In the dusty trails of the financial frontier, ol’ silver-tongued David Morgan reckons the skies are growlin’ with storm clouds. Gold and silver, them trusty steeds of the monetary range, are whinnyin’ warnings of a supply drought and policy stampedes ahead. 🏜️💨

Gold’s Weather Vane’s Pointin’ to a Tornado, and Them Policy Winds Ain’t Letting Up

The fella behind “The Silver Manifesto,” told Daniela Cambone this ain’t no ordinary currency hiccup-it’s a global bellyache. If the U.S. dollar takes a tumble, he figures, there ain’t much shelter ‘cept them shiny metals. For liquidity, gold and silver are the only game in town, like a saloon in a ghost town. 🥃✨

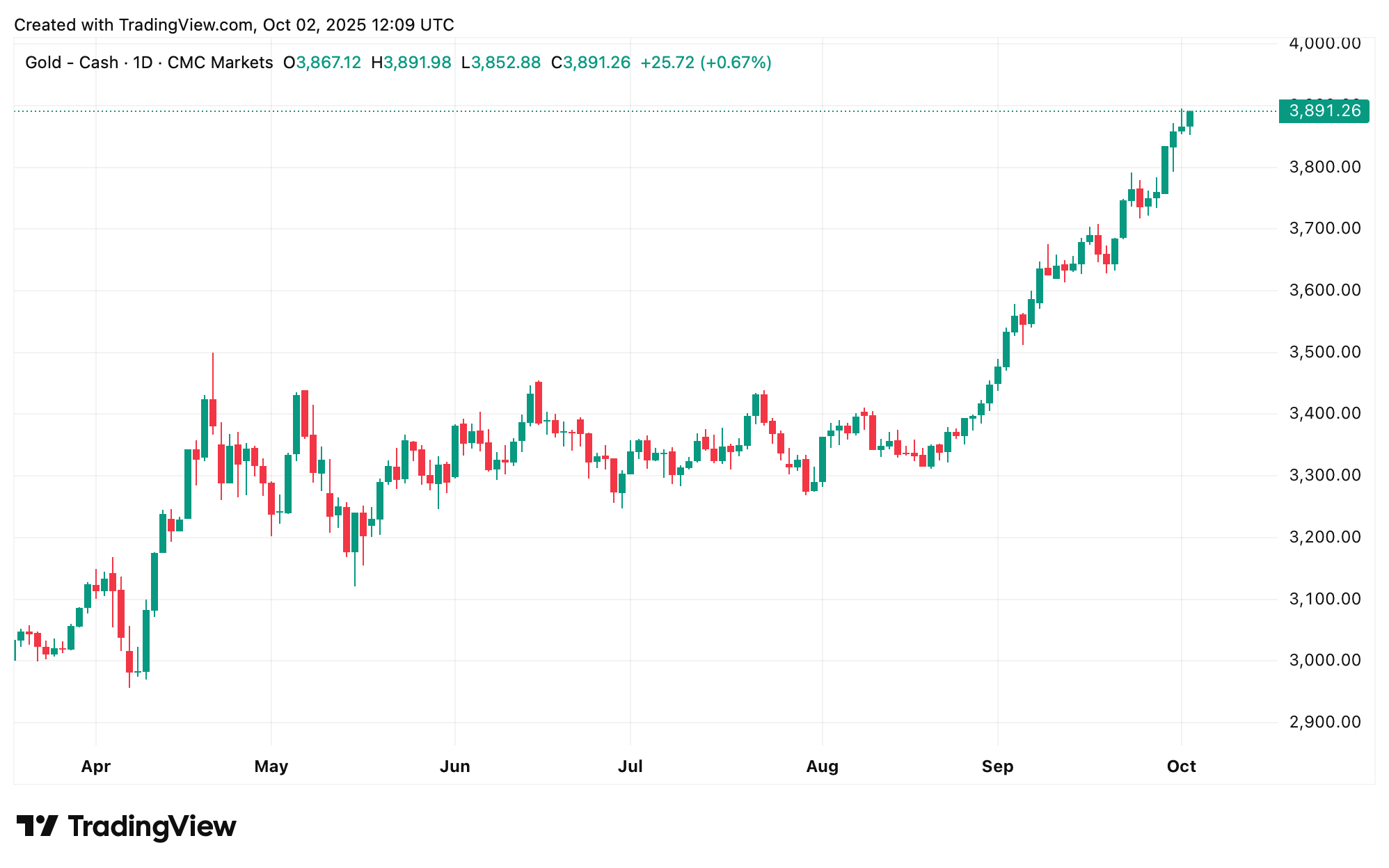

Morgan calls gold a weather vane, not a thermometer-it don’t tell you how hot it is, it tells you which way the wind’s blowin’. With gold prancin’ to record highs, he reckons the markets are in the “acceleration phase,” the wild ride where most gains come faster than a jackrabbit on a date. Fear of missin’ out (FOMO) does the rest, like a herd of cattle stampedin’ toward the trough. 🐂💰

Morgan’s paintin’ a picture: gold cleared $2,000, nudged $4,000, and if the momentum holds, it might gallop to $6,000-$8,000 by mid-2026. Latecomers usin’ futures leverage, he warns, could win or lose “retirement money” quicker than a cowboy loses his hat in a brawl. That’s the mania zone, where discipline’s worth more than a six-shooter. 🔫💸

The warning signs are as obvious as a skunk at a picnic: debt, geopolitics, and portfolios older than a tortoise. Fear’s the real catalyst, he says-fear of shrinkin’ wallets and pricier beans. 🦨🍲

One sign he points to: stocks and gold risin’ together. Since gold usually moves opposite equities, a dip in the S&P could send bullion into overdrive. If it’s strong when stocks are strong, he asks, how strong could it be when stocks take a nosedive? 🤔📉

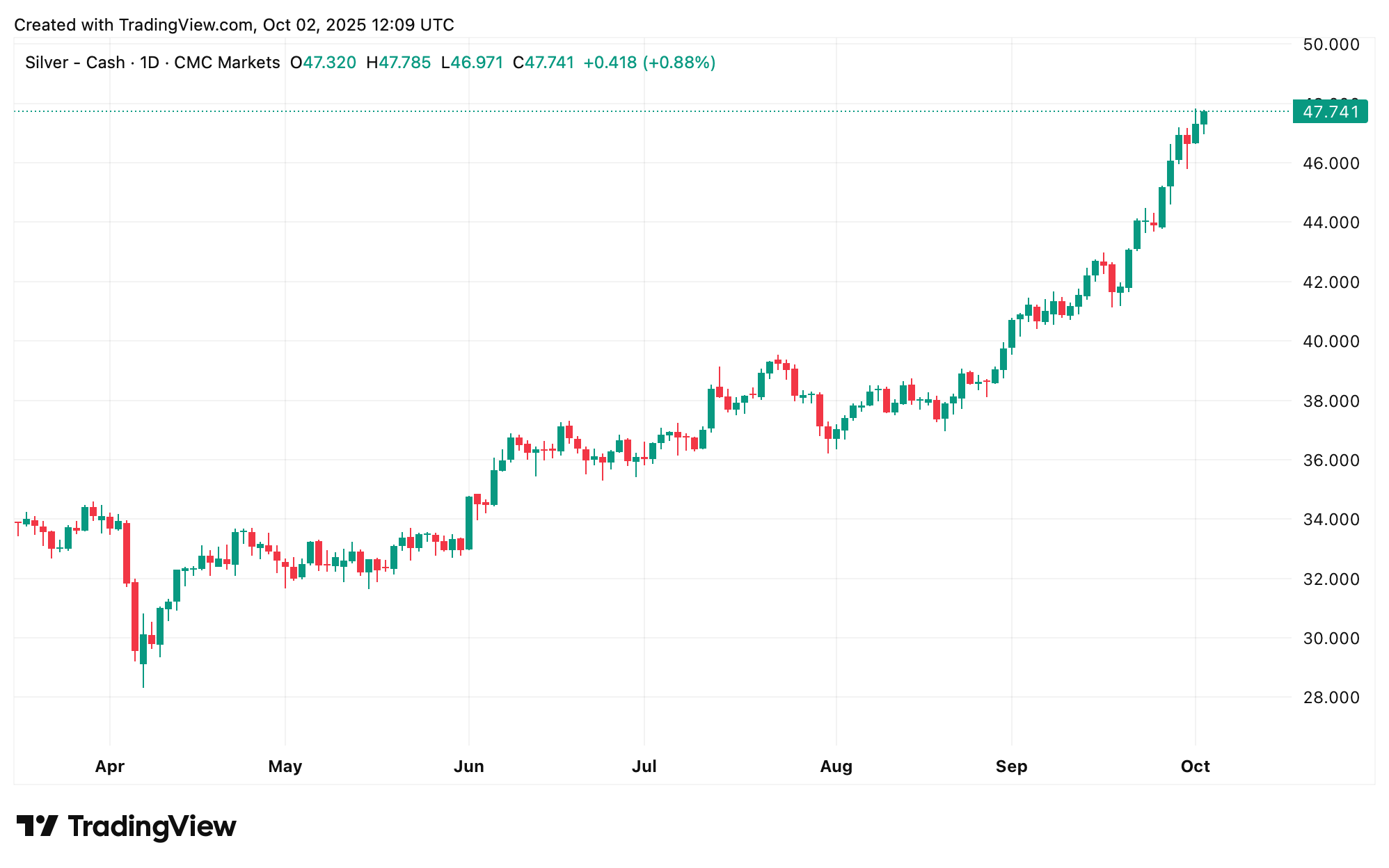

Silver, he argues, packs the punch. Industrial demand’s climbed from a third to near 70%, even as mined supply rose from 550 million to 850 million ounces. The market’s been runnin’ deficits, patched up by above-ground stash. If 1% of $7 trillion in money-market cash chased silver, that’s two years of mine output-enough to make a prospector weep. ⛏️💎

He tosses in two caveats: exchanges tend to hike margins during moonshots, and shakeouts are as common as a cowboy’s lasso-think a whipsaw from $47 back to $40. 🪢💥

Globally, he says “follow the gold”: flows from West to East hint at a power shift bigger than a land grab. At home, he mourns social fractures wider than the Grand Canyon, arguin’ that debased money cheapens civic life-and that integrity, not political idols, is the foundation worth defendin’. 🏛️⚖️

“What made America great, I said this way before the MAGA thing, was that we had high integrity,” Morgan drawled.

He added:

“And I try to shout it out. It was integrity that made America. That we have a set of laws that are the same rules, laws, accountability for everybody. Everybody’s treated the same. It doesn’t matter if you’re a senator or, you know, a janitor. Well, it does matter now.” 🗽🤠

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Upbit’s Wild Goose Chase: $1.77M Frozen, Hackers on the Run 🕵️♂️💰

- Ethena’s $106M Token Unlock: Will Aave’s Liquidity Bust or Just a Bad Hair Day? 🤔

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

2025-10-02 20:39