Fed’s $13.5B Repo Gamble: Will It Save or Sink the Markets? 🧠💸

The Federal Reserve injected $13.5 billion into the U.S. banking system through overnight repurchase agreements, according to data shared by financial analytics firm Barchart. 📊

The Federal Reserve injected $13.5 billion into the U.S. banking system through overnight repurchase agreements, according to data shared by financial analytics firm Barchart. 📊

Right, so Kucoin has somehow managed to snag a MiCAR license in Austria 🥨. This means its European entity can now offer regulated crypto services across 29 EEA countries. Basically, it’s like Kucoin just got the golden ticket to Willy Wonka’s crypto factory 🍫.

Yes, we are on the edge, teetering on the brink of a major decision. Will XRP crash like the Titanic, or will it pull off the greatest comeback since Rocky?

Ah, stablecoins. Those digital curiosities that promise the solidity of the dollar with the… well, volatility of a lovesick poet. It appears the esteemed Federal Deposit Insurance Corporation, under the direction of Mr. Travis Hill (a name that sounds suspiciously like a minor character from a Dickens novel), intends to impose some semblance of order upon this burgeoning field. Later this month, they are to unveil a “framework” – a delightfully bureaucratic term for a collection of rules, no doubt – for US stablecoin laws. One can only anticipate the paperwork. 🙄

The revelation was met not with laughter, but with sheer panic as if peasants learnt of an invasion on Midsummer’s Eve. Chairs overturned, peasants gathered in frantic profusion, pushing their silver and counsel alike into the early morning chill as if to challenge the very sphinxes themselves!

A Few Observations, If You Will

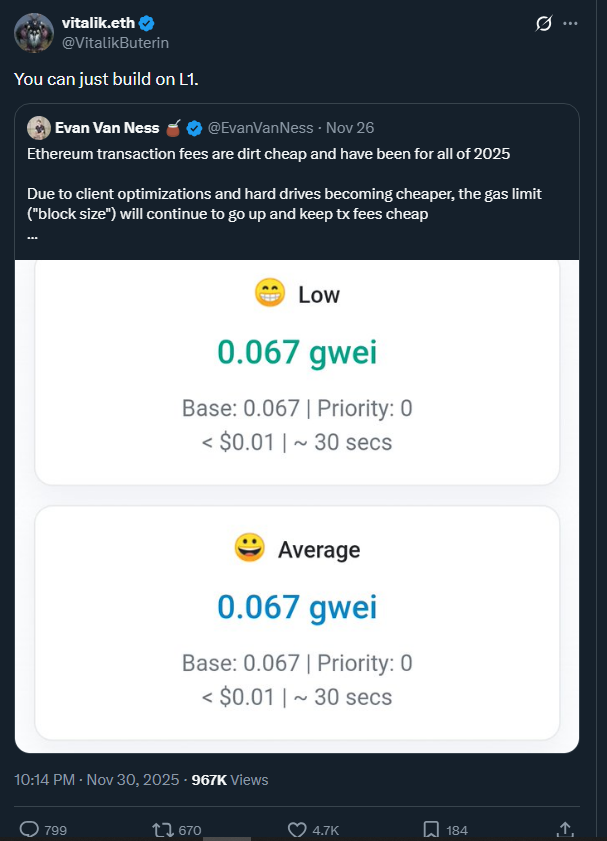

The goodly Vitalik, whose mind is a labyrinth of digital revolutions, made a statement on the 1st of December ’25 via a platform they call ‘X.’ Out of nowhere it seemed to rise, this pronouncement, both startling and sly, questioning the new craze for Layer 2 solutions, much like our Nebraskan folks pondering the appeal of those flashy, newfangled Eastern trains.

As we speak, ETH hovers near $2,800, down 8% over the last 24 hours-because what’s life without a little daily volatility? Yet, somehow, it’s up on the week. The market, she is a fickle mistress, after all.

Bitcoin, Ethereum, Solana-oh, the usual suspects-all tumbled like drunkards down a flight of stairs. Bitcoin, that self-proclaimed “digital gold,” proved once again that it’s just as susceptible to human folly as any other speculative trinket. And the altcoins? Ha! They clung to Bitcoin’s coattails, only to be dragged into the abyss alongside it. Such loyalty! Such predictability! 🐑

According to Bloomberg – who apparently didn’t get the “I’m retired” memo like the rest of us – as of December 2, Vanguard customers can now trade crypto-focused funds. Surprise! They include Bitcoin (BTC), Ethereum (ETH), XRP, and Solana (SOL). Not Shiba Inu, mind you. That would be ridiculous. Or… wait, no, actually, it wouldn’t. But more on that later. 😒