In the dim tribunal of finance, the spot Ethereum ETFs perform yet another act of withdrawal, the week-long carnival of volatility marching on as if ledgers themselves were subjects of unease. Friday’s ledger shows net outflows of $248 million, swelling the week’s sum to $795 million-a figure that could make even the metronome of a provincial clerk blush. 😅

These five mournful days of losses stride in step with a price decline of ETH, as though the coin were pensive, glancing at its own boots and sighing about the weather.

As the moment unfolds, ETH lingers above the $4,000 threshold. Yet earlier in the week a gust of misfortune swept it from near $4,500 on September 21 to as low as $3,850 on September 25, a tumble that would make a cartographer weep. 😂

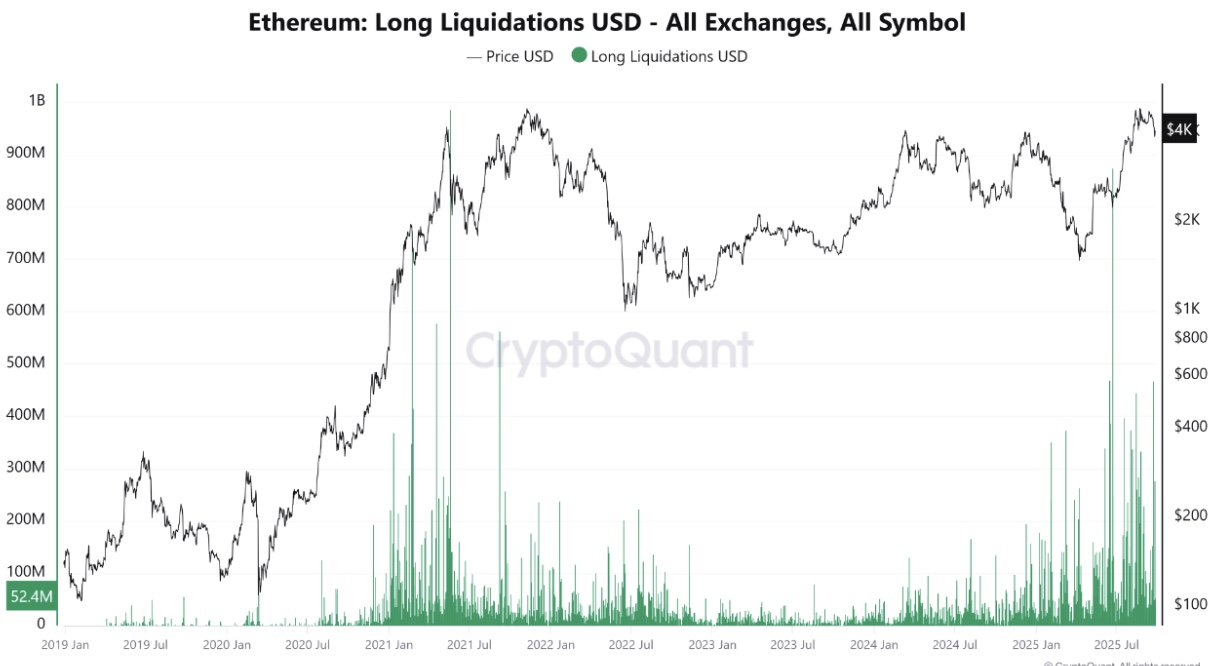

This descent coincided with one of the grandest resets in the derivatives theatre since 2024, according to CryptoQuant. Open interest across exchanges shrank mightily, and hundreds of millions of dollars’ worth of long positions were liquidated, as if the market itself had mislaid its spectacles. 🫥

Ethereum long liquidations across all exchanges | Source: CryptoQuant

Whales Accumulate, But Why No Surge?

Amid this tempest of prices, the giants of the market-those whales-decide to fatten their purses. LookOnChain reports that 16 wallets, like patient merchants of fortune, collected 431,018 ETH, worth about $1.73 billion, from exchanges over the past two days. A procession of accumulation that would make even a stockroom of oats seem generous. 🐋

Whales keep accumulating $ETH!

16 wallets have received 431,018 $ETH($1.73B) from #Kraken, #GalaxyDigital, #BitGo, #FalconX and #OKX in the past 2 days.

– Lookonchain (@lookonchain) September 27, 2025

In total, investors have hoarded nearly 570,000 ETH in the past week. Yet the price refuses to stage a triumphant revival, like a theatre that forgets its lines.

A CryptoQuant analyst explains the paradox of “buying but falling” as the architecture of the derivatives market-the formidable mountain of long positions that can collapse under its own weight, provoking forced liquidations.

These liquidations sow waves of selling pressure, often outstripping demand. Similar resets happened in 2021, 2023, and earlier this year, each time sweeping away the excess leverage like a broom in a bureaucrat’s closet. 🧹

According to the analyst, such steep declines sometimes seed healthier, more sustainable rallies, even if the current gloom wears a shawl of reasonableness. Several analysts, including BitMine’s Tom Lee, foresee a strong ETH price rally in the fourth quarter. 🏮

Whale Sell-off Fear Looms

But not all observers wear rose-tinted spectacles. Earlier today, one major Ethereum whale appeared to trim its position. This investor, who had built a sizeable stake at the bottom of $1,582 five months ago, deposited 1,000 ETH (around $4 million) into an exchange just hours ago.

If sold, the move would lock in a profit of $2.42 million. The remaining 5,000 ETH in the whale’s wallet still carries an unrealized gain of over $12 million, like a merchant’s note tucked away for a rainy day. 💸

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

2025-09-27 15:07