Volatility does.

Outlook: Can Dogecoin Approach the $0.70 Zone Again?

Forecasts, as always, diverge. Some models note similarities between current charts and past cycles. Others suggest this is less a prediction and more a “what if?” exercise. A game of crypto dress-up, where everyone’s a historian and no one’s a prophet.

If Bitcoin resumes its upward march, DOGE might follow. But reaching $0.70? That would require a market rally, improved sentiment, and institutional participation. Or, as the wise Chekhov might say: “Hope is a good thing, but it’s better to have a backup plan-and a lawyer.”

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- EUR RUB PREDICTION

- CNY JPY PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- USD MYR PREDICTION

- GBP CHF PREDICTION

2025-12-05 23:00