In the hallowed halls of Harvard, where the air is thick with the scent of old books and ambition, a curious thing has happened. The university’s endowment fund, a veritable treasure chest of $53.2 billion, has decided to dip its toes into the murky waters of Bitcoin, acquiring nearly 2 million shares of the iShares Bitcoin Trust. It seems that even the most prestigious institutions are not immune to the siren call of cryptocurrency. Who knew that the Ivy League had a taste for digital gold? 💸

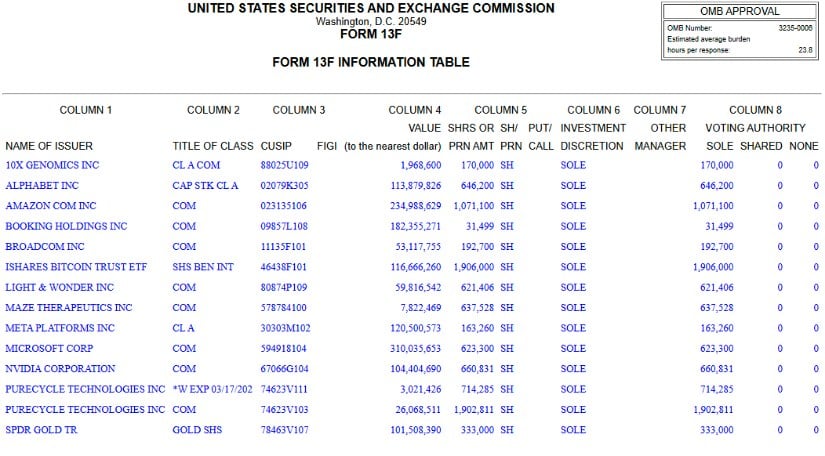

Details of this audacious investment emerged from a regulatory filing, submitted to the Securities and Exchange Commission on a day that will surely be remembered in the annals of financial history-August 8. The Harvard Management Company, the stewards of this vast fortune, revealed that as of June 30, they were holding 1.9 million shares of BlackRock’s IBIT fund. It’s almost as if they’re saying, “Why not throw a little Bitcoin into the mix?”

Bitcoin: Harvard’s New Favorite Child

Now, let’s not beat around the bush-this Bitcoin investment has catapulted itself to the rank of Harvard’s fifth-largest public stock holding. Only four tech titans stand in its way: Microsoft, Amazon, Booking Holdings, and Meta. And in a twist that would make any Wall Street trader chuckle, Bitcoin has managed to outshine Google’s parent company, Alphabet, by a cool $3 million. Take that, search engine! 😂

What’s even more eyebrow-raising is that Harvard now has more Bitcoin than gold. Yes, you heard that right! Their gold holdings through the SPDR Gold Trust are worth about $102 million, which is a paltry $14 million less than their Bitcoin stake. It seems the university has decided that shiny yellow metal is so last season. Who needs gold when you can have Bitcoin? 🪙

This Bitcoin allocation now represents about 8% of Harvard’s publicly reported portfolio, which totals over $1.4 billion. But let’s not get too excited; this only covers certain U.S.-listed securities. The full extent of Harvard’s investment portfolio is a labyrinthine affair, encompassing real estate, private equity, and who knows what else. Perhaps a secret stash of Beanie Babies? 🤷♂️

Harvard’s Crypto Curiosity

Now, before you think this is a spontaneous leap into the world of cryptocurrency, let’s set the record straight. Harvard has been flirting with the idea of crypto for years, dating back to 2018 when other universities were also dipping their toes into the digital waters. In 2019, they made headlines by investing $5-10 million directly in Blockstack cryptocurrency tokens. It seems they’ve been buying Bitcoin directly on exchanges since then, alongside their Ivy League pals at Yale and Brown. Talk about a crypto clique! 🕶️

Robert Kaplan, a business professor at Harvard, once explained their approach to volatile investments with a sage nod: “The endowment and its asset allocation is set up to anticipate you’re gonna have some volatile periods.” Wise words, indeed. It’s like saying, “We know the rollercoaster is going to be wild, but we’re strapped in for the ride!” 🎢

BlackRock’s Bitcoin Bonanza

Harvard’s choice to invest through BlackRock’s IBIT fund is a testament to the fund’s dominance in the Bitcoin ETF arena. Since its launch in January 2024, the fund has attracted over $86 billion in assets, making it the heavyweight champion of Bitcoin ETFs. It’s almost as if BlackRock has cracked the code to institutional investing in crypto. Who needs to worry about storage and security when you can just let BlackRock handle it? 🙌

BlackRock’s Bitcoin ETF has been so successful that it now generates more revenue than its flagship S&P 500 fund, despite having a smaller total asset base. Higher fees? Yes, please! It’s a cash cow, and BlackRock is milking it for all it’s worth. 🐄

Institutional Bitcoin Fever

Harvard isn’t the only one catching this Bitcoin fever. Other major institutions are also adding Bitcoin to their portfolios through ETFs. Michigan’s state pension fund recently tripled its Bitcoin investment to $11 million, while Brown University holds $13 million in the same BlackRock fund as Harvard. It’s like a game of “who can invest more in Bitcoin?” and everyone wants to win! 🏆

The Securities and Exchange Commission has made it easier for institutions to invest in Bitcoin ETFs by increasing the number of allowed options contracts from 25,000 to 250,000. This change could send demand for these investment products soaring. It’s like opening the floodgates to a tidal wave of institutional interest! 🌊

Bitcoin’s growing acceptance among traditional investors reflects a seismic shift in how institutions view cryptocurrency. What was once deemed too risky is now being embraced as a legitimate asset class for portfolio diversification. It’s a brave new world, folks! 🌍

And let’s not forget the supportive government policies that have emerged. President Trump’s administration has established cryptocurrency-friendly regulations and even plans to create a Strategic Bitcoin Reserve. It’s almost as if they’re rolling out the red carpet for Bitcoin! 🎉

The Future Looks Bright (and Bitcoin-y)

Harvard’s investment is a clear signal that Bitcoin has reached a new level of mainstream acceptance. When a prestigious institution like Harvard throws over $100 million into Bitcoin, it sends a resounding message to other institutional investors: “Hey, maybe we should consider this too!”

This move could inspire other university endowments and institutional investors to follow suit. Harvard’s decision validates BlackRock’s recommendation that investors consider allocating 1-2% of their portfolios to Bitcoin. It’s like a stamp of approval from the academic elite! 📜

For BlackRock’s Bitcoin ETF, Harvard’s investment adds yet another high-profile name to its growing list of institutional investors. The fund continues to attract billions in new money from pension funds, hedge funds, and other large investors. It’s a Bitcoin bonanza, and everyone wants a piece of the action! 💥

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

- Crypto Carnage: Fed’s “Hawkish Cut” Leaves Bitcoin in Tatters 🎢💸

2025-08-10 02:27