In a rather curious turn of events, Bitcoin almost touched the $94K mark, as the lackluster jobs report seemed to nudge the possibility of an interest rate cut by the Fed into the realm of the very likely.

Bitcoin Climbs on Weak Labor Data

Private employers decided to play the “let’s cut 32,000 jobs” game in November, according to ADP’s latest jobs report released Wednesday. And rather than causing a market panic, both Bitcoin and stocks decided to rise. Why? Perhaps because the “good news” for some means an increased likelihood of a rate cut by the Federal Reserve next Wednesday. A real plot twist, don’t you think?

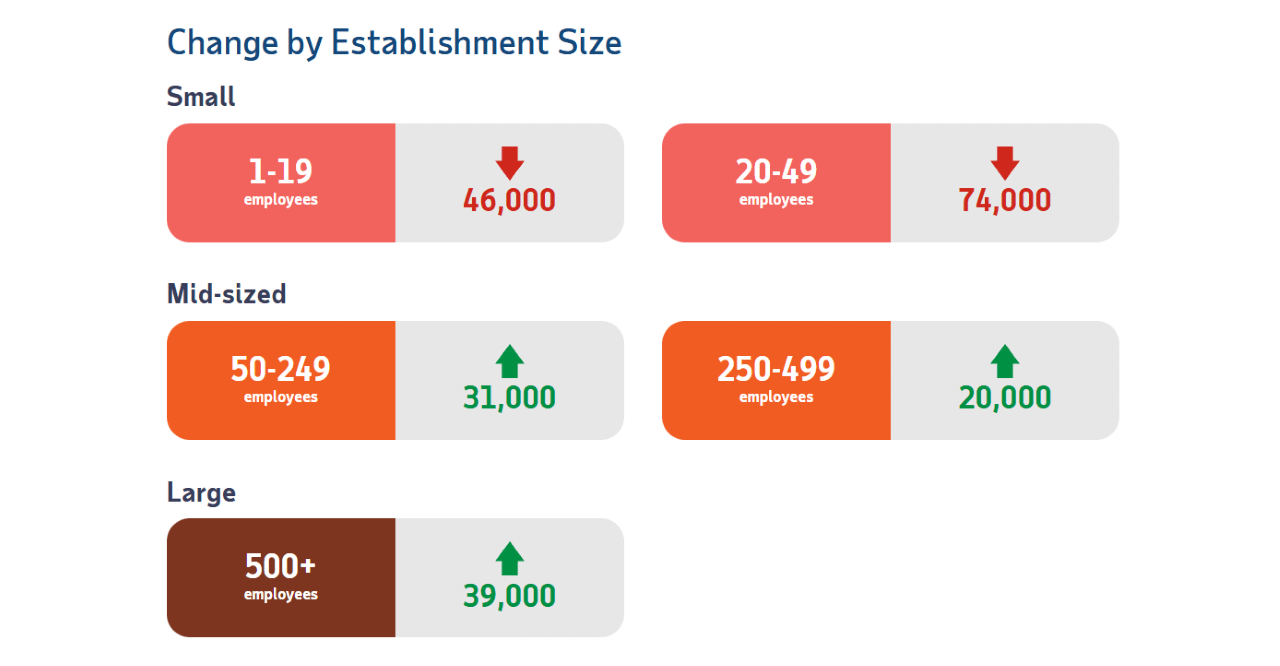

Now, the drop in private jobs was a bit of a surprise, given that economists had predicted 40,000 new positions. But instead, we saw the astonishing loss of 120,000 jobs at small businesses. Meanwhile, medium and large employers added about 90,000 new jobs, though they didn’t quite have enough muscle to make up for the small business bloodbath.

“Hiring has been a bit all over the place recently, as employers face cautious consumers and the unpredictable beast that is the macroeconomic environment,” said Dr. Nela Richardson, ADP’s chief economist. “While the slowdown in November was widespread, it was particularly painful for small businesses.”

To make matters more exciting, the Federal Reserve had already hinted that soft employment was a key factor in their previous rate cuts. With this new shock to private jobs, it’s almost a given that Fed Chair Jerome Powell and his team will happily join the rate-cutting bandwagon next week. The resulting stock market jump was no surprise, but hold your horses-Bitcoin, which has been stubbornly indifferent to both positive and negative news alike, also ticked up, bringing a sigh of relief to many.

But of course, Bitcoin’s rise isn’t just about a jobs report. Investment firm Charles Schwab, with its $10 trillion in client assets, recently announced plans to offer Bitcoin and ether spot trading sometime in the first half of 2026. Not to be outdone, Vanguard-yes, the firm with $11 trillion in assets-has decided to offer crypto exchange-traded funds (ETFs) on its platform. Talk about institutional support! As they say, the tide lifts all boats… even those in the cryptocurrency sea. 🌊

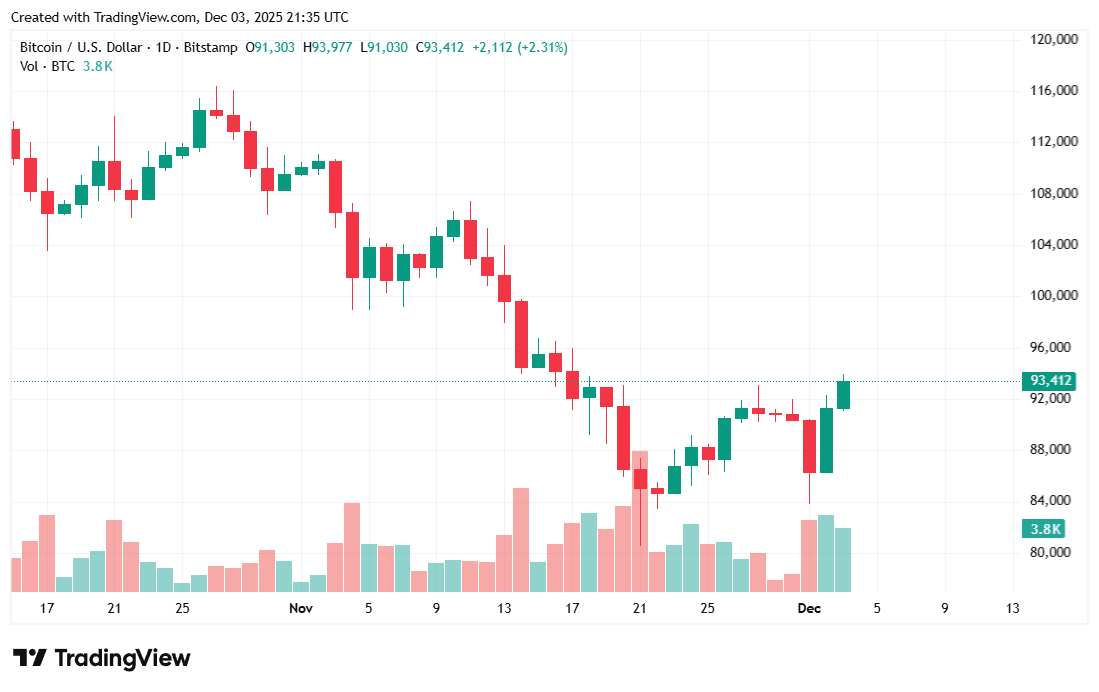

Given these tailwinds, Bitcoin’s 2% rise shouldn’t be shocking. However, after the bloodbath of the past few weeks, some investors were probably holding their breath for something a bit more, shall we say, “unexpected.” 🫣

Overview of Market Metrics

Bitcoin was priced at $93,286.68 at the time of writing, up 1.98% for the day and 3.35% for the week, according to Coinmarketcap data. The price fluctuated within a relatively narrow range, between $91,056.39 and $93,965.10 over the past 24 hours.

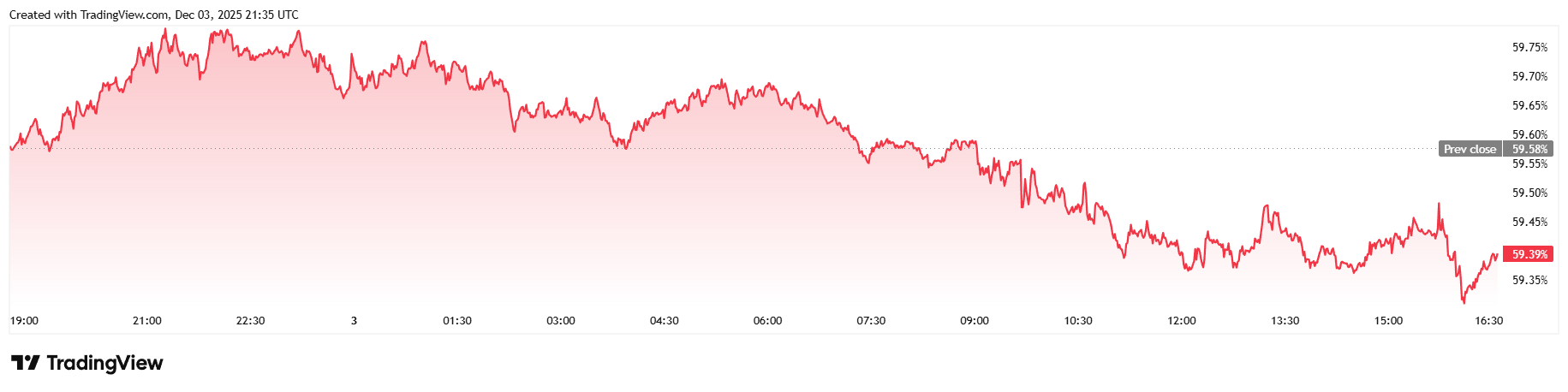

Daily trading volume was slightly less exciting, climbing a modest 2.52% to reach $76.77 billion. Market capitalization stood at a whopping $1.86 trillion, and Bitcoin dominance inched lower, easing 0.28% to reach 59.40%.

Total Bitcoin futures open interest rose by 1.55%, to reach $60.16 billion, according to Coinglass data. Liquidations fell by 30%, totaling $132.59 million. The shorts led the losses to the tune of $92.47 million, while bullish long investors shed about half that amount-roughly $40.13 million.

FAQ ⚡

- Why did Bitcoin rise after the weak jobs report?

Because weaker labor data increased expectations of a Federal Reserve rate cut, improving risk sentiment for assets like Bitcoin. - How did private employers perform in the latest ADP report?

ADP reported a surprise loss of 32,000 private-sector jobs, driven largely by steep cuts at small businesses. We love a plot twist! - Why are analysts confident the Fed will cut rates next week?

The sudden drop in employment aligns with the conditions the Fed has previously cited when justifying rate cuts. It’s almost like a script! - What other catalysts helped lift Bitcoin’s price?

Announcements from Charles Schwab and Vanguard expanding access to Bitcoin products have strengthened institutional support and boosted investor confidence. And who doesn’t love a good institutional boost? 💪

Read More

- EUR USD PREDICTION

- Gold Rate Forecast

- Brent Oil Forecast

- BTC PREDICTION. BTC cryptocurrency

- EUR AUD PREDICTION

- Silver Rate Forecast

- Bitcoin’s Downfall: Two Scenarios That’ll Make You Scream 😱

- CNY JPY PREDICTION

- EUR RUB PREDICTION

- USD INR PREDICTION

2025-12-04 02:19