TL;DR

- Ethereum‘s clinging onto $4,100 like it’s the last lifeboat on the Titanic, with a falling wedge setup and Wyckoff model hinting at a glorious rebound.

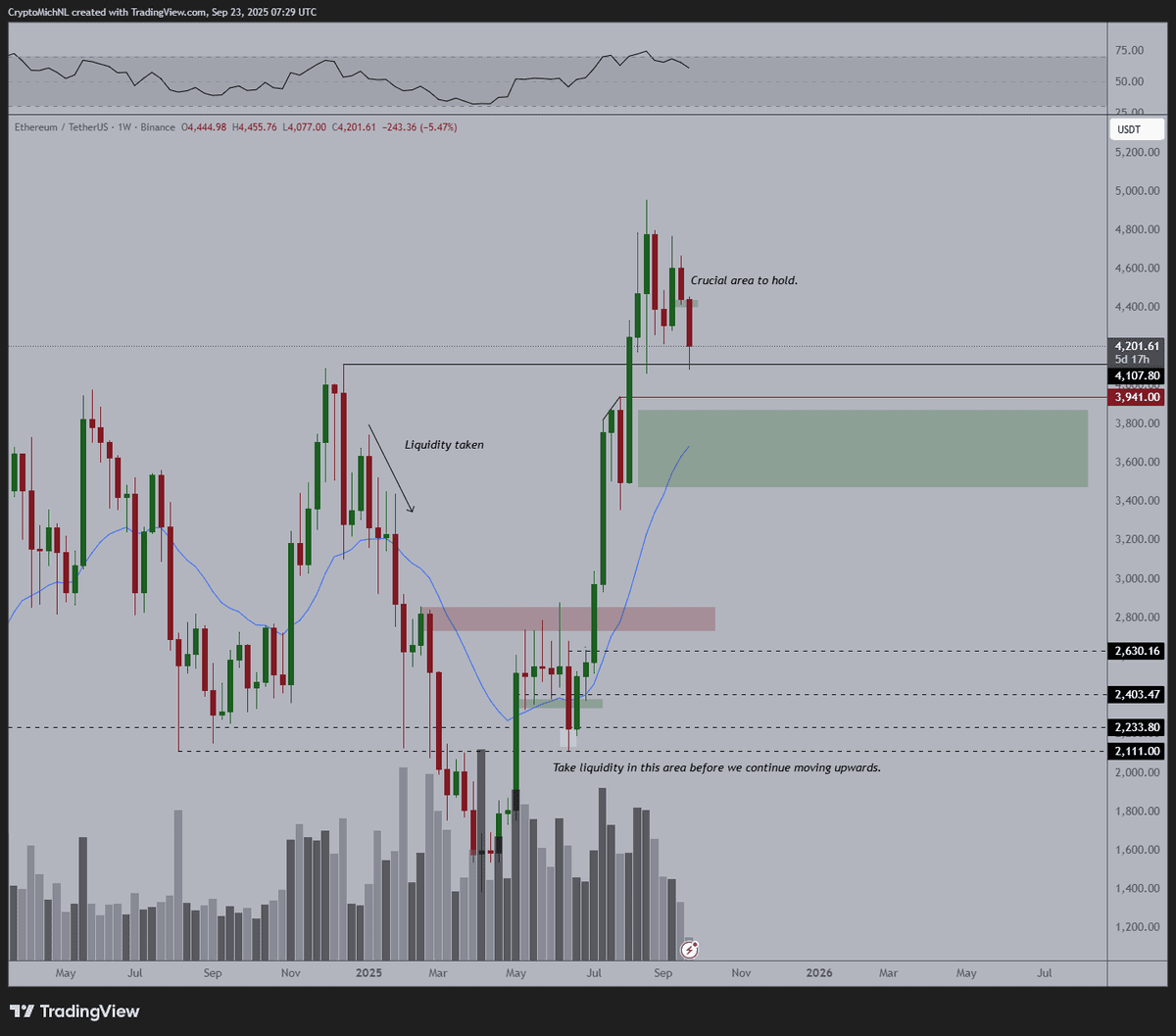

- Compression near the 20-week MA is squeezing harder than your jeans after Thanksgiving dinner. Eyes are on the $3,550-$3,750 zone as the next potential dip party.

- If history’s a good teacher, ETH might just channel its 2017 and 2020 Q4 rallies for a wild ride into late 2025.

The Support Test – Is Ethereum Holding On For Dear Life?

Ethereum (ETH), currently trading at a cozy $4,200, is doing its best impression of a shipwrecked sailor after a sudden plunge from the lofty $4,950 heights. With a nifty 20% drop from its peak, some market enthusiasts are eyeing potential “safe zones” for a bargain buy.

Our trusty market analyst, Michaël van de Poppe, believes Ethereum might do the good old sideways shuffle for a while. He also noted that the 20-week moving average is rapidly approaching, creating a nice little compression squeeze.

Van de Poppe was heard saying, “I don’t know if we’ll dip as deep as $3,550-$3,750,” which, honestly, sounds like a “maybe” wrapped in a “who knows?” The zone between $3,550 and $3,750 is definitely on the radar as a possible cushion, especially since it’s close to the rising 20-week MA.

On the weekly chart, Ethereum’s still holding above $4,100 like a stubborn child refusing to leave the candy store. Below that, there’s a broader support range between $3,550 and $3,750, with a nice historical breakout area and the comforting presence of the 20-week MA. Oh, and if you look a little lower, there’s another cozy green box at $2,800 just in case ETH wants to throw a nostalgia party for its previous consolidation days.

Past performance has shown that ETH likes to show up to these levels for a bit of a dance. Phrases like “liquidity taken” at $3,900 and “take liquidity in this area” near $2,800 suggest that if ETH swings by these areas again, it could stir up some action. The lower volume in recent weeks gives the impression that ETH’s setting up for something big. Stay tuned for the next episode!

The Chart Pattern Saga: A Falling Wedge or Just Falling Woes?

Enter Trader Tardigrade (yes, we’re serious), who’s identified a lovely falling wedge setup. The price’s wandering inside two downward lines, but as they say, it’s always darkest before the breakout. The wedge is nearly at its apex, and Ethereum’s testing previous breakout levels. If all goes according to plan, ETH could be headed to $6,800. Fingers crossed, folks.

Meanwhile, Merlijn The Trader is over here using the Wyckoff model to describe Ethereum’s movement, which sounds like something out of a high-level wizard’s spellbook. According to this model, Ethereum might have just completed its “Spring, Test, and Sign of Strength” phases. Now, it’s in the Last Point of Support, which is basically the time when Ethereum usually decides to go full throttle into five-digit territory. Can someone get this crypto a cape?

Is Q4 Ethereum’s Moment in the Spotlight?

Ethereum’s past Q4 performances were nothing short of spectacular. In 2017, it saw a jaw-dropping 140% gain, and in 2020, it was over 100%. Fast forward to 2025, and after a rather tragic Q1 (-45.41%), Ethereum bounced back in Q2 (+36.48%) and Q3 (+79.55%).

Crypto Rand, not one to miss a chance to stir the pot, quipped:

GM guys! Is $ETH getting ready to perform like in 2017 and 2020?

– Rand (@crypto_rand) September 23, 2025

While no one’s calling this a guarantee, the historical strength in Q4 has some traders dreaming of another round of moonshot glory. Grab your popcorn and keep an eye on those charts-Ethereum might just be gearing up for an encore!

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

2025-09-23 19:23