Is XRP About to Win a Seat at the State Treasury Table? You Might Want to Read This

More States Jump Aboard the Digital Asset Craziness

More States Jump Aboard the Digital Asset Craziness

Investigators traced hundreds of millions through a snail trail of shell companies spanning Prague, Montenegro, Antigua, Manila, and Spain. Spoiler: they all have one thing in common-Ayre’s gambling empire and a suspicious amount of money passing through. Who knew that online betting could fund an international thriller? 💸🌎

Enter Midnight’s Glacier Drop, the heart and soul of Hoskinson’s revival fantasy. As he fondly read from the “State of the Network” memo (which he assures us is totally credible), he gushed that the airdrop “was the largest distribution event in the history of cryptocurrencies.” Now, we know that’s a stretch, but let’s roll with it-he has numbers, and numbers are his thing. “This is not puffery,” he smirked, as he recounted how over 4.5 billion NIGHT claims were registered across a mere 8 million addresses during the Scavenger Mine phase. Big numbers, lots of excitement. The future of token distribution, he mused, had a “new standard,” blending “community-driven allocation” with-wait for it-“fairness and systemic integrity.” Hilarious, right? If only DeFi worked that way.

From the eleventh month of the year 2025, upon the earthly days of November 17, to the final twilight of December twenty-first, a contest abides-a contest of digital daring, where men and women across the land of the free may throw their lot into the mysterious whirlpool of cryptocurrency. The chance to strike gold-bitcoin, the modern dragon’s hoard-is open to all, by transactions or the humble postal carrier, who may yet deliver riches wrapped in silly paper, all for the mere effort of clicking or scribbling. 🧙♂️

So, WLFI is chilling at $0.171, up 8% in the last 24 hours. That’s basically the financial equivalent of showing up to a party and being like, “Oh, this old thing?” 💁♀️ It’s also 20% higher on the week and 15% higher in the past month. Go on, little token, get your shine on! ✨

boasting a 14% slice of the pie, China might just edge past Russia’s 15.5%, if the trend of stubborn resurrection persists. Because, why not? Even empires fall only to crawl back.

On Tuesday, the renowned Korea JoongAng Daily reported that the grand stablecoin framework, eagerly awaited to grace us by the end of 2025, is more likely to be delayed than delivered. Apparently, while tech companies dream of a free-for-all market, the central bankers insist that banks must hold at least a lion’s share of the digital pie-specifically, over 51%. Because, of course, stability is best maintained by banks-who have historically proven to be paragons of unchangeable wisdom. 🏦

If you thought U.S. Bank’s latest move was bold, wait until you hear their second act. They’re using Stellar blockchain to send money like it’s the future. But Mike Villano, a man whose title sounds like it was written in Comic Sans (Senior Vice President and Head of Digital Asset Products), says stablecoins are “another way to move money.” Wow, groundbreaking. 🔥

In a blog post dripping with ambition, Coinbase Ventures declared its thirst for investing in teams dabbling in asset tokenization, arcane exchanges, trading terminals straight out of sci-fi, next-gen DeFi, and AI advancements that might just take over the world. Or your toaster. Who knows? 🤖

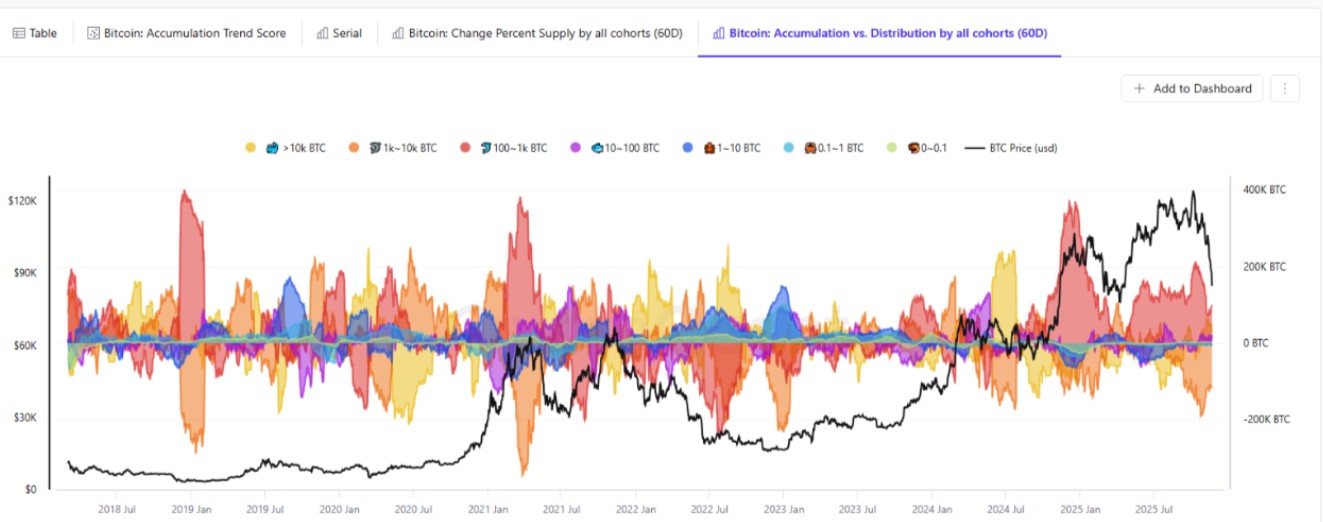

Well, if you ask the ever-optimistic Carmelo Aleman from CryptoQuant, the charts are giving us a little glimmer of hope! According to his analysis, the market’s doing a funny little dance of redistribution, weakness, and a sneaky sign of recovery. Could it be? Is a local bottom peeking through the clouds?