Oh, darling, Ethereum (ETH) is holding its champagne flute steady at $3,100 while Bitcoin (BTC) is face-planting into the $94,000 cushion like it’s last season’s trend. 🍸💅 Meanwhile, the FOMC meeting minutes are about to drop, and unemployment claims are giving us major anxiety vibes. PMI readings? Treasury Currency Report? Honey, it’s a macro fashion show, and we’re all just praying our crypto portfolios don’t end up on the discount rack. 👠📉

But let’s toast to ETH, shall we? It’s outshining BTC like a sequined gown at a black-tie gala. Derivatives positioning? Healthy. Liquidity flows? Fabulously on point. While BTC is sobbing into its blockchain, ETH is sashaying through the chaos like, “I woke up like this.” 💃✨

ETH: The Beyoncé of Crypto During Risk-Off Moves

Ethereum’s currently strutting around $3,190, holding its ground like a boss while the rest of the market is having a meltdown. BTC lost 6% in 24 hours? Tragic. ETH only dipped 2.1%? Iconic. The ETH/BTC ratio bounced +1.8%? That’s the sound of capital whispering, “ETH, you’re my ride or die.” 🚀💸

Futures data? Oh, it’s serving us facts. ETH long liquidations are 40% lower than BTC’s, which means ETH’s avoiding the drama of cascading sell pressure. BTC, sweetie, take notes. 📚💔

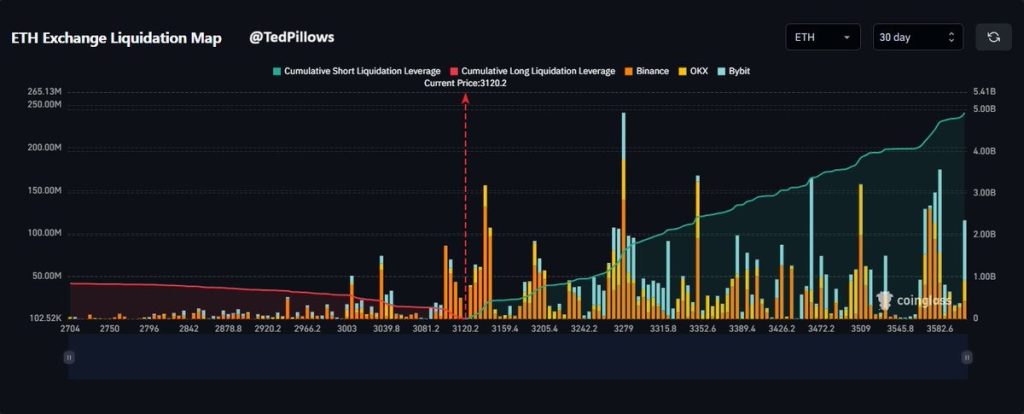

Derivatives Landscape: Liquidation Map Says “Upside, Please!”

The 30-day liquidation map is basically ETH’s Instagram filter-it’s smoothing out the downsides and highlighting the glow-up. Long liquidations between $2,950 and $3,050? That’s just a tiny pimple on ETH’s otherwise flawless complexion. But the real tea? Most of the high-volume liquidation liquidity is on the upside, darling. Short-liquidation leverage in the $3,250-$3,600 band? That’s a mechanical rally waiting to happen. 💄💥

In short:

- Downside risk? Limited to one tiny cluster. Like, who even cares? 🙄

- Upside wicks? Practically guaranteed if ETH gets its groove back. 💃

- Derivatives positioning? ETH’s the prom queen, and BTC’s the wallflower. 👑🌸

This aligns with ETH’s spot-market stability, which is basically the crypto equivalent of “I’m not crying, you’re crying.” 😭✨

ETH Price Analysis: Strong Structure, Weak Bulls, and a Dash of Hope

ETH’s trading near $3,150-$3,200, clinging to the demand zone like it’s the last slice of pizza at a party. Lower highs and lows? The bulls are tired, darling. Losing the $3530-$3589 support? That’s four months of gains down the drain. But the technicals? They’re whispering sweet nothings about a rebound. Will the bulls step up? Or will they ghost us like a bad Tinder date? 🤔💔

ETH’s trying to rebound from $3,020, a level it’s defended twice this month. RSI’s at 37? That’s “I’m fine” energy when we all know it’s not. MACD’s still bearish? Sellers are the exes we can’t shake. To prove its strength, ETH needs to reclaim $3,360-$3,420. Fail? It’s retest city at $3,020. Break down? Hello, $2,850. But break above $3,420? Darling, $3,875 is the after-party. 🎉🚀

ETH’s Setup: Macro Data, Be Kind! 🌞

Next week’s macro releases will decide if we’re still in risk-off hell or if stabilization is our new BFF. ETH’s the least fragile major asset right now, so even a tiny sentiment upgrade could trigger an upside liquidity sweep. Reclaim $3,250-$3,320? That’s the green light to $3,480-$3,600. Dip into $2,950-$3,050? Only if the macro gods are really mad at us. 😇😈

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- Brent Oil Forecast

- EUR USD PREDICTION

- POL PREDICTION. POL cryptocurrency

- USD KZT PREDICTION

- EUR KRW PREDICTION

- PI PREDICTION. PI cryptocurrency

2025-11-17 12:10