Crypto Whales’ Secret 2025 Moves Revealed!

Because nothing says “confidence” like buying when prices are stable. Or maybe they’re just trying to avoid a panic sell. 🐟

Because nothing says “confidence” like buying when prices are stable. Or maybe they’re just trying to avoid a panic sell. 🐟

Artificial intelligence (AI) is apparently going to create thousands of jobs in proctoring and verification because it’s so good at faking everything-including your cat’s Instagram account. But fear not! Blockchain, with its “strict deterministic patterns,” will somehow save us all from this existential crisis. Former Coinbase CTO Balaji Srinivasan, on a16z’s podcast, delivered this wisdom like it was the last loaf of bread in a post-apocalyptic bakery.

Here’s a whirlwind tour of the most moustache-twirling headlines you might have zoned out on.

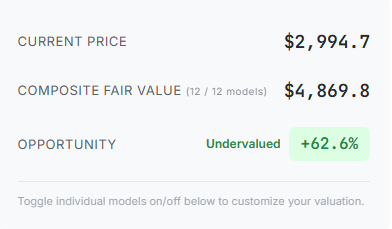

This expert of numbers and convoluted financial jazz threw everything but the kitchen sink at it-from the old-fashioned Discounted Cash Flow and Price-to-Sell ratios to the more crypto-casual metrics like Total Value Locked, and even the fancy Metcalfe’s Law, which, if you ask me, sounds like a law made up after a few too many drinks. 🍻

Meanwhile, Wall Street’s been throwing money at XRP and SOL like it’s confetti at a crypto parade 🎉💸. $600 million? Pfft. That’s just the price of entry if you want to pretend you’re not a fraud. But hey, CoinShares is “focusing on higher-margin opportunities” now. Translation: They’re probably buying a yacht and blaming the SEC. Again. 🛥️

Amundi, the self-proclaimed custodian of €2.3 trillion, now peddles “tokenized shares” of its AMUNDI FUNDS CASH EUR money market fund. A noble endeavor, to be sure, but one cannot help but chuckle at the irony of a $2.3 trillion empire now hitching its wagon to a blockchain’s whims. Jean-Jacques Barbéris, with the solemnity of a priest, declares this “a transformation set to accelerate.” Let us hope the acceleration doesn’t resemble a rocket launch gone wrong. 🚀

About $32 million in Korean won (which, let’s be honest, is just a drop in the bucket for a crypto exchange) vanished in late November 2025. Upbit, ever the hero, paused deposits and withdrawals and promised to repay users from their own pockets… or maybe just from their own pocketbook. 💸

BTIG’s prophets chant of a $100,000 utopia, as if the markets heed the prayers of mortals 📈. Jonathan Krinsky, their soothsayer, claims a “reflex rally” is nigh-because nothing says “reflex” like a chart drawn by wishful hands.

The Korean government is on a mission-think of it as their version of a crypto cleanup crew. Financial Services Commission (FSC) boss Lee Eok-won announced they’re tightening the noose: expanding the travel rule and banning serious criminals from becoming crypto bigwigs.

BitMEX co-founder Arthur Hayes has predicted that crypto-style perpetual futures will crush traditional stock exchanges. He claims equity price discovery will migrate to 24/7 crypto platforms because, apparently, humans can’t function during “off hours.” This is according to recent public statements. Classic.