Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead. 😂

Grab a coffee, or a therapist, as Ethereum is no longer just for crypto-native players. Wait, what even is a “crypto-native player”? Is that a thing? I don’t know, but apparently, public companies are getting in on the action. Who knew?

Crypto News of the Day: Fresh Public Companies Now Collectively Hold 113,000 ETH 🚀

A new report by CoinGecko shows that total Ethereum holdings by public firms have surged to 1,002,666 ETH as of July 23, 2025, worth approximately $3.70 billion. Wow, that’s a lot. I’m sure they’re all just holding it for the “long-term value”… or maybe they just like the aesthetic of having a bunch of digital coins in their balance sheets.

Of that, 113,000 ETH (about $409 million) is held by companies that disclosed their positions for the first time this quarter. First time? What, did they think Ethereum was a secret? 🤔

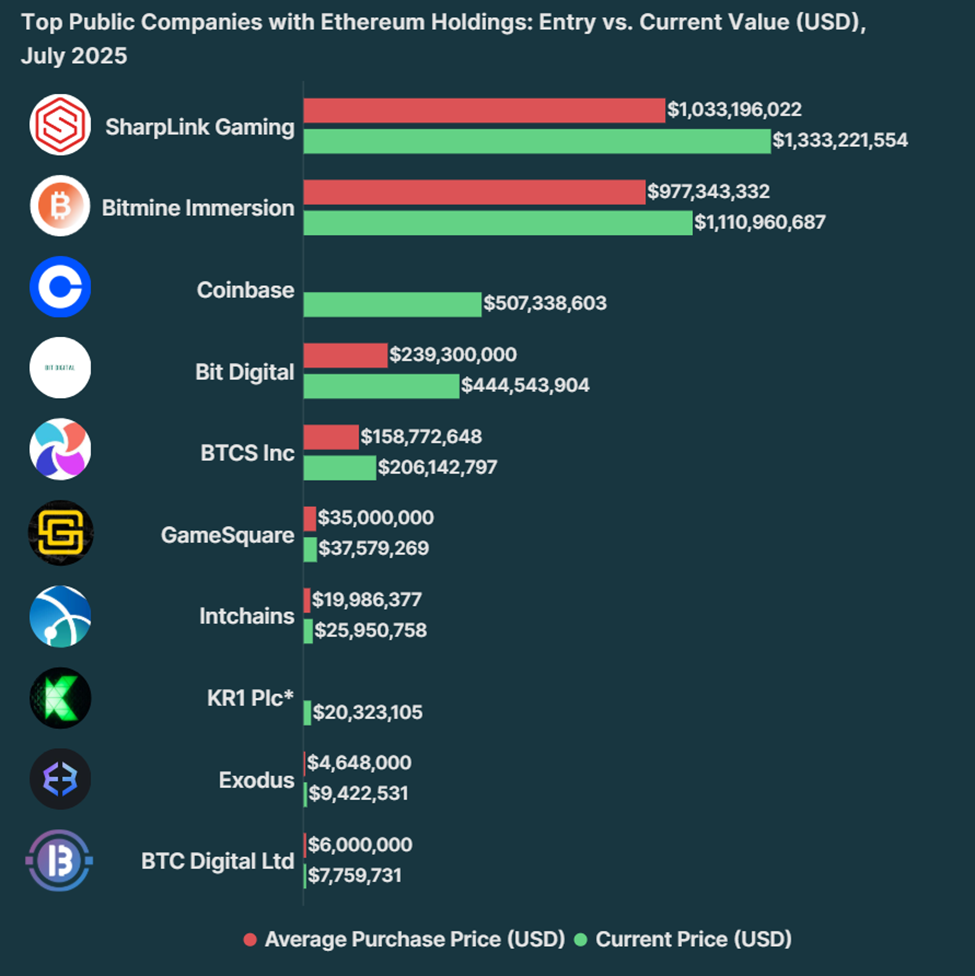

At the top of the leaderboard is SharpLink Gaming, which holds 360,807 ETH, now worth over $1.33 billion. Notably, over 95% of its ETH is deployed in staking and liquid staking platforms. So, they’re basically saying, “We’re not investing in this, we’re just keeping it as a backup plan. Or maybe a hedge. Or maybe we’re just really into the whole “blockchain” vibe.

SharpLink has clearly positioned Ethereum as its core treasury reserve, a strategy aimed at both yield generation and long-term value preservation. Or maybe they just like the idea of being “influential” in the crypto space. 🏆

Second is BitMine Immersion, with 300,657 ETH tokens valued at $1.11 billion. Chaired by Fundstrat’s Tom Lee, BitMine has one of the most aggressive ETH accumulation targets on record. The firm aims to hold 5% of all ETH in existence, or roughly 6 million ETH. That’s like saying, “I’m going to own 5% of the internet. Just wait.”

Appreciate this @cosmo_jiang

Pantera has been a great partner @PanteraCapital

Bitmine $BMNR is committed to rapidly growing ETH value per share

And the stated goal is eventually 5% of ETH

— Thomas (Tom) Lee (not drummer) FSInsight.com (@fundstrat) July 24, 2025

Its average entry price is $3,251, putting it at a 13.7% unrealized profit so far. That’s like buying a stock for $3,251 and it’s now worth $3,700. Not bad, but I bet Tom Lee is already planning his next move. 🚀

Coinbase, the largest US-based crypto exchange, holds 137,300 ETH worth over $507 million, or nearly 13.7% of all ETH held by public companies. Although its position was recently surpassed, Coinbase remains a core institutional holder. Wait, but they’re an exchange. Shouldn’t they be facilitating trades, not hoarding coins? Or is this the new “trust but verify” approach?

Bit Digital, best known for Bitcoin mining, has pivoted heavily into Ethereum staking, sidestepping BTC. It now holds 120,306 ETH (worth $444.5 million), nearly doubling its position value with an 85.8% unrealized gain. So, they’re switching from mining to staking. That’s like switching from digging a hole to just standing in it and hoping something falls out.

Rounding out the top five is BTCS Inc., with 55,788 ETH valued at $206.1 million. The company recently issued convertible bonds to increase its ETH reserves, demonstrating a firm conviction in Ethereum’s long-term value. That’s the kind of confidence you only get after a few years of watching the market go up and down like a rollercoaster.

“We’ve been accumulating ETH since 2021,” BTCS CEO Charles Allen said recently.

This aligns with a recent US Crypto News publication, which highlighted public companies racing to buy Ethereum. Because nothing says “racing” like slowly accumulating assets over four years. 🏃♂️

Smaller Players Signal Expanding Institutional Interest 🧠

Outside the top five, companies like GameSquare Holdings (10,170 ETH), Intchains Group (7,023 ETH), KR1, Exodus, and BTC Digital hold smaller but still strategic positions. So, they’re not in the top five, but they’re still holding ETH. Maybe they’re just trying to keep up with the Joneses. Or maybe they’re just hoping to be the next big thing. Either way, it’s a gamble.

GameSquare, for example, recently expanded its treasury mandate from $100 million to $250 million, hinting at future ETH purchases and NFT yield strategies. That’s like saying, “We’re going to double our budget, but we’re not sure how yet. Maybe we’ll just throw money at the problem.”

Despite holding only 2,550 ETH tokens, Exodus has the largest unrealized gain of 102.7%, highlighting how early buys in volatile markets can yield significant upside. That’s like buying a stock for $1 and selling it for $2. But instead, they bought it for $1 and it’s now worth $2.10. Who knew?

Notwithstanding the growing accumulation of ETH, Ethereum remains a distant second to Bitcoin when it comes to public treasury adoption. The top two firms, SharpLink and BitMine, alone hold over 65.9% of all publicly disclosed ETH, topping $1 billion. Institutional ETH adoption is still highly concentrated. That’s not a conspiracy, that’s just basic math.

However, with the launch of spot Ethereum ETFs in 2024 and the network’s transition to proof-of-stake (PoS), the barriers for corporate exposure have dropped significantly. Finally, a way for regular people to get in on the action. Or maybe just another way for the rich to get richer. Either way, it’s a win for the people who already have the money.

With Ethereum holding above $3,600 as of this writing, after dipping to $1,383 earlier this year, corporate treasuries are now in the green across the board, with the largest altcoin on market cap metrics now officially on the balance sheet. So, it’s not just a coin, it’s a status symbol. Or a gamble. Or both.

Charts of the Day 📊

Byte-Sized Alpha 🧠

Crypto Equities Pre-Market Overview 📈

| Company | At the Close of July 23 | Pre-Market Overview |

| Strategy (MSTR) | $412.67 | $412.31 (-0.087%) |

| Coinbase Global (COIN) | $397.81 | $396.50 (-0.33%) |

| Galaxy Digital Holdings (GLXY) | $31.03 | $30.90 (-0.42%) |

| MARA Holdings (MARA) | $17.57 | $17.57 (0.00% |

| Riot Platforms (RIOT) | $14.34 | $14.23 (-0.70%) |

| Core Scientific (CORZ) | $13.49 | $13.54 (+0.37%) |

Read More

- GBP USD PREDICTION

- EUR USD PREDICTION

- USD INR PREDICTION

- STX PREDICTION. STX cryptocurrency

- EUR RUB PREDICTION

- Tajikistan’s Bitcoin Blunder: $3.5M Gone! 🚨

- USD TRY PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- INJ PREDICTION. INJ cryptocurrency

2025-07-24 17:54