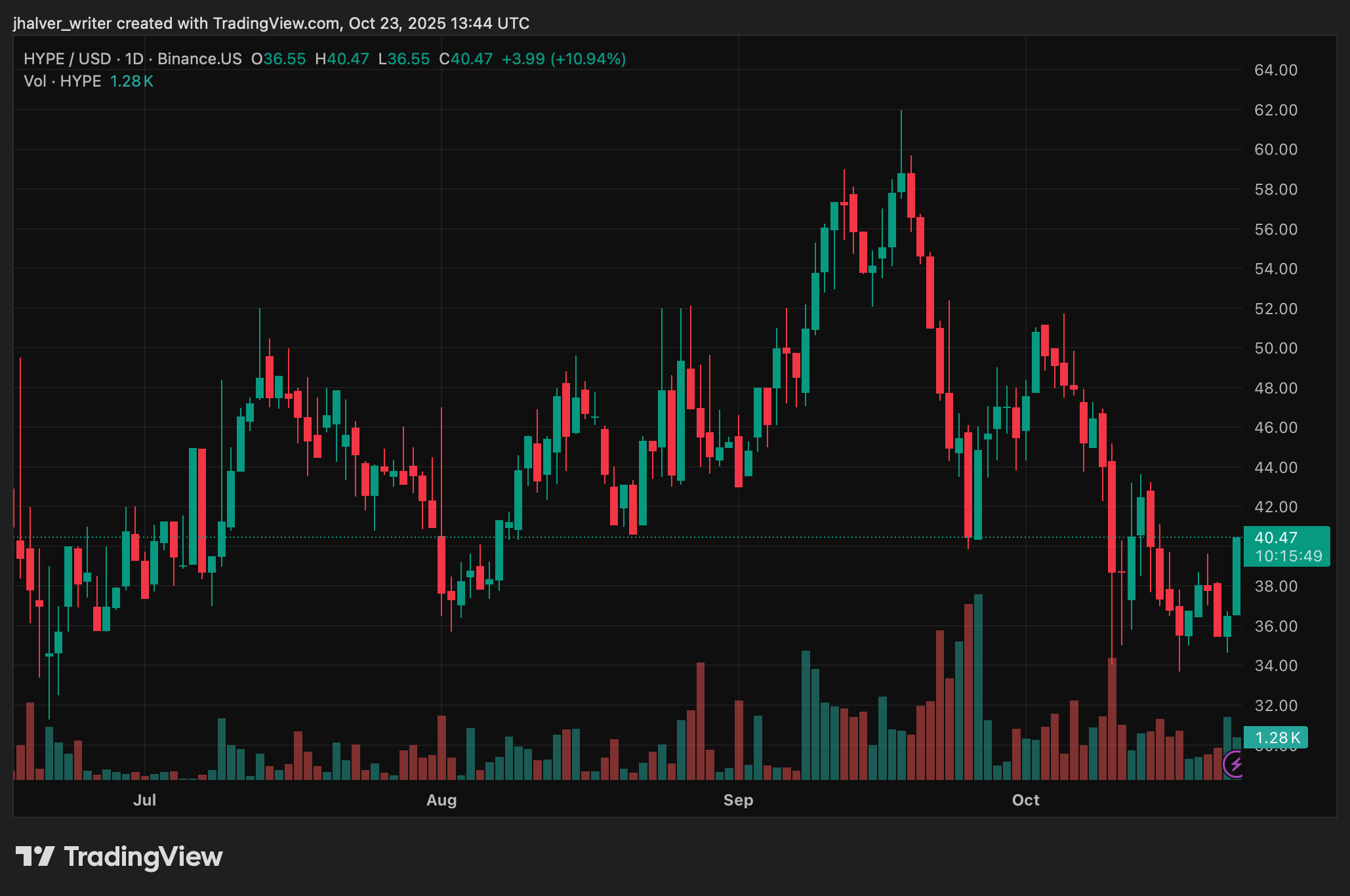

One fine modest day, the marketplace was buzzing-an extraordinary surge of ten dulcet percent attempted to nudge the stately Hyperliquid price into an uncharacteristic prance of over $39. The escape had something of a recklessness about it, as if the HD Ltd. Featherweight Prize it sought was vital-and vital-o-liciously elusive.

Hovering above its customary ordinary appearance, whispers ran through the alleyways of financial offices, recounting tales of institutional nods and daring gambles by whales-with more metaphorical blubber than I had expected by some counts-now agape as further carnivals of supply antics awaited.

Striking back triumphantly after reclaiming a haphazard obstacle known as the 61.8% Fibonacci level at $35.84, Hyperliquid began showing signs of valor that would shame even the most illustrious of Russian matadors, especially amid the unpredictable swings of this cryptic orchestra. Ample volume spikes anticipated celebration for upcoming galas of corporate events-a peculiar blend of equities and exotica.

$1B Fundraising and Public Listing Plans Spark Institutional Excitement

In the noise of a financial quarter typically as vivid as a well-cooked samovar, Hyperliquid Strategies Inc. decided to unleash their belated ambitions upon the unsuspecting eyes of the Securities Exchange Commission-more lepidoptera than rocket science. By rattling a grand filing box to hoist $1 billion under its wing, Hyperliquid plans to grace the Nasdaq with an offering of shares, ensuring the event will be talked about for a time.

The very funds, they suggest, will be used to expand the family and acquire several chests of HYPE tokens, thereby forging links as delicate as lace between the novel DeFi milieu and the labyrinth of traditional marketplaces-scrupulous in transparency but chaotic in intent. Born through the precarious unity of the esteemed and ledger-bound Sonnet BioTherapeutics, and the enigmatic Rorschach I LLC, the company dreams of publicly treasuries, purporting to act as safe passage for crypto management ventures.

Indeed, analysts in their elegant hats and velvet seats thrust the venture headlong toward legitimacy. At once suggesting buyer-Semprunna flurries and staking hunts-one imagines-to perpetuate the market’s fervor for such daring escapades.

How the Developments Will Affect the Hyperliquid Price

Thus, having received the merger and impending bonanza from the $1B parade, the sagacious might conjecture that bullish joy lingers, poised to take flight. A testimony to the institutional emergency ward, confidence germinates like a heretofore undiscovered passionflower, aiding its ascent past obstructive pillar-like levels; trumpets already blare, praising a planned bourse stock debut.

With gesticulating interest peaking above $2 billion, traders are seen-not for trading, perhaps, but rather for peering into the Carrier Pigeon, anticipating a path of leaping longs wielded by whales. Such inventory machinations as buybacks and staking may constrict the atmosphere above, nurturing desires for altitude in Hyperliquid pricing.

A telltale dance breaching $41.76 might exclaim a storied new page of rallying; thereby placing Hyperliquid upon its pedestal as the grandiose marquee intersecting elusive DeFi and the peculiarities of bazaar-tradition.

Cover image courtesy of ChatGPT, with trading representation from TradingView.

Read More

- EUR USD PREDICTION

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Crypto Carnage: Fed’s “Hawkish Cut” Leaves Bitcoin in Tatters 🎢💸

- USD MYR PREDICTION

2025-10-24 08:15