The blue-chip cryptos like BTC, ETH, XRP, and others are struggling, while the privacy sector is witnessing a massive resurgence, with the Monero price today at $623. XMR/USD’s price action is strongly driven by a robust demand witnessed both on the technical chart as it has strong on-chain utility. In this Monero price prediction for January 2026 article, the data examined shows exactly why the asset is currently positioned to challenge its previous all-time highs and reach uncharted territory. 🤯

Privacy Sector Dominance and Network Utility

Moving forward, the health of the privacy coin market is best reflected in its daily transaction throughput. Current data from the bitinfocharts platform shows a robust level of blockchain activity, with Monero crypto recording 27.415k transactions on January 18, 2026. While DASH crypto showed a slight higher spike at 29.754k, the overall stability and privacy-preserving nature of XMR keep it at the forefront of the sector’s $11.56 billion market cap valuation. 🐚

Furthermore, ZEC crypto continues to play a role in this sector with 5.996k daily transactions, yet it is the Monero price USD performance that has captured the primary attention of trend-following investors. 🎯

Monero Price Prediction January 2026: Technical Breakout and Targets

Furthermore, the technical setup on the monthly timeframe highlights a major shift in historical trends. For years, the XMR/USD asset traded within a defined ascending parallel wedge, but January 2026 has seen a decisive breach of the upper border. 🧠

This move suggests that the previous 2017-2024 cycles of consolidation are over, paving the way for a more aggressive markup phase. 🚀

Simultaneously, the daily Monero price forecast remains bullish despite a recent pullback from the $800 all-time high. This retracement has allowed the asset to find dynamic support at the 20-day EMA band, effectively flipping the old resistance of the monthly wedge into a new support floor. 🧩

Whale Participation and Institutional Sentiment

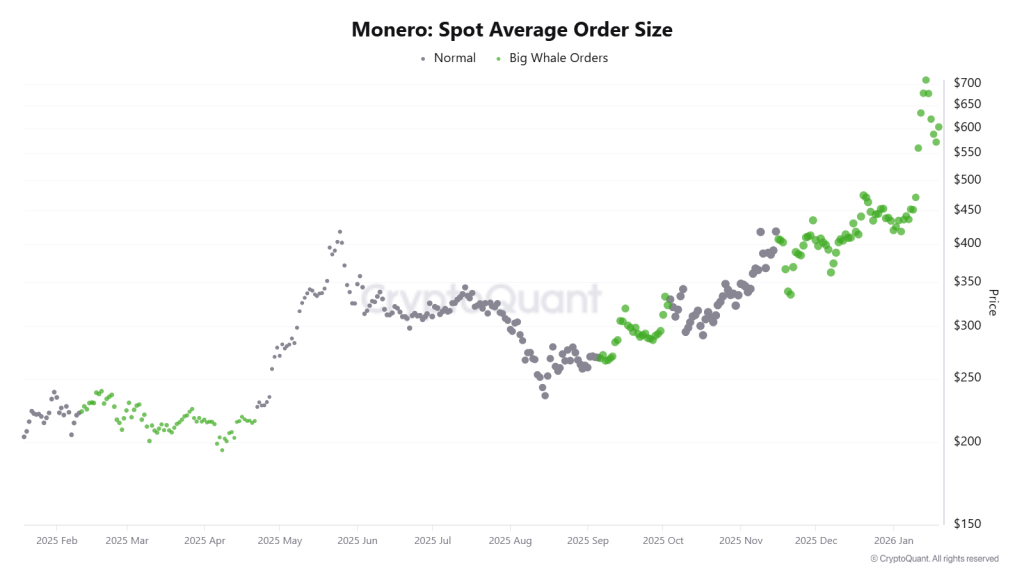

In addition to technical strength, the “smart money” is clearly making its presence known through on-chain order flow. According to the Monero price chart metrics for average order size, there has been a consistent presence of “Big Whale Orders” throughout the recent price surge. 🐋

Historically, larger average order sizes suggest increased participation from whale investors who are less likely to be shaken out by minor volatility. 🧊

This accumulation pattern supports the thesis that once the $800 resistance is flipped into support, the Monero price prediction January 2026 will likely see the asset target psychological round numbers at $900 and eventually $1,000. 🎯

Looking at the broader horizon, the convergence of network utility and institutional accumulation provides a strong foundation for the current price action. 🧱

As long as the Monero price USD remains above the dynamic 20-day EMA support, the momentum is expected to carry the asset through its previous peaks. 🌊

Consequently, the Monero price prediction January 2026 remains one of the most compelling narratives in the privacy sector, as the market anticipates a historic run toward the four-digit price milestone. 🧙♂️

Read More

- EUR USD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- GBP CNY PREDICTION

- STX PREDICTION. STX cryptocurrency

- NEXO PREDICTION. NEXO cryptocurrency

- CNY JPY PREDICTION

- USD MYR PREDICTION

- USD COP PREDICTION

- OP PREDICTION. OP cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

2026-01-19 17:22