On Wednesday, the price of Flare cryptocurrency picked up speed due to rising demand, and its future contracts’ open interest hit an all-time high.

The FLR token reached a peak of $0.0281, marking its highest point since January 30 and representing an impressive 157% increase from its lowest value this year. This upward trend has elevated the token’s market capitalization above $1.8 billion, while its 24-hour trading volume jumped by a substantial 535%, reaching $109 million.

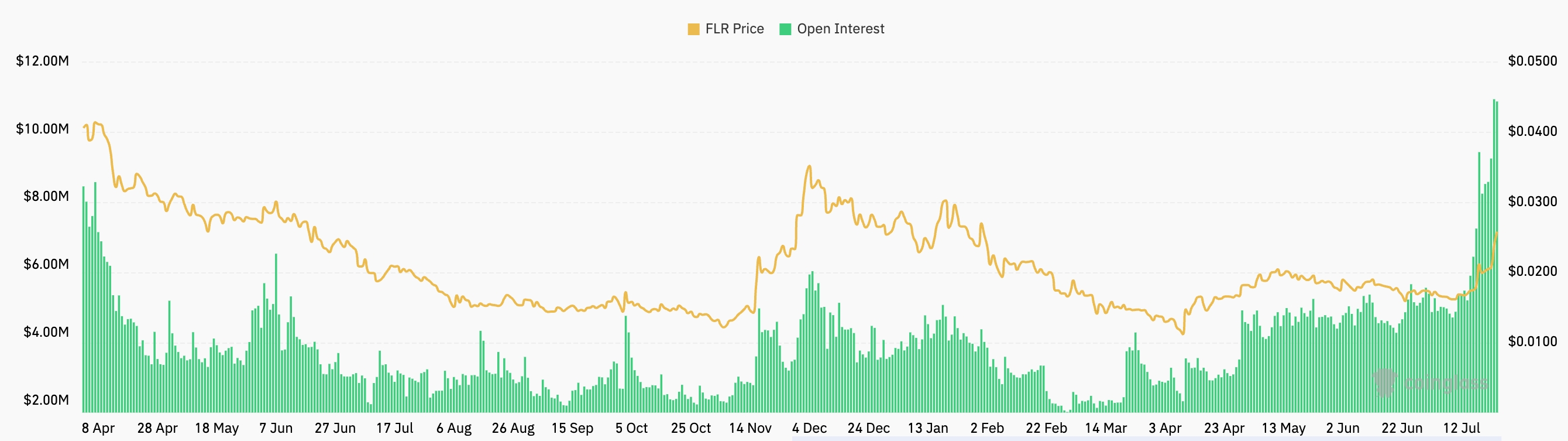

Flare futures open interest hits all-time high

This week, the price of Flare experienced a significant boost due to increased demand for its token. The daily trading volume in the open market skyrocketed by an impressive 535%, placing it among the busiest tokens in the cryptocurrency industry.

To put it simply, the open interest in the futures market reached an all-time peak of $10 million. Since hitting a low of $1.7 million in February, this level of interest has consistently risen.

An increasing number of open interests indicates strong demand and ease of trading, serving as a powerful signal that fuels optimism for the market.

FLR token price faces risk as funding rate turns negative

Despite the recent surge in Flare’s price, there are potential hazards that could impact its continued growth. For one, the weighted funding rate has consistently been negative over the past few days according to available data, which could be a sign of bearish sentiment among traders.

When the funding rate is negative, it indicates that those holding short positions are actually paying those with long positions. This situation often results in a significant amount of short interest. Essentially, this financial setup suggests that the traders believe the market’s future price will drop below its current value.

Another significant concern is that Flare’s ecosystem isn’t thriving as expected, even amidst the current surge in the cryptocurrency market. To illustrate, Tether’s circulation within the network has decreased by approximately 23% over the past 30 days, dropping to around $64 million. Likewise, the supply of USD Coin has fallen by nearly 30% to roughly $18 million during this period.

Over the last few months, the trading volume on Flare’s decentralized exchange has been decreasing. This month, it sits at around $91 million, which is lower than the figures from June ($122 million) and May ($167 million).

Flare crypto price technical analysis

The daily graph shows a notable spike in the price of Flare, which has been on an upward trend lately. This surge took place following the formation of a falling wedge pattern, a commonly recognized bullish reversal symbol. A falling wedge consists of two lines that slope downward and gradually converge.

As a crypto investor, I’ve noticed an exciting development in the Flare coin’s price: a golden cross formation. This happens when the 200-day and 50-day weighted moving averages intersect, signifying a potential trend reversal or continued upward momentum. The recent surge in its price can be attributed to this technical indicator.

Based on the current positions of the Relative Strength Index and the Stochastic Oscillator reaching the overbought zone, it’s predicted that the token might experience a correction or pullback towards the psychologically significant level of $0.20. After this brief dip, the uptrend is expected to continue.

Read More

- BTC PREDICTION. BTC cryptocurrency

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Shocking Rally Ahead for NIGHT Token: Analyst Predicts 4x Surge to $0.20!

- EUR USD PREDICTION

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

2025-07-23 17:23