It is a truth universally acknowledged, that a fortune in Bitcoin must be in want of a correction. Indeed, the price of this digital commodity continues to hover in a most indecisive manner, oscillating betwixt eleven thousand five hundred pounds and, dare one say, close to twelve thousand! Whilst some speculators confidently predict an ascent to heights hitherto unimagined, others—those of a more prudent disposition, naturally—fear a regrettable diminution in value, citing the tiresome regularity of market cycles and the grasping tendencies of those eager to secure a profit. 🧐

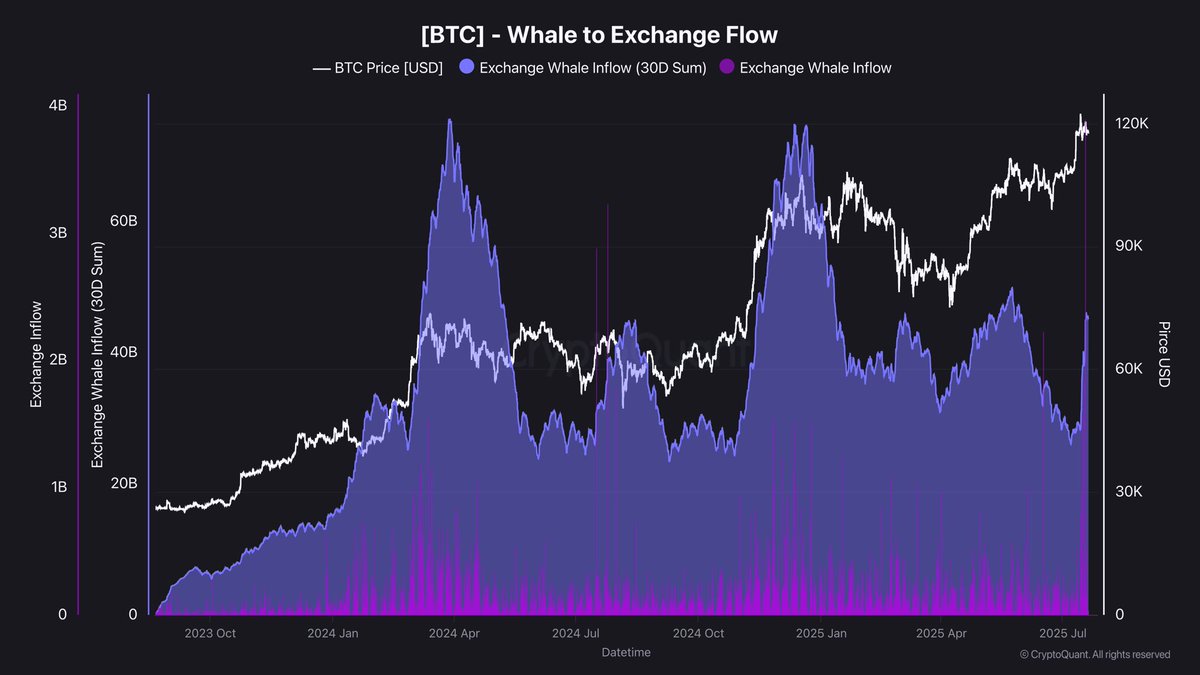

And now, to add fuel to the fire of anxious deliberation, we are presented with intelligence concerning the movements of certain…substantial holders of Bitcoin. It appears these ‘whales’, as they are so charmingly termed, have been transferring vast quantities of their holdings to the exchanges—a disconcerting increase of nearly seventeen billion pounds in but four days! Such activity, one recalls, often precedes either a flurry of profit-taking or, heavens forbid, a period of unsettling volatility. 💸

Though the bulls maintain a semblance of control, this influx of whale-sized transactions may introduce a temporary resistance to further advancement, particularly as the price lingers near its highest point yet. The coming days, therefore, promise to be of considerable consequence, as discerning investors attempt to ascertain whether this is merely a readjustment within a generally favourable trend, or the ominous prelude to a more substantial decline.

Concerning Whale Inflows and a Possible Abatement

Mr. Darkfost, a gentleman possessed of no small acumen in these financial matters, has drawn attention to a most intriguing observation. He notes that during previous peaks in the market, similar inflows from these large holders exceeded seventy-five billion pounds—an event invariably followed by a period of correction or, at the very least, prolonged stagnation. It seems these whales are, shall we say, rather keen to realise their gains after a spirited rally. 🤔

Between the fourteenth and eighteenth of July, this Whale to Exchange Flow, as it is known, rose from twenty-eight billion to forty-five billion pounds, a truly remarkable increase. Though the transfer of eighty thousand Bitcoin, linked to a most ancient holder, no doubt contributed, it signifies a wider tendency: these whales, it appears, are determined to secure their fortunes whilst the sun still shines.

However, a most curious nuance is revealed. Whilst the monthly average has indeed spiked, the daily figures suggest a lessening of this outflow. This implies that the pressure to sell may, for the present, be diminishing—a most agreeable prospect, and one which may allow the market to regain its composure and perhaps even prepare for another advance. One can but hope! ✨

Bitcoin Remains Hesitant Below a Significant Boundary

Bitcoin continues to trade within a rather restricted range, betwixt eleven thousand five hundred and seventy-four pounds and twelve thousand and seventy-seven pounds. Despite some pauses in its upward journey, the general disposition remains bullish, as evidenced by the alignment of the fifty, one hundred, and two hundred simple moving averages, all sloping upwards with commendable steadfastness. 💪

The twelve thousand and seventy-seven pound level has proven a particularly stubborn obstacle, repelling numerous attempts to surpass it. The eleven thousand five hundred and seventy-four pound support, however, has remained unbroken, forming a clear, though limited, range. Volume has, regrettably, diminished of late, suggesting a want of conviction amongst both those who hope for advancement and those who fear decline. Such consolidation frequently precedes a decisive movement, particularly when supported by a generally favourable trend.

Should the price decisively exceed twelve thousand and seventy-seven pounds, accompanied by a vigorous increase in volume, it would likely confirm a further ascent, perhaps targeting the thirteen thousand pound zone. However, should the bears prevail and break below eleven thousand five hundred and seventy-four pounds, Bitcoin might test the hundred SMA near eleven thousand four hundred and eighty pounds, or even descend to deeper levels of support. Until then, judicious traders will carefully monitor the volume and structure around these key points, awaiting the inevitable breakout or breakdown. 🙄

Read More

- BTC PREDICTION. BTC cryptocurrency

- Cardano’s Melancholy Ballet: Death Cross Dances as Markets Pause for Dramatic Effect

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- SEC’s Peirce Champions Crypto Privacy as Tornado Cash Trial Heats Up 🚒💼

- 🔥Vienna’s Crypto Carnage: Ukrainians Burn Wallets & Souls! 💰💀

- EUR USD PREDICTION

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

2025-07-21 17:53