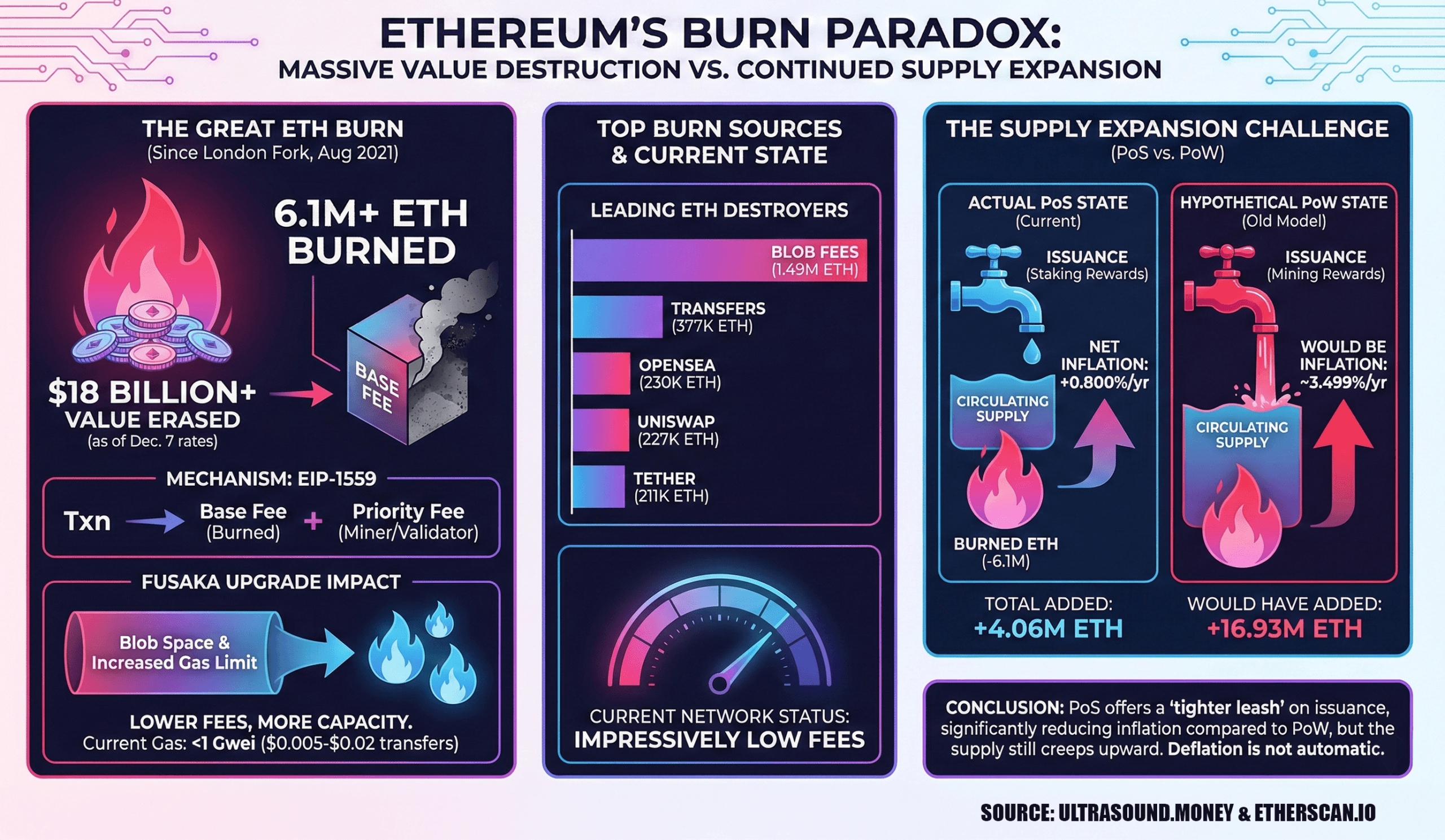

Ah, the grand theater of Ethereum! 🪙🔥 Behold, the ledger of folly declares that over 6 million ETH, a treasure valued at $18 billion, has been consigned to the digital flames since the London hard fork in August 2021. What a spectacle of wealth turned to ashes! Yet, the supply, like a stubborn mule, refuses to yield, creeping ever upward. Oh, the irony of it all!

ETH’s Grand Bonfire: 6M and Counting Since the London Fiasco

In the land of Ethereum, where upgrades are as frequent as a drunkard’s promises, the Fusaka upgrade arrived with much fanfare. 🌟 It expanded the network’s data and gas capacity, allowing blocks to carry more call data and rollup blobs. A marvel, indeed! Yet, the fees, like a cunning merchant, found their way to the L2 realm, offering a modest reprieve to the L1 gas costs. Onchain fees now dip below a single gwei-a pittance, really, for the privilege of dancing in the blockchain’s grand ball.

On the fateful day of Dec. 7, at 11 a.m. Eastern time, a low-priority fee lingered at 0.305 gwei, while its high-priority cousin strutted at 0.326 gwei. Transfer costs? A mere $0.005 to $0.02. Smart contract moves? A trifle, ranging from $0.14 to $0.50. Ah, the life of a digital serf! 💸

The London hard fork, that august event of 2021, brought with it EIP-1559-a revolution in fee mechanics. A dynamic base fee, burned with each block, like a sacrificial offering to the gods of decentralization. Since then, 6.1 million ETH, worth $18 billion, has been immolated. And who leads this pyre? Blob fees, the grand arsonists, have torched 1,492,094 ETH. Traditional transfers, NFTs, and DEXs follow, each contributing their share to the inferno.

Yet, despite this grand bonfire, Ethereum remains inflationary-a mere 0.800% per year. Since the London fork, 4,065,657 ETH have been added to the supply. The proof-of-stake model, though a gentler master, still allows the supply to creep upward. Deflationary dreams? A mirage, it seems. 🌴🚫

And what of the old proof-of-work days? A simulated glimpse reveals an annual inflation rate of 3.499%, with 16,931,820 ETH added to circulation. Ah, the folly of the past! Yet, even now, the supply grows, a reminder that progress is a slow and stubborn beast.

FAQ ❓

- What sparked Ethereum’s fiery burn totals?

EIP-1559, the grand arsonist, burns the dynamic base fee with each block. 🔥 - How much ETH has been burned since the London hard fork?

Over 6 million ETH, valued at $18 billion, has been reduced to digital ashes. 💨 - Did the Fusaka upgrade affect Ethereum fees?

Indeed, it expanded block capacity, chiefly aiding L2 transaction costs. 🛠️ - Is Ethereum deflationary after all this burning?

Alas, no. The network remains slightly inflationary, despite the flames. 🌋

Read More

- Gold Rate Forecast

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- Brent Oil Forecast

- Silver Rate Forecast

- USD MYR PREDICTION

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- EUR RUB PREDICTION

- CNY JPY PREDICTION

- USD KZT PREDICTION

2025-12-07 20:58