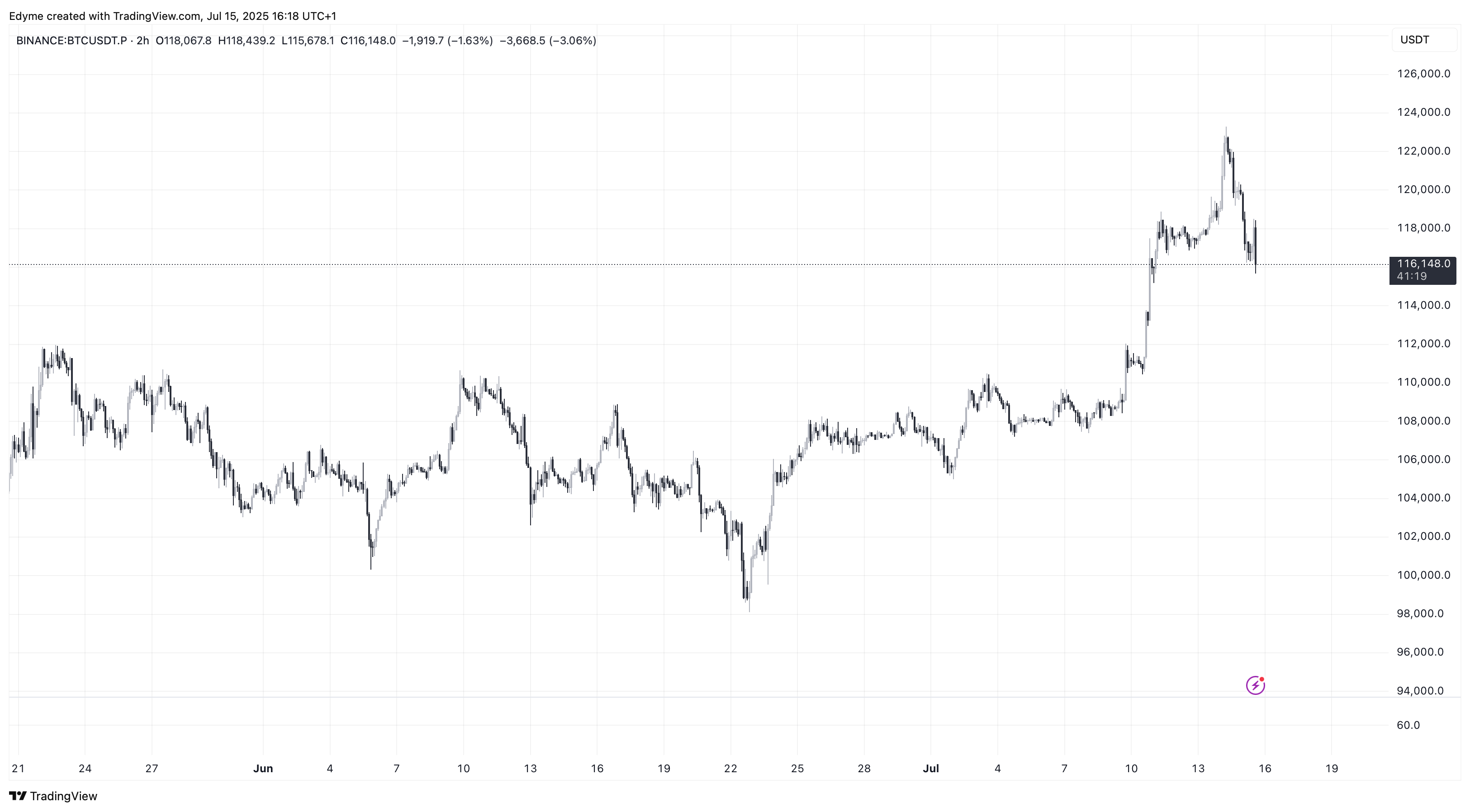

Bitcoin‘s recent price surge hit a speed bump after the latest US Consumer Price Index (CPI) revealed inflation rising to 2.7% in June. The inflation increase seems to have dampened investor spirits.

After reaching a new high of over $123,000 on Monday, Bitcoin has since dropped by roughly 5.4% from that peak, with its price currently hovering just above $116,000.

The broader crypto market also reacted to the news, with the global crypto market cap valuation plummeting by nearly 7% in the past day amid renewed uncertainty about future interest rate policy.

While Bitcoin has shown a strong upward trend in recent weeks, the latest dip introduces short-term volatility that analysts are keeping a close eye on. One particularly noteworthy event occurred on-chain: a transfer of 10,000 BTC, worth around $1.2 billion, from a dormant address that hadn’t been active for over a decade.

Historic Bitcoin Transfer Raises Eyebrows, but No Signs of Exchange Activity

CryptoQuant analyst Carmelo Alemán shared insights into the massive transaction in a recent post titled “10,000 Historic BTC Move On-Chain.” According to Alemán, the transaction took place on July 14 at 16:17 UTC, moving 10,000 BTC from address ‘bc1q84…7ef6k ‘ to ‘bc1qmu….8v2p.’

These coins hadn’t moved in over 10 years, indicating they likely originated from early miners during Bitcoin’s earliest days when the block reward was 50 BTC.

Alemán noted that such old unspent transaction outputs (UTXOs) often raise concerns about potential sell-offs, but in this case, further analysis suggests a more neutral interpretation.

The movement of old coins can happen for various reasons, including UTXO consolidation, wallet upgrades, or potential sales. Alemán explained that this transfer displayed characteristics consistent with consolidation for efficiency and security purposes.

For example, the transaction used 16 different inputs, which can help reduce future transaction fees. Additionally, no corresponding inflow to centralized exchanges (CEXs) was detected, typically a key signal when holders intend to liquidate.

The analyst also pointed out that two small test transactions were sent to the receiving address before the full transfer. These included a 0.00089 BTC and a 1 BTC transaction, commonly used to verify wallet accessibility before moving a large sum.

Interestingly, two hours after the initial transaction, the same destination wallet received another transfer of 10,009 BTC, bringing the total to more than 20,000 BTC moved in the span of a few hours.

Implications for Market Behavior and On-Chain Trends

While the transaction did not lead to immediate market selling, it has added fuel to ongoing discussions about the role of long-term holders in Bitcoin’s supply dynamics.

Large transfers from early addresses are rare and often interpreted as strategic reorganization of funds. Alemán noted that the absence of exchange-related activity makes it unlikely that the coins are being liquidated in the short term.

However, he cautioned that such movements warrant continued monitoring, particularly if additional large transfers follow or if the recipient wallet later transacts with exchanges.

Read More

- ETH PREDICTION. ETH cryptocurrency

- GBP CHF PREDICTION

- USD VND PREDICTION

- SOL PREDICTION. SOL cryptocurrency

- EUR RUB PREDICTION

- XMR PREDICTION. XMR cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- CNY JPY PREDICTION

- EUR ARS PREDICTION

- SHIB PREDICTION. SHIB cryptocurrency

2025-07-16 09:06