Ah, Ethereum. The cryptocurrency that’s more dramatic than a soap opera. Today it’s down by over 5%, lounging around $4,300 like it’s on a beach vacation. But don’t panic just yet-monthly gains are still up by 13%. So, the uptrend isn’t broken… unless it is. Who knows with crypto? 🤷♂️💸

Now, the big question: Is this dip just a blip, or is it the start of something truly horrifying? On-chain data and technical mumbo-jumbo suggest it might be temporary. Why? Because whales-the crypto equivalent of rich uncles-are stepping in to buy the dip. And they’re doing it with style (and about $1 billion worth of ETH).

Profit-Taking Takes a Nap, Whales Go Shopping 🛒

Let’s talk about the Spent Coins Age Band, which tracks when old coins get sold. Right now, it’s dropped to a month-low of 135,000 ETH. That’s a 74% drop from earlier in August when it was above 525,000 ETH. Translation: Long-term holders are chilling like penguins in Antarctica. They’re not selling much anymore.

History has a funny way of repeating itself. For instance:

- On July 7, spent coins hit 64,900 ETH, and Ethereum rallied from $2,530 to $3,862-a 52% jump. Cha-ching! 💰

- On August 17, the same pattern led to a 20% surge, with ETH climbing from $4,074 to $4,888. Not too shabby either.

So, this latest dip might just mean the selling spree is running out of steam. Or maybe it’s the calm before the storm. Who can say? Certainly not me. 😊

Want daily token insights and market updates? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here. Because who doesn’t love more emails? 📧

Meanwhile, whales have been busy hoarding ETH like it’s toilet paper during a pandemic. Addresses holding over 10,000 ETH increased their stash from 95.76 million ETH on August 27 to about 96 million ETH now.

At current prices, that’s roughly $1 billion worth of ETH in two days. Yes, you read that right. While we were all debating whether pineapple belongs on pizza, these folks were quietly stacking digital gold. 🍍🍕

Price Action Meets Liquidation Maps: A Tale of Two Charts 📈📉

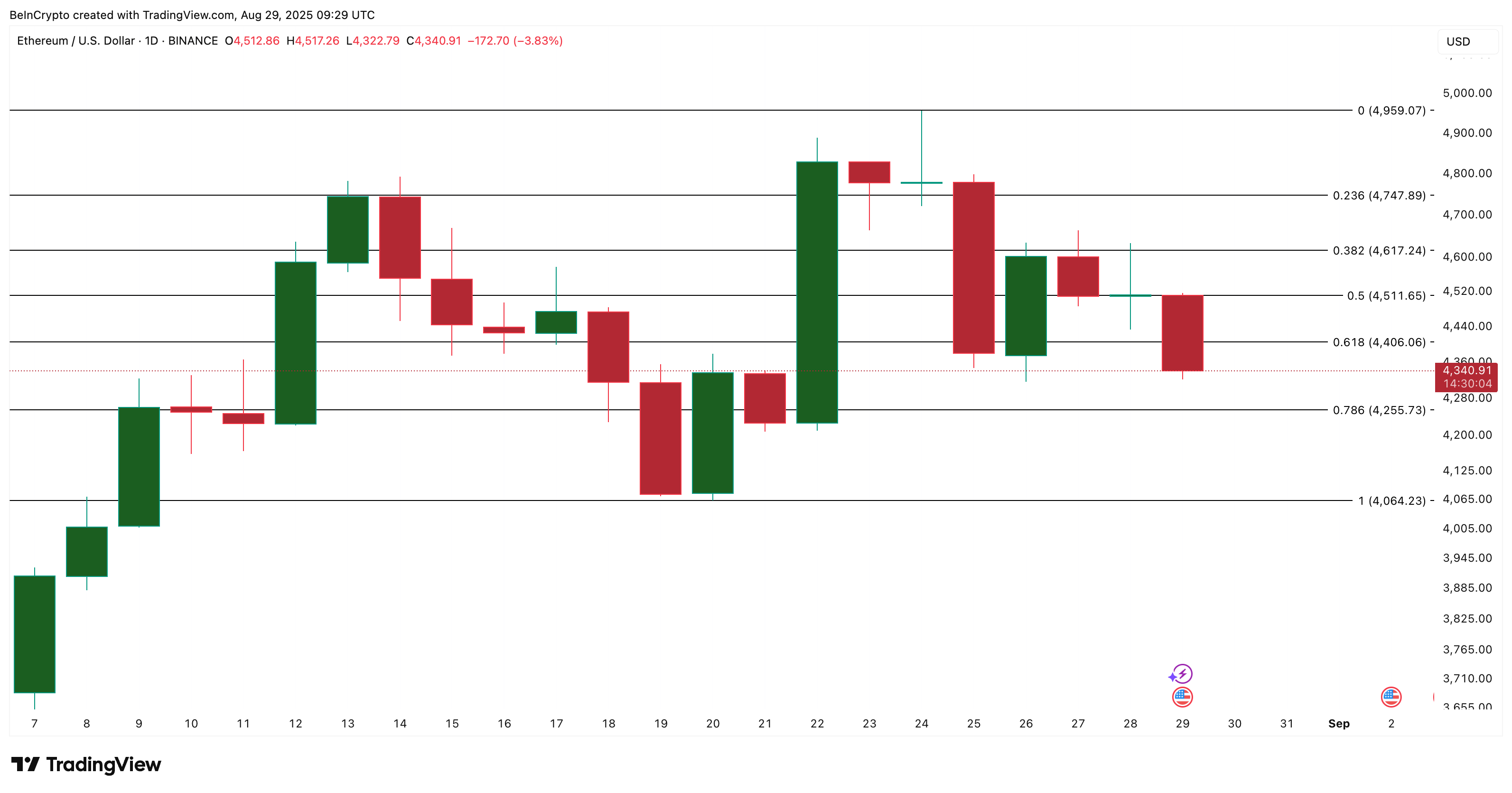

On the Bitget liquidation heat map, short positions are piling up at $4,400. If Ethereum manages to close above $4,406, those shorts will get liquidated faster than ice cream in summer. Forced buying could push prices higher. It’s like watching dominoes fall, but with money. 💸

On the downside, immediate support sits at $4,255. Break below that, and the next stop is $4,064. Fall under that, and things might turn bearish faster than you can say “sell.” Which, let’s face it, is pretty fast. 😅

The alignment between liquidation clusters and price levels means everyone’s watching the same numbers. It’s like being stuck in traffic because everyone decided to take the same shortcut. 🚗💨

For now, the roadmap is simple: Hold above $4,255 and reclaim $4,406, and the dip reversal might happen. Fail, and Ethereum risks turning into the sad trombone meme. 🎺

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- Brent Oil Forecast

- STX PREDICTION. STX cryptocurrency

- Silver Rate Forecast

- CNY JPY PREDICTION

- EUR AUD PREDICTION

- USD JPY PREDICTION

2025-08-29 22:38