BlackRock’s Fink Reveals: Sovereigns Buy Bitcoin at $80k!

Sovereign wealth funds were buying the dip in bitcoin, according to BlackRock CEO Larry Fink. 🤝💸

Sovereign wealth funds were buying the dip in bitcoin, according to BlackRock CEO Larry Fink. 🤝💸

Ah, Bitnomial, thou hast etched thy name into the annals of history, not with the ink of mere ambition, but with the blood of regulatory compliance! 🖋️ The Commodity Futures Trading Commission, in a rare moment of poetic exuberance, has proclaimed this as a milestone in America’s quest to dominate the digital asset arena. How quaint, that the same institution once mired in red tape now sings hymns to innovation! 🎶

The Gateway to Glory

Ethereum, that bustling metropolis of decentralized exchanges (DEXs), has become the stage for this drama. Its open block-building market, a veritable bazaar of order flow, exposes the unsuspecting to the whims of searchers. CryptoMoon Research, ever the vigilant observer, delves into the annals of sandwiching activity from November 2024 to October 2025, armed with a dataset of over 95,000 attacks, courtesy of the enigmatic EigenPhi. 🕵️♂️✨

Throughout this fateful year, the crypto triumvirate has moved with a precision that would make a Swiss watchmaker blush. Side by side, their price charts tell a tale of harmony, or perhaps, collusion. While Apple stock (AAPL/NASDAQ) clings to its earnings and dividends like a miser to his gold, these digital assets have embraced a higher calling-or so the institutions would have us believe. 🧐📈

With a sense of grandiose purpose, these titanic entities proclaim their alliance to craft a seamless gateway-a portal-between the stale stone walls of legacy finance and the shimmering, volatile mirages of cryptocurrencies, as if they believe that some mystical balance can be achieved amid the chaos.

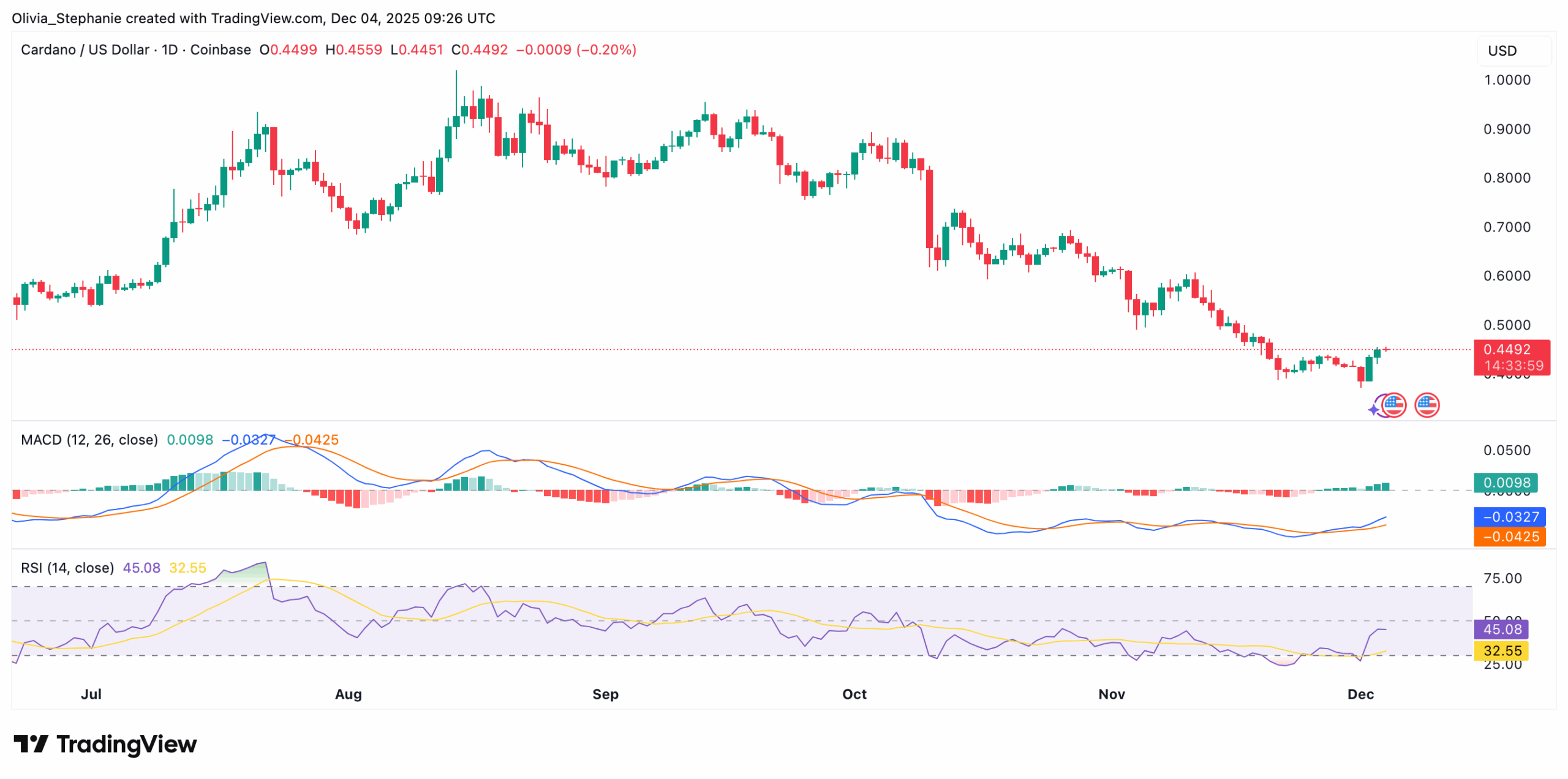

Both altcoins, having endured the slings and arrows of prolonged declines, now pirouette with patterns that hint at a dramatic reversal. 🌀 Shall we indulge in the theatrics of their potential resurgence? But of course, darling, for what is life without a touch of financial melodrama?

The crypto crowd, ever the drama queens, hummed a buoyant tune as BTC flirted with $93,500 and ETH rose to $3,200 post-Fusaka upgrade. A mere trinket of optimism, really, but enough to keep the crowd from rioting 🥁.

On the most uneventful December 3rd, the Connecticut Department of Consumer Protection (such a mouthful, darling!) dispatched letters sharper than a Coward quip, accusing these platforms of engaging in “unlicensed online gambling.” Commissioner Bryan Cafferelli, with all the drama of a West End premiere, declared: