I watched MYX Finance (MYX) perform its 24-hour soap opera the way you watch a distant relative at Thanksgiving-with a mix of curiosity, horror, and the dread that you’ll end up in the family photo anyway. The token slunk 35% lower, sliding from a stubborn $17.06 to a support range between $9.4 and $8.83, depending on which conspiracy theory you trust, per TradingView. Nice to know the market has a mood, and it’s a mood you don’t want to borrow from.

It wasn’t a clean break, of course. There were several failed attempts to reclaim higher ground-almost like a stubborn uncle insisting he’s “just resting his eyes” after three glasses of scotch. That’s what prompts the questions: what’s next, and why did momentum decide to take October off, despite crypto appearing to be the favorite child of the bullish month club?

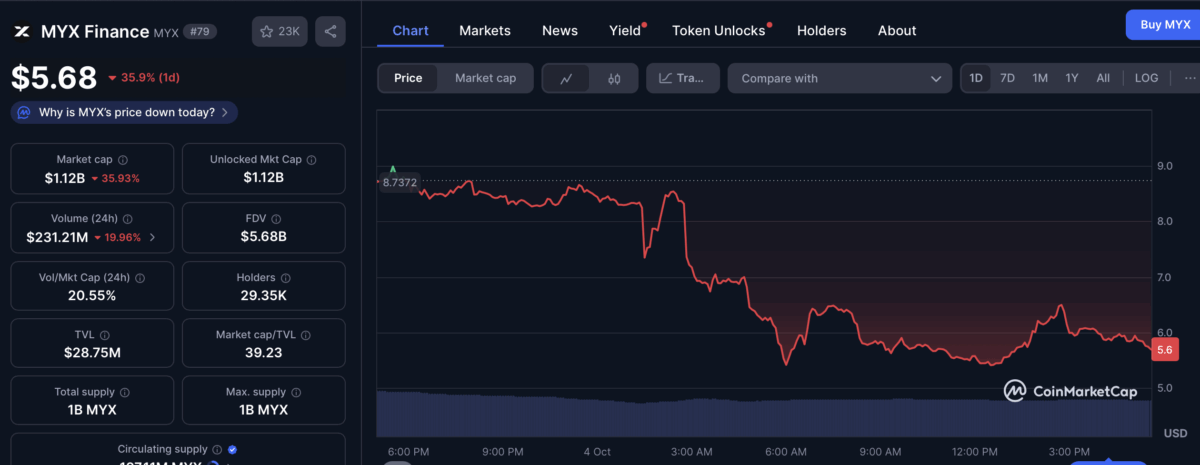

The token is currently trading around $5.68 per token, with the market cap slumping 35.93% to $1.12 billion. The week? A merciless ~60% down. And yes, in the background we have CoinMarketCap telling us there was a staggering 402.84% surge last month, which is basically the financial equivalent of a magician pulling a rabbit out of a hat and a second rabbit out of your tote bag while you’re staring at the wrong hat. So what changed? A rhetorical question that sounds like it was written by a psychic who misplaced their crystal ball.

On the daily chart via TradingView, it’s a tug-of-war where the buyers bring a pep talk and the sellers bring a shrug. The shrug, alas, is currently dominating the room. If you squint, you can almost see a candle trying to whisper “maybe we’ll recover,” but the candles are notoriously bad at small talk.

The Moving Average Convergence Divergence (MACD) histogram has remained in red territory-bearish, yes, but the narrowing bars suggest selling momentum might be weakening and could spark a comeback, or at least a polite apology for all the red ink. Either way, the drama persists with the enthusiasm of a late-night infomercial.

Yet caution lingers like a cautious librarian. The Exponential Moving Average (EMA) hints at a bearish crossover, and the 12 EMA sitting below the 26 EMA isn’t exactly waving a white flag for the bulls. Breaking through resistance would require more enthusiastic buyers than a crowd waiting for the free snack bar at a conference-and that’s not a guarantee you can count on.

There’s still a glimmer, though-a possibility of a rebound if MYX can retest the 8.29 support-turned-resistance zone and gather enough momentum to bust through. Without that surge, we’re staring at a deeper retreat and a longer stretch of bearish vibes, which is basically the market’s way of saying, “Take 5, you ridiculous spreadsheet.” 🤑📉💫

Read More

- BTC PREDICTION. BTC cryptocurrency

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- You Won’t Believe What Secretly Predicts Bitcoin’s Next Crash! 😱

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Binance Now Fully Approved in Abu Dhabi-What This Means for Crypto!

- Meet Vector: The Blockchain That Tosses Finality Speeds Out the Window! 🚀

2025-10-04 22:24