In a most riveting tale of corporate intrigue, Securitize has appointed Giang Bui as the illustrious Vice President, Head of Issuer Growth. This nugget of news, which dropped on January 27, has sent ripples through the financial waters. Giang, previously a luminary at Nasdaq-where she orchestrated the grand symphony of US Equities and ETP partnerships-now embarks on a new adventure.

One might say her journey has been akin to a grand theatrical performance, where she danced gracefully among the complexities of spot Bitcoin ETF initiatives. The numbers are almost poetic, with Bitcoin prancing around at $89,101, and a market cap that sings in harmony at $1.78 trillion. And let us not forget the thrilling 24-hour volatility of 1.1%, which is surely enough to make any heart race!

“We are absolutely thrilled-nay, elated-to welcome Giang Bui as our Vice President,” announced Securitize, perhaps with a hint of dramatic flair.

She arrives from Nasdaq, where she was not merely a participant but a maestro of U.S. Equities & ETP strategy, guiding the exchange’s forays into the enigmatic world of spot Bitcoin ETFs.

– Securitize (@Securitize) January 27, 2026

The company, in its infinite wisdom, has laid out a mission for Giang: to focus on the noble pursuit of regulated tokenization, which promises to deliver the sacred trinity of ownership rights-dividends, voting, and disclosures-while ensuring a resilient market infrastructure. One can only imagine the grandeur of this undertaking!

Before her illustrious days at Nasdaq, Giang was a mere Director of Listings at Cboe Global Markets, where she engaged in the high-stakes game of ETF business development and liquidity programs. Her résumé reads like a bestseller, detailing her pivotal role in crafting and marketing new indexes at the New York Stock Exchange-truly a tale for the ages.

Securitize: BlackRock’s Tokenization Arm

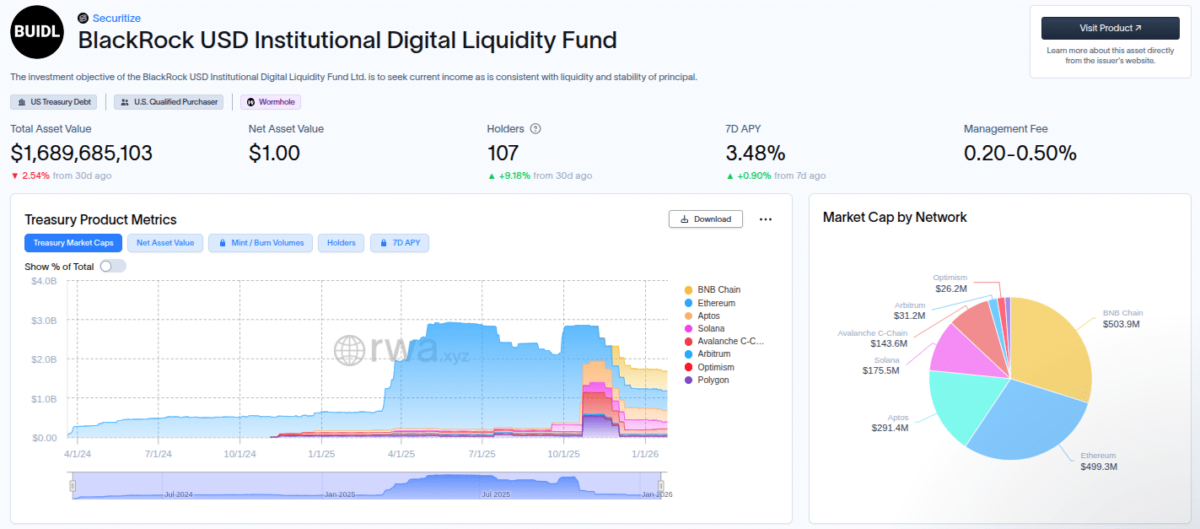

Securitize, the self-proclaimed bridge between the blockchain realm and traditional finance (TradFi), has become something of a beacon in the industry. Acting as BlackRock’s on-chain arm, they launched the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) in March 2024, which now boasts an impressive $1.69 billion across seven blockchains, according to the ever-reliable data from rwa.xyz.

BlackRock USD Institutional Digital Liquidity Fund (BUIDL) data as of Jan. 27, 2026 | Source: rwa.xyz

In a twist befitting a Shakespearean comedy, Nasdaq too has been dabbling in the art of tokenization, beginning its flirtation while Giang was still in the fold. The intersection of TradFi and crypto continues to blossom, as former titans of Nasdaq find themselves in the embrace of key players in the tokenization arena-like Giang, now strutting her stuff as the Vice President of Securitize.

Read More

- EUR USD PREDICTION

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- NEXO PREDICTION. NEXO cryptocurrency

- Gold Rate Forecast

- BTC PREDICTION. BTC cryptocurrency

- DOGE PREDICTION. DOGE cryptocurrency

- Tajikistan’s Bitcoin Blunder: $3.5M Gone! 🚨

- EUR ARS PREDICTION

- AAVE PREDICTION. AAVE cryptocurrency

2026-01-28 02:40