Ah, the grand spectacle of U.S. equities prancing about like a troupe of dainty ballet dancers by mid-day Tuesday! Investors, with their noses buried in the latest retail sales data-sadder than a cat in a dog park-decided to rotate selectively across sectors, as if choosing the finest chocolates from a box, all while the markets remained open and prices played the ever-elusive game of hide and seek.

Stocks Maintain A Merry Shade of Green as Investors Await the Big Reveal

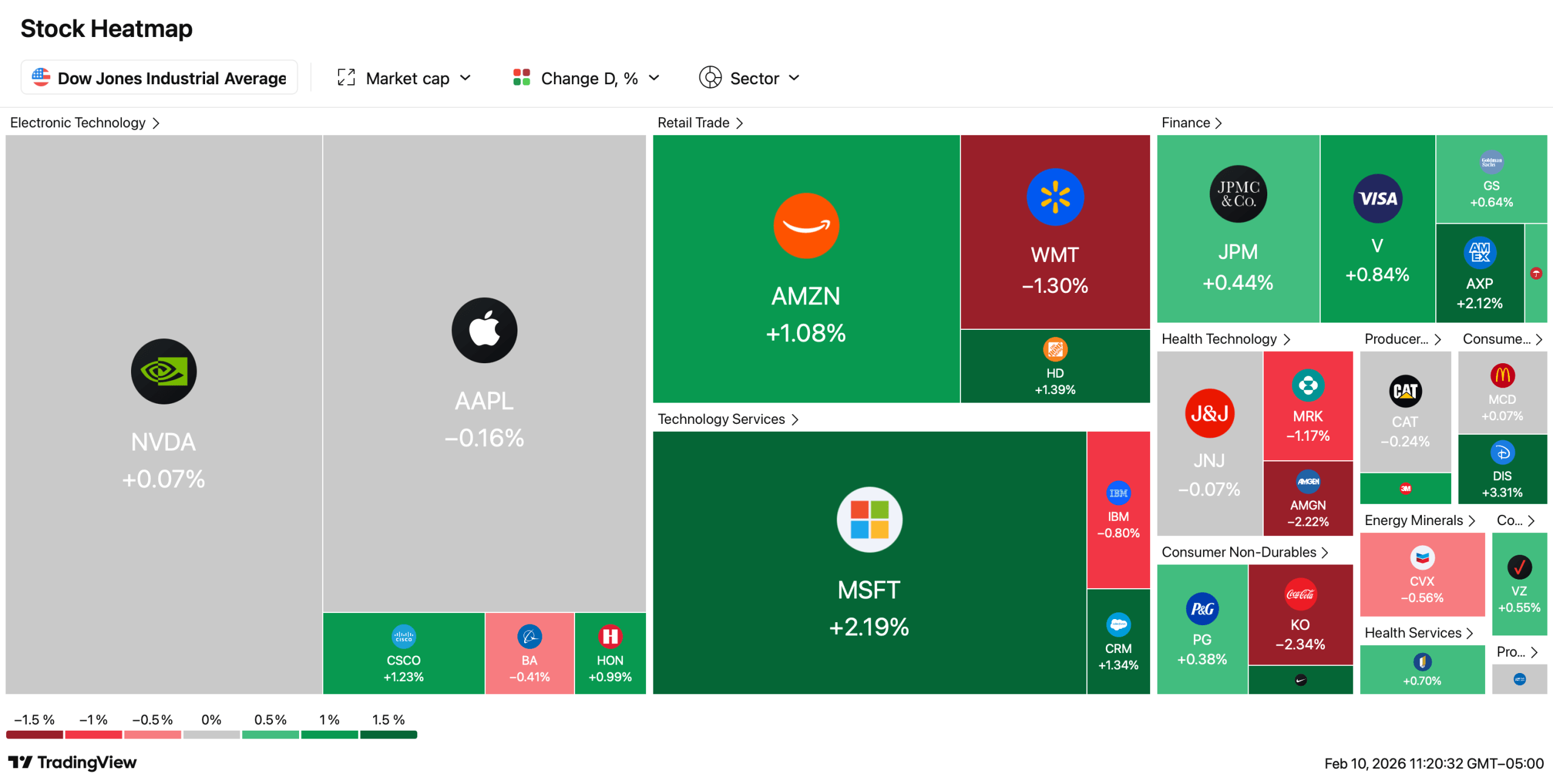

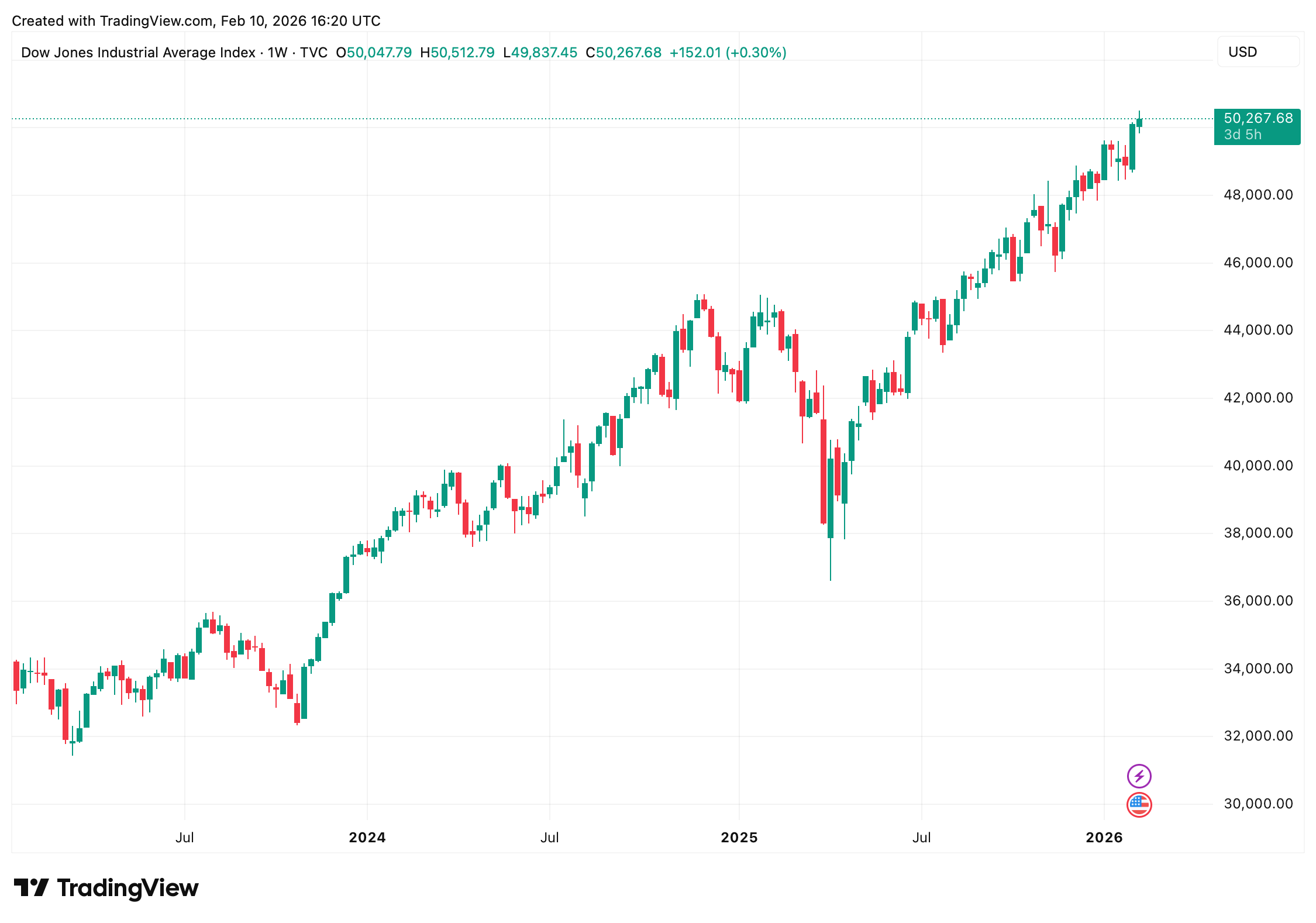

Wall Street opened its gates with the calmness of a monk meditating, and maintained this serene demeanor through late morning. Gains, like a rather picky dinner guest, were spread unevenly across the major benchmarks. Traders seemed quite content to let Monday’s rebound breathe, perhaps reminiscent of letting a fine wine aerate before indulging. The Dow Jones Industrial Average, bless its heart, led the pack, extending its record-setting frolic above the 50,000 mark, while the S&P 500 and Nasdaq Composite made more modest advances, like overworked butler tending to esteemed guests.

By approximately 11:45 a.m. EST, the Dow was cavorting near 50,300, up about 175 points on the day, while the S&P 500 tiptoed around 6,970 and the Nasdaq Composite lounged near 23,246, each edging higher by mere fractions. The muted atmosphere suggested a market enjoying a leisurely coffee break rather than making any rash decisions.

Meanwhile, economic data set the mood lighting just right. January retail sales came in flatter than a pancake, failing to meet expectations for modest growth and reinforcing the narrative that consumer spending may be experiencing a rather unceremonious cooling-off period. Treasury yields, responding like a well-trained puppy, slipped, nudging rate-cut expectations higher, offering just enough breeze for equities without igniting a full-blown raucous fiesta.

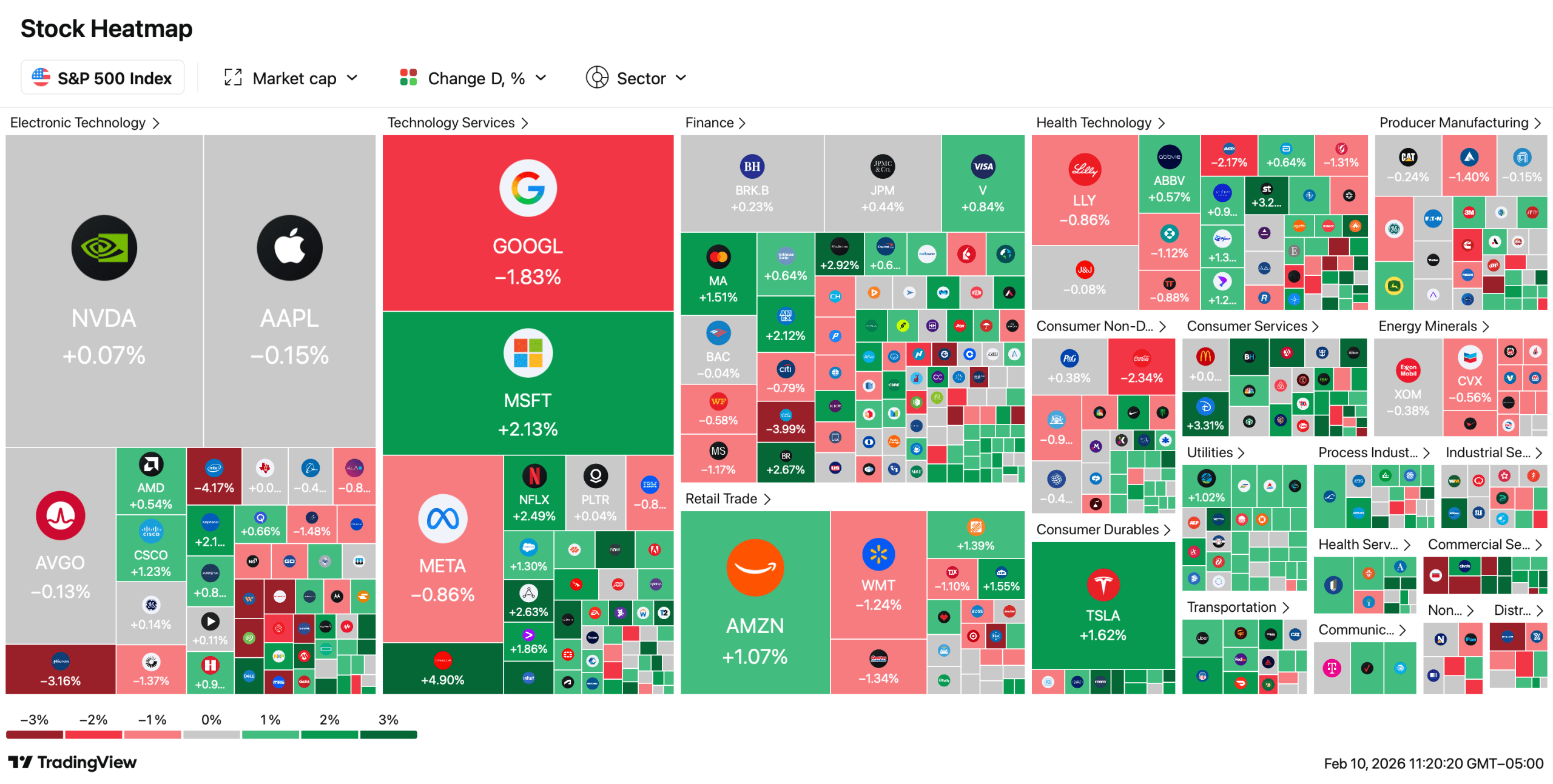

Sector performance, dear reader, was a reflection of that cautious optimism. Financials and value-leaning names put on their best show, while some chipmakers decided to take a breather after recent gains-like a sprinter pausing for a sip of water. Software stocks, however, continued their rebound following last week’s volatility, hinting at a rotation rather than a retreat from technology-a delightful twist in the plot!

Earnings remained a stock-by-stock affair, much like a game of musical chairs. CVS Health spruced up its spirits after a positive reception to its results, while Coca-Cola took a nosedive following an earnings miss-oh, the drama! Oracle gained ground on continued enthusiasm around artificial intelligence spending, even as Nvidia chose to ease slightly after its Monday jump. In short, the tape rewarded specifics, not just catchy slogans-a lesson for all!

Global markets offered a supportive backdrop, with Asian equities rallying overnight, led by Japan’s Nikkei hitting fresh records, while the dollar weakly waved goodbye. Gold prices remained steady as investors weighed policy uncertainty like careful chefs balancing flavors, while risk assets moved with all the restraint of a seasoned diplomat. The crypto economy, too, was treading water, consolidating its position. The price of bitcoin stood at just above the $69,400 mark at 11:45 a.m. EST on Tuesday, a figure that sounds impressively high-though not as high as one might hope for a thrilling rollercoaster ride.

Volatility remained subdued, with the CBOE Volatility Index hovering near recent lows. This calm suggests traders are currently comfortable-not unlike a cat on a sunny windowsill-parking near record levels ahead of heavier data later in the week rather than stampeding for the exits.

Looking ahead, all eyes will soon turn to upcoming labor and inflation reports, which could quickly alter the tone, sending ripples through the pond of tranquility. For the time being, however, U.S. equities appeared quite content to grind higher, proving once again that sometimes the market’s most telling move is simply refusing to panic.

FAQ ⏱️

- Are U.S. stock markets still open?

Yes, this report reflects mid-day pricing with trading ongoing, much like a never-ending party. - Which index is leading today?

The Dow Jones Industrial Average is showing the strongest mid-day gains, strutting about like a peacock. - What’s influencing markets right now?

Flat retail sales data and shifting rate-cut expectations are shaping sentiment, like a sculptor at work. - Is volatility elevated?

No, volatility remains as subdued as a librarian’s whisper compared with recent sessions.

Read More

- BTC PREDICTION. BTC cryptocurrency

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- EUR USD PREDICTION

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- Ethereum Whale’s Bold $280M Short: Is the Market on a Cliff or Just a Cliffhanger? 🤔

2026-02-10 20:28