In the tumultuous sea of capital, where the waves of institutional flows crash against the cliffs of momentum readings, the Ethereum narrative trembles on the precipice of the $4,000–$4,200 resistance band. Here, in this realm of tightening liquid supply and existential dread, the market’s soul is laid bare—a cacophony of greed and fear conducting its eternal symphony. One might ask: Will this band become a tomb or a cradle? Only time, that merciless judge, shall decree.

Ethereum’s Price Rally: A Whale’s Gambit and ETFs’ Desperate Hug

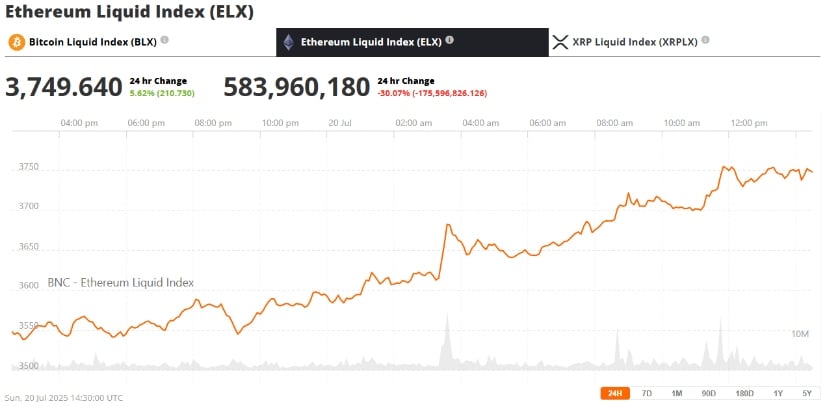

Ethereum, that tormented soul, clawed past $3,700 this week, briefly touching $3,750—a 180-day peak born from a 169% resurrection from March’s icy grave at $1,392. July, that fateful month, saw the asset ascend 40%, buoyed by institutional inflows into spot ETH ETFs, as if corporations had suddenly discovered the meaning of life in blockchain’s cold embrace. And lo! A $50M whale, cloaked in anonymity, devoured tokens at $3,715, a gluttonous feast signaling not despair, but a sly confidence in Ethereum’s long-term crescendo. “Behold,” the market whispered, “the professionals have returned to play.”

This whale’s purchase, a modern-day Promethean act, ignited fervor. Analysts, those modern prophets, mused: Such moves often herald shifts in market structure, as capital, ever the opportunist, seeks refuge in crypto’s core. Yet one cannot help but chuckle—what wisdom lies in a whale’s shadow? 🐋

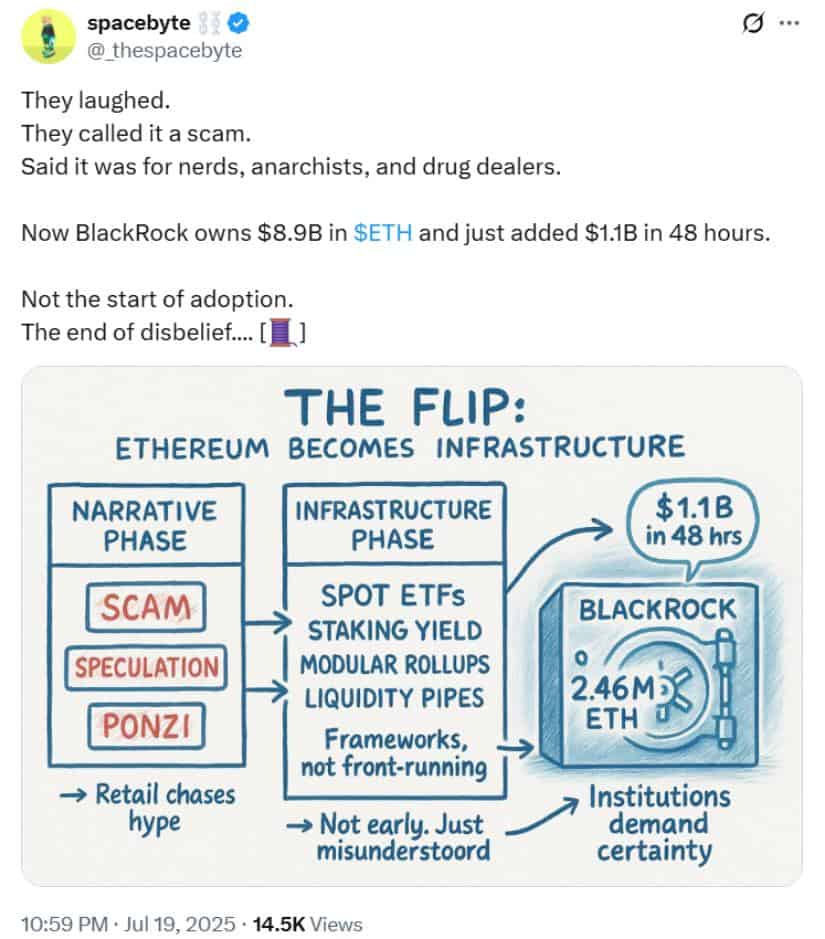

ETF demand, that relentless siren, has become the rally’s lifeblood. U.S. spot ETH products gorged on $727M in a single day, as corporate treasuries and asset managers, like moths to a flame, flocked to Ethereum’s glow. Yet does this not reek of hubris? For what is an ETF but a modern Icarus, soaring too close to the sun? 🔥

Ethereum’s Chart: A Dance with Overbought Demons

The Ethereum chart, a chiaroscuro of hope and despair, traces an ascending channel from March’s capitulation. Now, it presses the upper boundary at $3,700–$3,800, a stage where exponential moving averages whisper of bullish vindication. Yet the RSI, that spectral barometer, hovers near 78—a number that screams of overbought peril yet sings of bullish fervor. History, that fickle friend, reminds us: Pullbacks here often find support, a cruel joke for those who dare to short. Will this time be different? Or is it merely another chapter in the same old story? 🤷♂️

Analysts, clutching their charts like holy relics, fixate on $4,000–$4,200—a “strong high” zone where volume may yet confirm or condemn. “Break this,” they cry, “and the explosive leg begins!” But what is an explosive leg but a delayed reckoning? 💣

Layer 2’s Rise: A New World Order? Or Just a Distraction?

Amid this chaos, Layer 2 networks—Arbitrum, Optimism, zkSync—rise like phoenixes, their scaling ambitions fueled by Ethereum’s price rebound. DeFi and L2 enthusiasts, emboldened by ETF inflows, ripple capital into liquidity pools and dApps, a modern Promethean theft of fire. Yet is this progress or merely a distraction from Ethereum’s existential crisis? One might argue both, for in the blockchain world, all is paradox.

Short liquidations, those tragicomic spectacles, amplify swings. Forced buying at $3,600 and speculative flows into DeFi create a feedback loop, a Sisyphean dance between core asset and application. “Behold,” the market sighs, “the cycle continues.” 🌀

Institutional Alchemy: ETFs and the Quest for Yield

Institutions, those modern alchemists, reshape Ethereum’s investor base. Coinbase Institutional, in its 2025 report, declared “surging” corporate treasury accumulation of ETH, staking yields and tokenization as their grails. ETF creations hit records, while derivatives basis trades—long spot, short futures—harvest spreads like vultures circling a carcass. Yet what is sophisticated strategy but a mask for greed? 🦅

July’s ETF inflows, a $890M deluge, tightened ETH’s float, with BlackRock hoarding 1.5% of supply. Reduced exchange liquidity, paired with institutional custodianship, brews a volatile cocktail. One might say: Institutions have become Ethereum’s puppeteers, yet the strings remain taut. 🎭

Regulation’s Shadow: A Guardian or a Tyrant?

Rapid institutionalization, that double-edged sword, draws regulatory scrutiny. Compliance expectations loom over Web3 firms and DAOs like a specter, while staking rules and tokenization frameworks teeter on Congress’s chopping block. “Clarity,” they cry, “will broaden access!” Yet clarity often begets control. Is this not the fate of all revolutions? 🚨

Legislation, that slow-moving leviathan, may yet define Ethereum’s future. But until then, uncertainty reigns—a cruel master that keeps the market in perpetual purgatory. Institutions, ever the optimists, persist. Perhaps they believe in salvation. Or perhaps they simply do not know when to quit. 🎲

Ethereum’s Price Prediction: A $4,100 Mirage?

Traders, those modern-day gamblers, watch $4,000–$4,200 like hawks. A decisive close above would signal buyers chasing higher, despite stretched momentum. Technical models project $4,100 as a measured-move target, yet history warns: Bitcoin’s dominance may yet cast a shadow on ETH’s ambitions. Is this catch-up or folly? Only time will tell. 🕰️

Breakout or Bust?

Ethereum’s ascent to a six-month peak is underwritten by ETFs, whales, corporate treasuries, and Layer 2’s expansion—a symphony of forces tightening supply and fortifying the technical backdrop. Yet as price presses the resistance shelf, the question remains: Will the bulls conquer $4K, or will the abyss swallow them whole? For now, inflows and institutional interest remain the pillars of this fragile edifice. But pillars, like all things, may one day crumble. 🏗️

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- NEXO PREDICTION. NEXO cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- CNY JPY PREDICTION

- STX PREDICTION. STX cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🐳 Crypto Whales Beware: Phishing Plunge Masks Sinister Shift! 🕵️♂️

2025-07-21 00:44