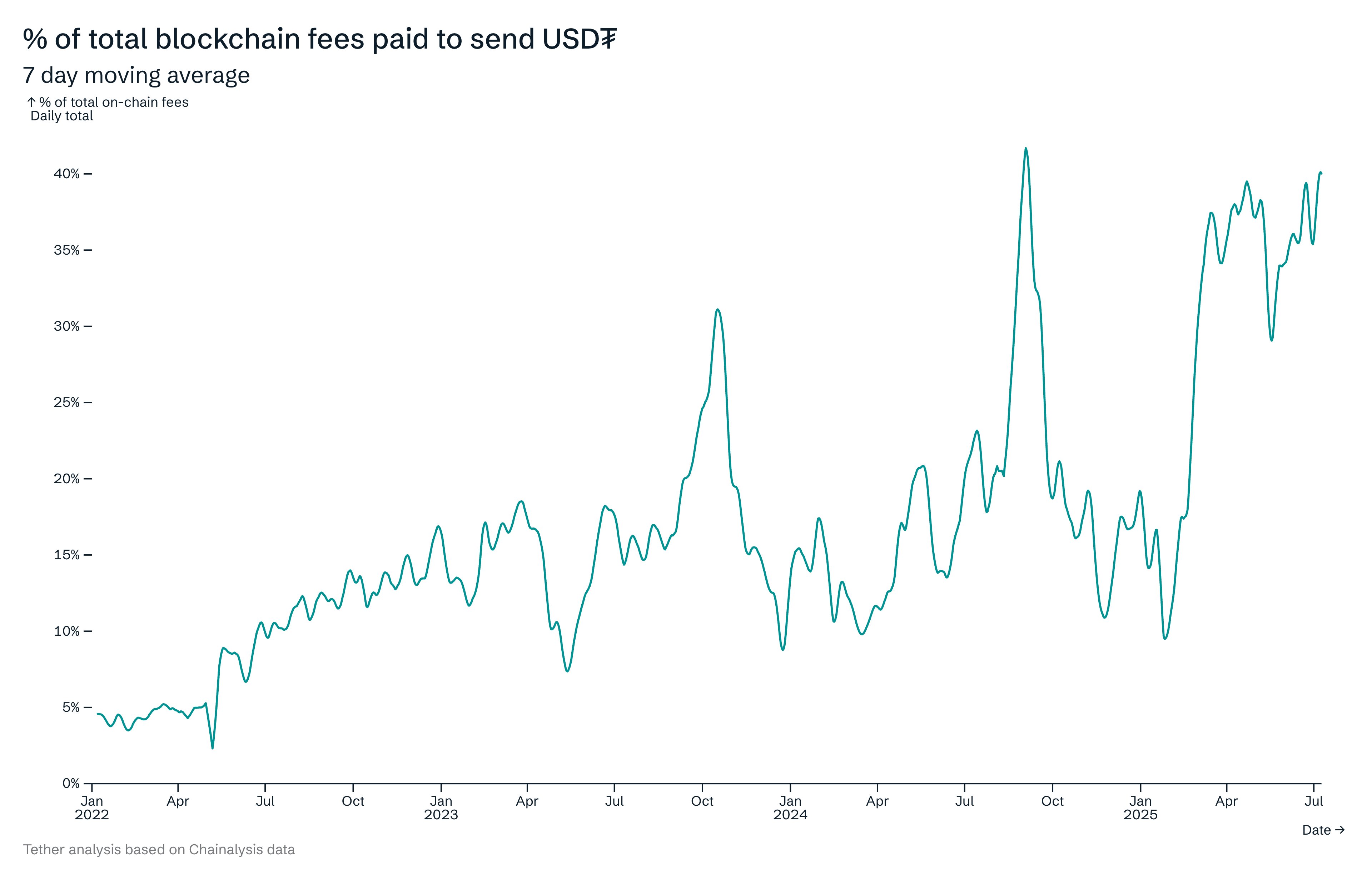

Ah, the delightful intricacies of modern finance. Tether CEO Paolo Ardoino-bless his soul-has graced us with the revelation that a jaw-dropping 40% of all blockchain fees are essentially being funneled into moving USDT. Yes, dear reader, nearly half of your hard-earned crypto gas money is going toward shuffling around Tether’s beloved stablecoin. How poetic. 🎭

USDT: The Diva of Network Fees 💃

In a post on X (formerly Twitter, because apparently even social media needs a glow-up), Ardoino shared data so riveting it could make even the most stoic blockchain enthusiast weep with joy-or despair, depending on their portfolio. Transfer fees, for those uninitiated in the art of blockchain economics, are the sacrificial offerings users must make to validators in exchange for their transactions being processed. Think of it as tipping a barista, except the barista is a decentralized network and the coffee is… well, questionable at best.

Behold, the chart that Ardoino shared-a veritable masterpiece of numeric artistry:

Nine networks grace this grand stage: Ethereum, Tron, Toncoin, Solana, BSC, Avalanche, Arbitrum, Polygon, and Optimism. Lo and behold, the 7-day moving average of USDT-related fees has reached the dizzying height of 40%. One might say Tether is the Beyoncé of blockchains-always in demand, always taking center stage. 🕶️

This hefty fee share suggests that people are absolutely obsessed with USDT. “Hundreds of millions of people in emerging markets use Tether’s digital dollar USDt daily,” Ardoino notes, presumably while sipping champagne. Why? To shield their families from the perils of inflation and the whims of devalued national currencies. Truly, Tether is the hero we didn’t ask for but apparently got anyway. 🦸♂️

Now, here’s a twist worthy of a Wildean drama: On most networks, you must pay these fees using the chain’s native token. For instance, Ethereum demands ETH like a bouncer demanding ID. But wait! There is one rebel in the pack: Tron. This year, Tron introduced a feature allowing users to pay gas fees in other tokens-including USDT. Revolutionary? Perhaps. Opportunistic? Absolutely. As a result, Tron has become the undisputed king of USDT supply. Bravo, Tron. You’ve earned your crown. 👑

“Blockchains that focus on lower gas fees and allow paying these in USDT will take over the world,” declares Ardoino, channeling his inner prophet. A bold statement, though one wonders if he’s considered the possibility that the world might prefer a little less USDT domination and a little more… oh, I don’t know, actual innovation? 😏

In unrelated but equally dramatic news, the on-chain volume for all stablecoins recently hit a new record, as Sentora-an institutional DeFi solutions provider-pointed out in yet another X post. Feast your eyes on this chart:

Yes, the combined monthly transaction volume of stablecoins surpassed $1.5 trillion last month. An all-time high! Truly, the age of the stablecoin is upon us, whether we asked for it or not. 🚀

Ethereum: The Brooding Romantic 💔

Meanwhile, Ethereum-the moody poet of the crypto world-is currently trading at around $3,600, having fallen more than 4% over the past week. Poor Ethereum. It’s like watching Mr. Darcy after Lydia elopes with Wickham. Here’s a snapshot for your viewing pleasure:

And so, dear reader, we find ourselves at the end of this tale of fees, stablecoins, and blockchain drama. What lessons shall we take from this? Perhaps none, for life-and crypto-is often absurd. But if there’s one thing we can agree on, it’s that Tether certainly knows how to keep things interesting. 😉

Read More

- 🚀 NEAR Protocol Soars 8.2% While Others Stumble – CoinDesk 20 Chaos! 💸

- BTC PREDICTION. BTC cryptocurrency

- EUR USD PREDICTION

- 🐳 XRP Whales Splash Cash: Is the Tide Turning? 🌊

- SEC v Cryptos: ‘Innovation Exemption’ Will Arrive in 30 Days… Maybe? 🧨💸

- PEPE Frenzy—Will Frogs Outlast Bears? 🐸📈

- Bitcoin’s Wild Ride: Whales Strike Back, Shorts Cry 😭💰

- Chinese Company Sheds Cars, Digs Digital Gold-You Won’t Believe Cango’s Bitcoin Binge! 🚗💰

- Bitcoin’s Cosmic Cringe: Why the Crypto World Is Now a Black Hole 🌌💸

- ENA Price Jumps 18% as December Breakout Setup Strengthens: Can It Hit $0.65 Next?

2025-08-06 23:19