Is it fate, or mere absurdity? Once more the world awakens beneath the sorrowful proclamations of the Federal Reserve’s supreme functionary—Jerome Powell, a man for whom “uncertainty” is not so much a condition as a breakfast beverage. And what a feast he served! The FOMC meeting of the 30th, held with all the grim composure of a Dostoevskyan confession, ended with rates unchanged at the pantomime-like range of 4.25-4.50%. “Change nothing, but tremble deeply,” thus spoke the modern oracle! 😂📉

Five times—five acts without climax! The Federal Reserve, in its wisdom (or perhaps cowardice fit for a Raskolnikov), refused to act from January through now, haunted by the voice of President Donald Trump, who, like an oversized Svidrigailov, hovers outside the meeting room shrieking: “Cut, cut!” Meanwhile, some within the Fed itself whisper their own secret dissents, their courage wilting beneath the fluorescent lights. ☕🤔

Powell’s New Gospel: No Joy for Markets, But Plenty of Existential Angst

Did the Fed maintain rates? Yes. Did they maintain composure? Debatable. This time, the official statement muttered about the “growth of economic activity has moderated”—ah, such restraint, such chilling understatement! Gone is the blustering confidence of June, swept aside by the cold winds of statistics: “GDP rose a pitiful 1.2% in the first half, not the robust 2.5% of years past.” Last month, it was “solid expansion”; today, the air hangs heavy with suspicion. Somewhere, Ivan Karamazov smirks.

Powell, with all the warmth of a Siberian winter, raised “downside risks to the labor market”—not once, but twice! There is a certain Dostoevskyan flavor in repeating bad news, to let it sink into the soul like weak tea. In his press conference, he pontificated:

“Downside risk in the labor market… two mandate variables—one, inflation, the other, maximum employment. The labor market looks solid. Inflation’s above target, even if you squint at it sideways, and that’s the reason we stand where we stand. But, as I repeat to you, downside risks—oh, certainly, they haunt us like poor Alyosha haunted by the world’s pain.”

Consumer sentiment, battered by the spectral menace of tariffs, sags like existential hope on a rainy Petersburg morning.

Yet in the next breath, Powell erects a cardboard monument to false optimism: “Unemployment low! Labor market strong! Inflation, a bit cheeky above target but, comrades, the economy is in a solid position.” Irony, thy name is central banking.

Bitcoin Bewails Its Fate: Drops Below $116,000 as September Rate Cut Becomes Ghost Story

The mood in the briefing room was that peculiar American mix of boredom and catastrophe. At the start: calm, bored, scrolling through phones, betting on a September rate cut. By the end? The numbers turn to dust—US stocks lurch downward, bond yields stagger upward, and Bitcoin, that homeless gambler’s coin, dives below $116,000. Powell’s mere hint of negativity cast markets into existential crisis faster than you can say “underground man.”

Queried on September’s fate, Powell played coy: “September? Why think of September? We have made no decisions. We do not work in advance, only in hindsight. Each meeting, every time, an eternal return…” And who among us has not avoided all commitments until the very last moment? 🤷♂️

The Federal Reserve, like the errant son in a Russian novel, has two impossible fathers—employment stability and price stability. Their quarrel rages eternally in the attic. Yet within the previous decree, hints slipped free: perhaps September ought to see a cut! Yet Powell, like the Grand Inquisitor, will not say for certain. 😬

On the topic of inflation, Powell wore the mask of Honest Uncertainty: “Early days, comrades. We expect more suffering—more tariffs, more creative pain. Companies plan to foist tariffs onto customers, but perhaps they shall fail, perhaps not. Let’s simply watch and, like Rodion in the snow, ‘wait for Godot’—I mean, empirical evidence.”

In sum: Reasonable on its face, and yet an admission of paralysis; the institution stands before the abyss, unable to leap, unable to retreat, reciting statistics into the void.

Hawkish Powell, Dissenting Doves: Boardroom Discord Reaches Dostoevskyan Heights

Now, the real drama! On this fateful day, two Fed board members—heretics!—disagreed with the Chairman. Heresy in the house of consensus! For thirty-two years all nodded as one. Not today. Today, dissent! Civil war (or at least, passive-aggressive memos).

Our dissenters: Christopher Waller and Michelle Bowman, both elevated by Donald Trump, whose ghost roams these halls like a landlord demanding rent. Bowman, now vice chair, and Waller, both favor rate cuts but bicker over method—Trump wants cuts for glory, Waller for mercy, hoping to shield the labor market from future drought. Which is nobler? The punishment or the crime?

Waller notes: Non-farm jobs increased by 147,000 in June—hurrah? Alas, mostly government jobs! Maximum employment, yes, but at what cost? The Fed’s own doctrine gnaws at it: “Price and employment”—this bureaucratic schizophrenia threatens to trigger history’s dullest tragedy.

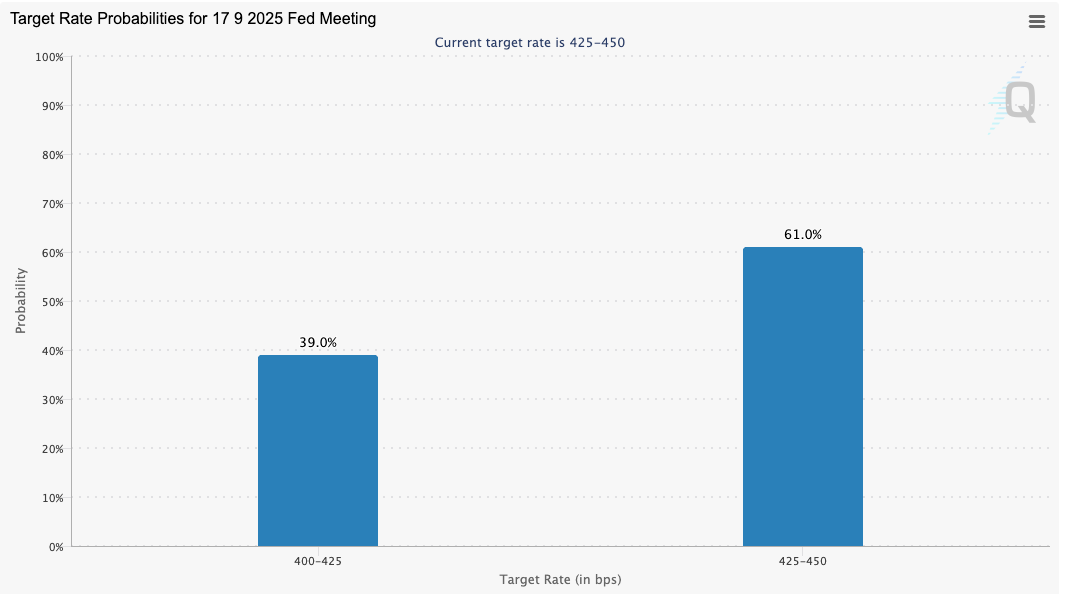

After Powell’s performance, the CME’s FedWatch tool did its own death spiral—odds of a September rate cut crashed from 63.3% to 43.0%. Markets, apparently, prefer certainty (or at the very least, fewer existential conundrums).

Read More

- GBP CHF PREDICTION

- ETH PREDICTION. ETH cryptocurrency

- USD VND PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- EUR RUB PREDICTION

- CNY JPY PREDICTION

- XMR PREDICTION. XMR cryptocurrency

- USD MYR PREDICTION

- EUR CLP PREDICTION

2025-07-31 16:33